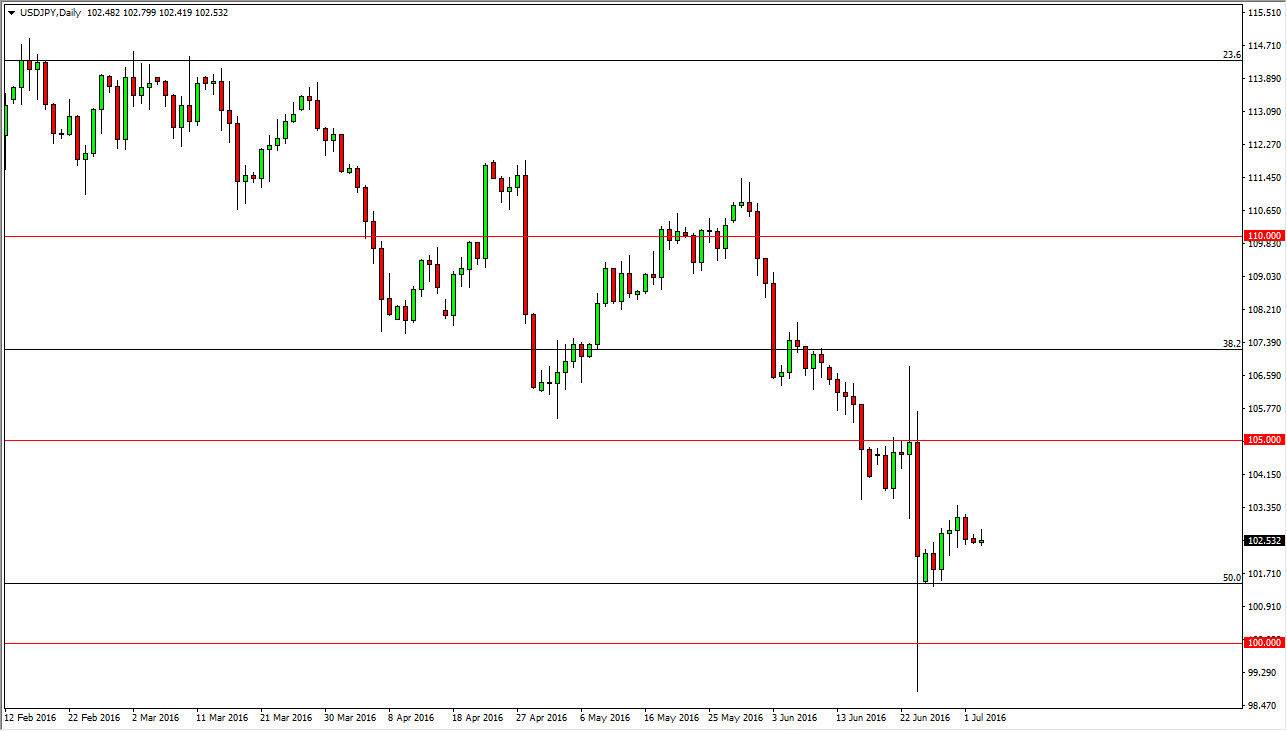

USD/JPY

The USD/JPY pair initially tried to rally during the day on Monday, but as you can see we turn right back around to form a slightly negative candle. However, I am not overly excited about shorting this pair, because the Bank of Japan will more than likely get involved if the USD/JPY pair drops below the 100 level. At this point, I do believe that intervention is a real threat, so ultimately I think that this pair does go higher. However, you’re going to have to be able to hang onto a longer-term and volatile position if you are to go long in this market. I’m not overly excited about doing it right now, but I do believe that eventually longer-term traders will find value in the US dollar when it comes to this market, especially with threats of the BoJ getting involved.

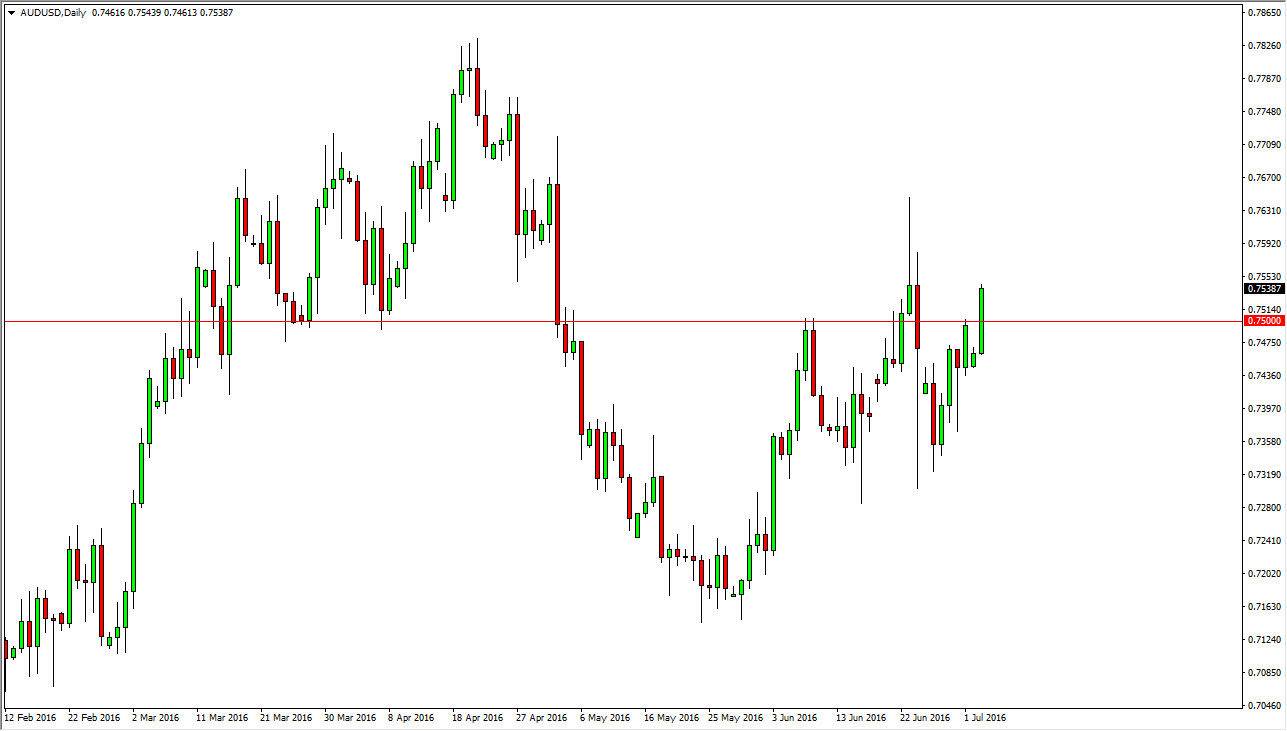

AUD/USD

The AUD/USD pair broke higher during the course of the session on Monday, slicing through the 0.75 handle. What is going to be more interesting about this market today though is that the Reserve Bank of Australia has an interest-rate announcement coming out during the day of course a monetary policy statement as well. Ultimately, the market looks as if it is going to try to grind higher, but there is a shooting star from last week that causes a bit of concern. With this I believe that the market will have a little bit of an upward bias but it will be a grind more than anything else. Be aware though that the interest-rate announcement can throw a monkey wrench into everything, so expect a lot of volatility regardless of what happens.

Currently though, this is one of my least favorite pairs to trade just simply because we are at a major area, and of course have the potential noise all the announcement which one can never truly know ahead of time. There is no expectation for an interest-rate cut, but they surprised last month, so they certainly could do it this one.