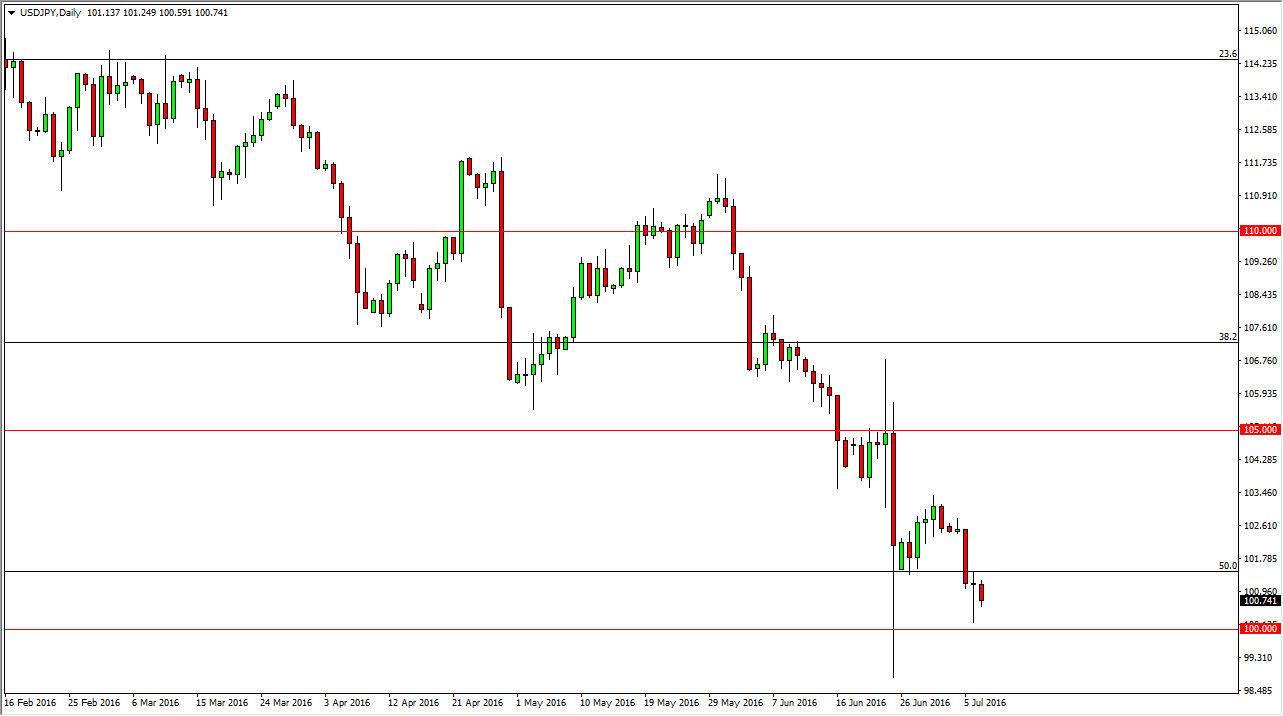

USD/JPY

The USD/JPY pair fell a bit during the course of the day here on Thursday, but as you can see is still well within the hammer from the Wednesday session. Because of this, it looks as if we are simply waiting to see what the jobs number will be in order to react. This is a pair that tends to be very sensitive to that announcement, and as a result will be an interesting place to pay attention to during the day. If the numbers are poor, typically this pair falls. If the numbers are strong typically will do the exact opposite. Having said that though, we do have to worry about the Bank of Japan intervening below the 100 level, so I think any break down below there will be a short-term move at best, as traders will be nervous about holding that position over the weekend.

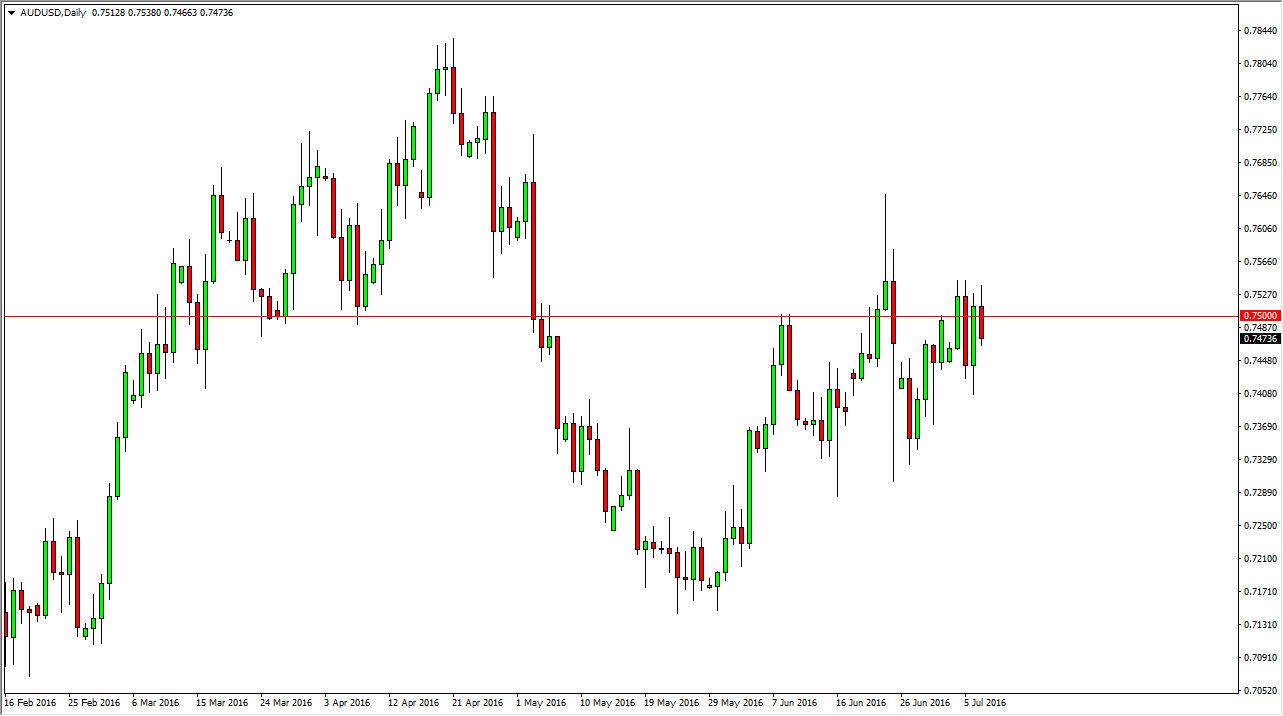

AUD/USD

The Australian dollar initially tried to rally during the day on Thursday, but turned right back around to form a relatively negative candle. Because of this, I believe that the market is not ready to go anywhere and we of course are waiting for the jobs announcement to make a decision. This pair tends to be very risk sensitive, so if the jobs numbers fairly decent, we should continue to go higher. On the other hand, if the jobs number is very poor, the Australian dollar will typically sell off.

At this point time though, I feel that this market will be choppy to say the least, see you are going to be careful the matter what happens. With that being the case, there are easier trades out there to take, and I have no interest whatsoever in putting a lot of money into this market as I think the volatility will be great during the session today. Ultimately though, we should get a break in one direction or the other that tells us where to go for the longer term fairly soon.