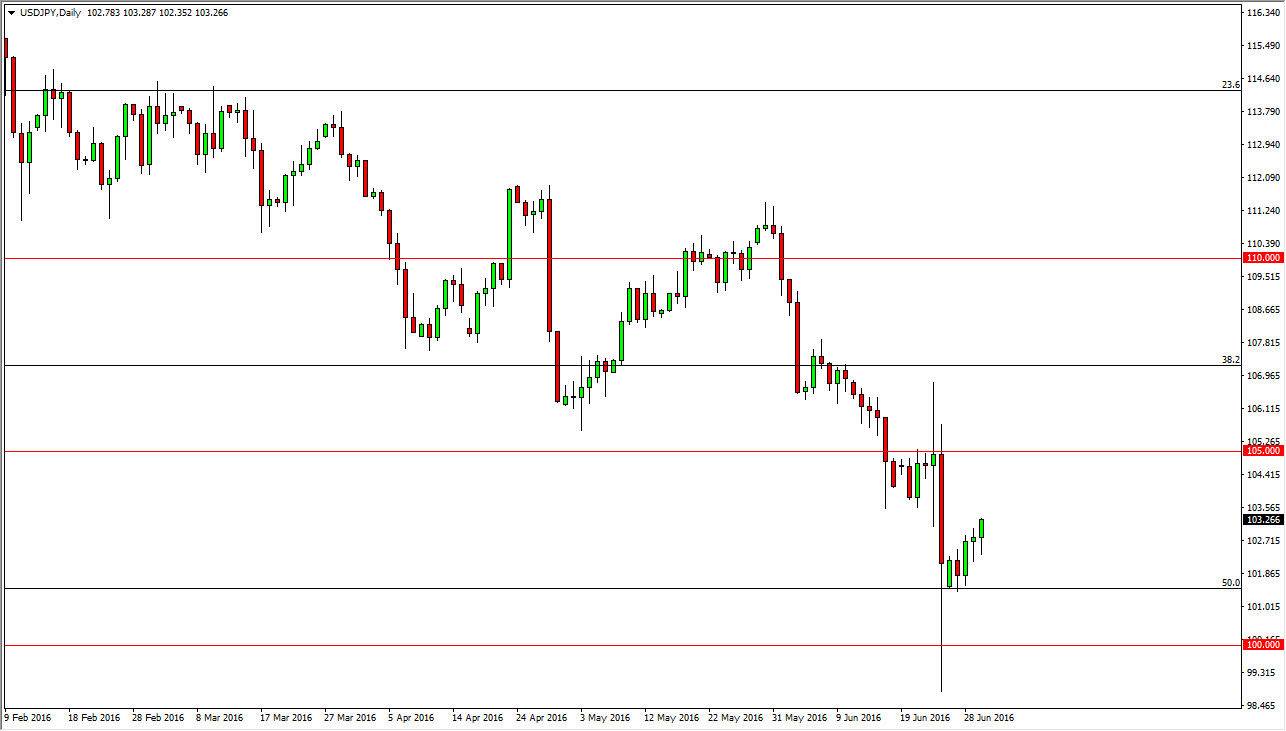

USD/JPY

This pair initially fell during the day on Thursday, but turn right back around to form a bit of a hammer. That of course is a sign that the buyers are continuing to push this market higher, but given the uncertainty out there, it is a bit difficult to get excited about buying this market. Also, if the realize that there is a significant amount of resistance between the 104 and the 105 levels, so I think it’s only a matter of time before we get an exhaustive candle that we can start selling. If we break down below the bottom of a hammer, that would be very negative as well, and also have me selling this pair.

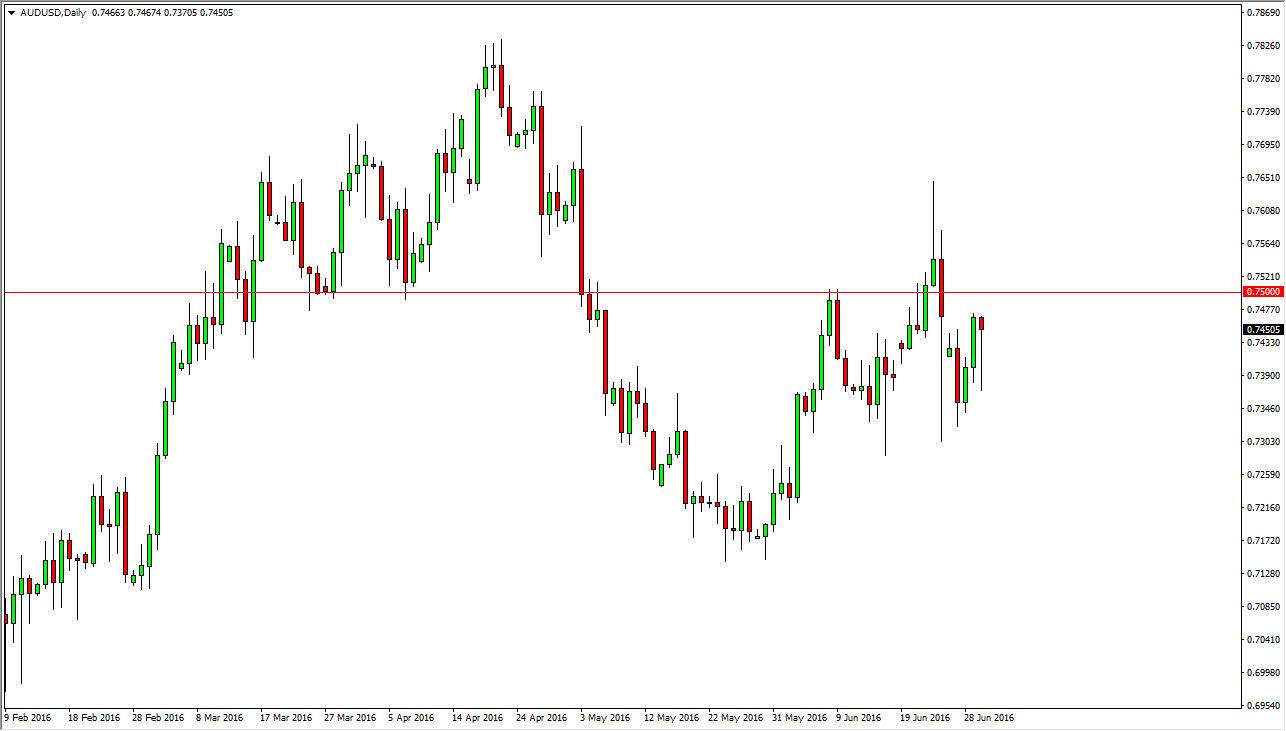

AUD/USD

The Australian dollar had a wild day as we initially fell fairly significantly during the day, but we turn right back around to form a massive hammer. There are a lot of reasons why this could happen, but quite frankly the one thing that I have my eye on is the silver market. It’s not that I necessarily look for the correlation between Australian dollars and silver, it’s just that a lot of times silver and gold will move in tandem, so we may be getting ready to see some type of significant move in the gold market. The silver market broke out to a fresh, new high, and that should drive gold higher eventually. That in turn could very well drive the Australian dollar higher.

However, I do have a lot of concerns about buying this pair simply because there was a shooting star last week just above the 0.75 handle. So with this being the case, I recognize that there is a significant chance that we will simply bounce around in this general vicinity overall and therefore make it a very difficult market to trade.