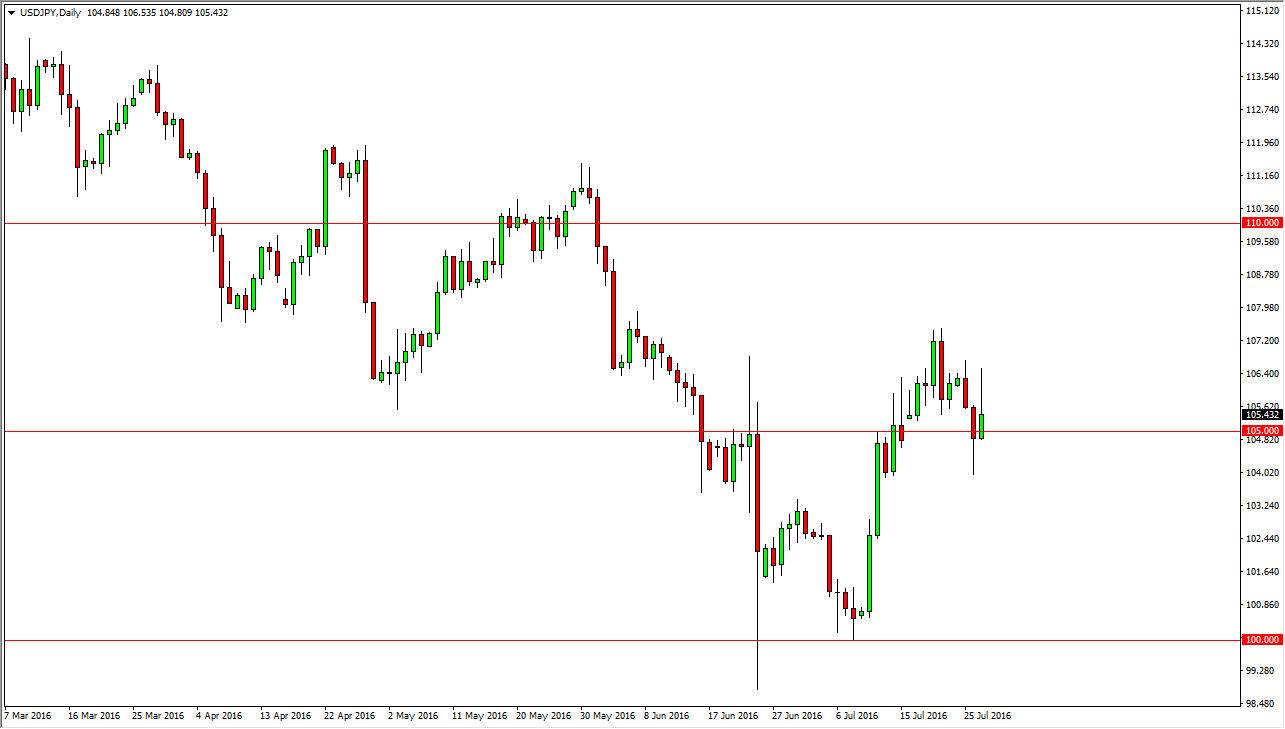

USD/JPY

The USD/JPY pair initially rallied during the course of the day on Wednesday, but turn right back around after the FOMC statement. With this, we ended up forming a fairly negative candle, but I still see a significant amount of support at the 105 level. If we can break above the top of the range for the day on Wednesday, I’m a buyer as this market should then reach towards the 108 level. This represents a very rocky market as far as I can see, but I still believe that the Bank of Japan is likely to get involved if we fall too significantly. Ultimately, this market will continue to be volatile, which is normally the case in this pair anyway.

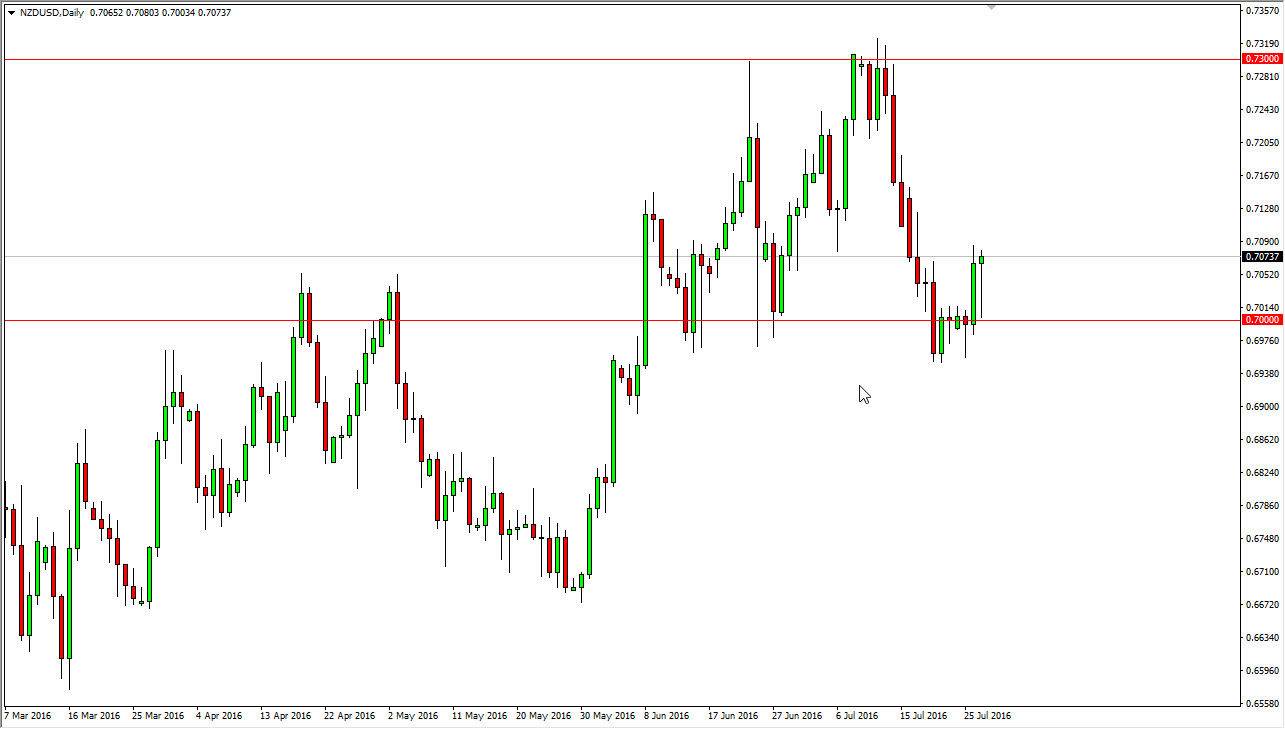

NZD/USD

The New Zealand dollar initially fell during the day on Wednesday, but found enough support at the 0.70 level to form a significant bounce, printing a hammer by the end of the day. This of course is a very bullish sign, so therefore on a break of the top of the hammer I feel that we go to the top of the recent consolidation area and perhaps even reach towards the 0.73 level given enough time. I don’t think it’s going to be easy, but it does seem to be what’s most likely to happen.

The Federal Reserve gave a little bit more of an upbeat statement during the day on Wednesday, so it is possible that people are betting on a little bit more of a “risk on” environment, which of course typically helps the Kiwi dollar anyway. With this, I believe that short-term pullbacks will continue to be buying opportunities as long as we can stay above the 0.70 support barrier, which I think extends all the way down to the 0.69 level. I remain bullish, but recognize that it is going to take real patience to hang onto this trade.