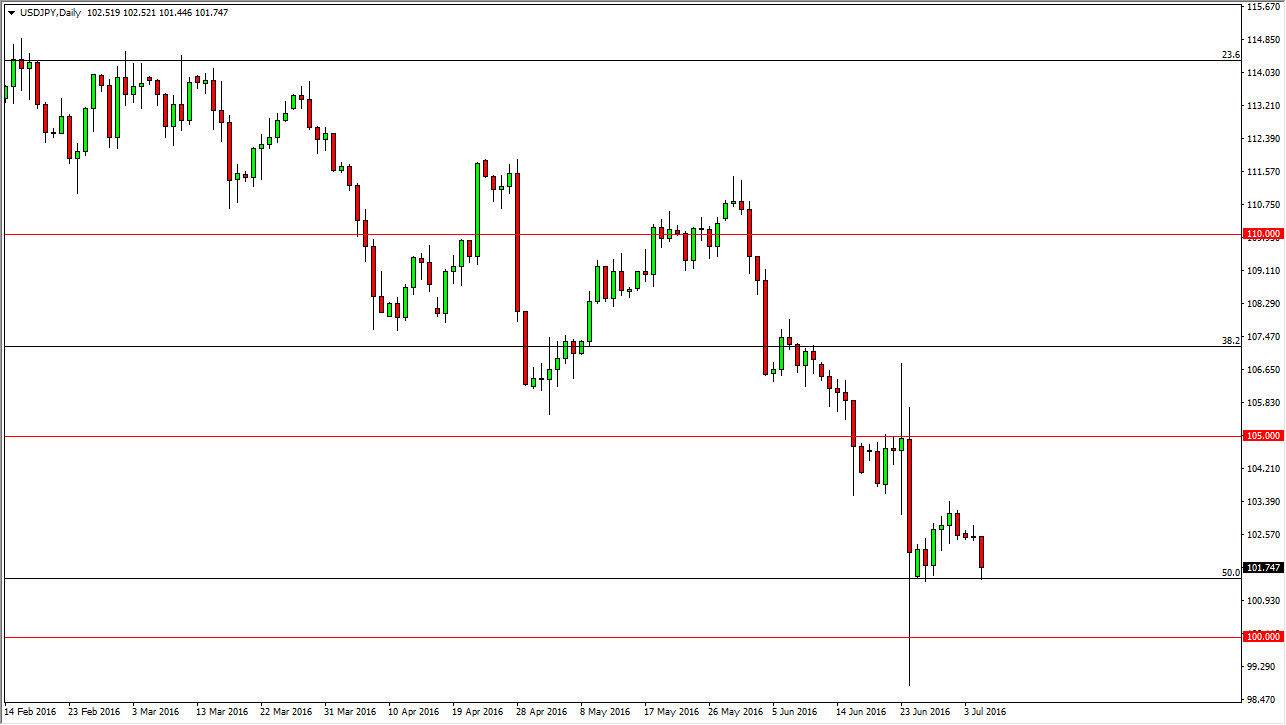

USD/JPY

The USD/JPY pair fell during the day on Tuesday, but at this point in time I believe that there is a significant amount of support below just waiting to get involved. After all, we have the Bank of Japan who will more than likely jump into this market if we break down below the 100 level. With this, the market will be cautious about going lower. I think that a supportive candle somewhere in that area would be an excellent buying opportunity but I also recognize that there is quite a bit of noise waiting just above and it would be a market that you would have to be very patient with. With this, I feel it’s only a matter of time before I can go long, but I would start out with very small positions and essentially think of it as an investment more than a trade.

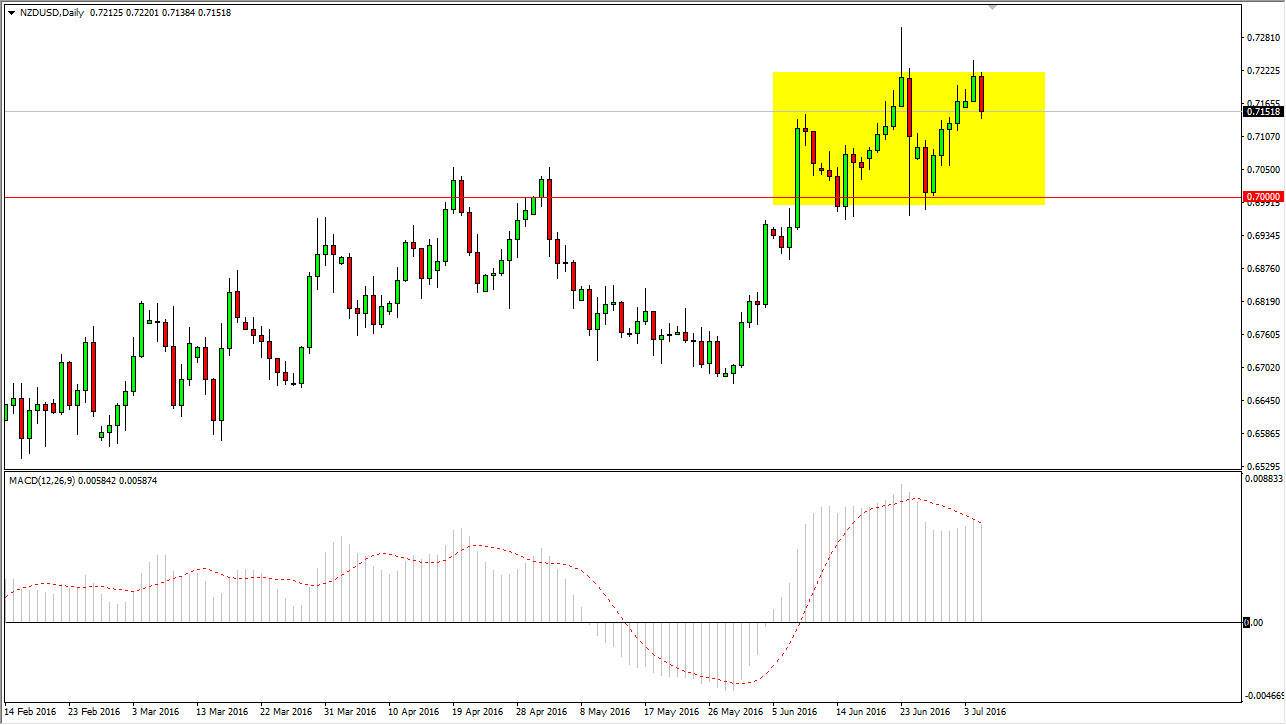

NZD/USD

The New Zealand dollar fell during the day on Tuesday, as the 0.7250 level offered quite a bit of resistance. That being the case, the market looks as if it is ready to continue in the consolidation area that I have marked on this chart in yellow. On top of that, we essentially have something along the lines of a “double top”, as that area has pushed the market back down. On top of that, I have the MACD on the chart showing that we are starting to run out of momentum, so I believe that we will continue to struggle to break out to the upside and perhaps drift down to the 0.70 level in the near term. I’m not looking for some type of massive selloff, just that we could find a short-term selling opportunity as we simply go back and forth in an area again and again as we try to build up enough momentum to finally break out to the upside for the longer-term move potentially.