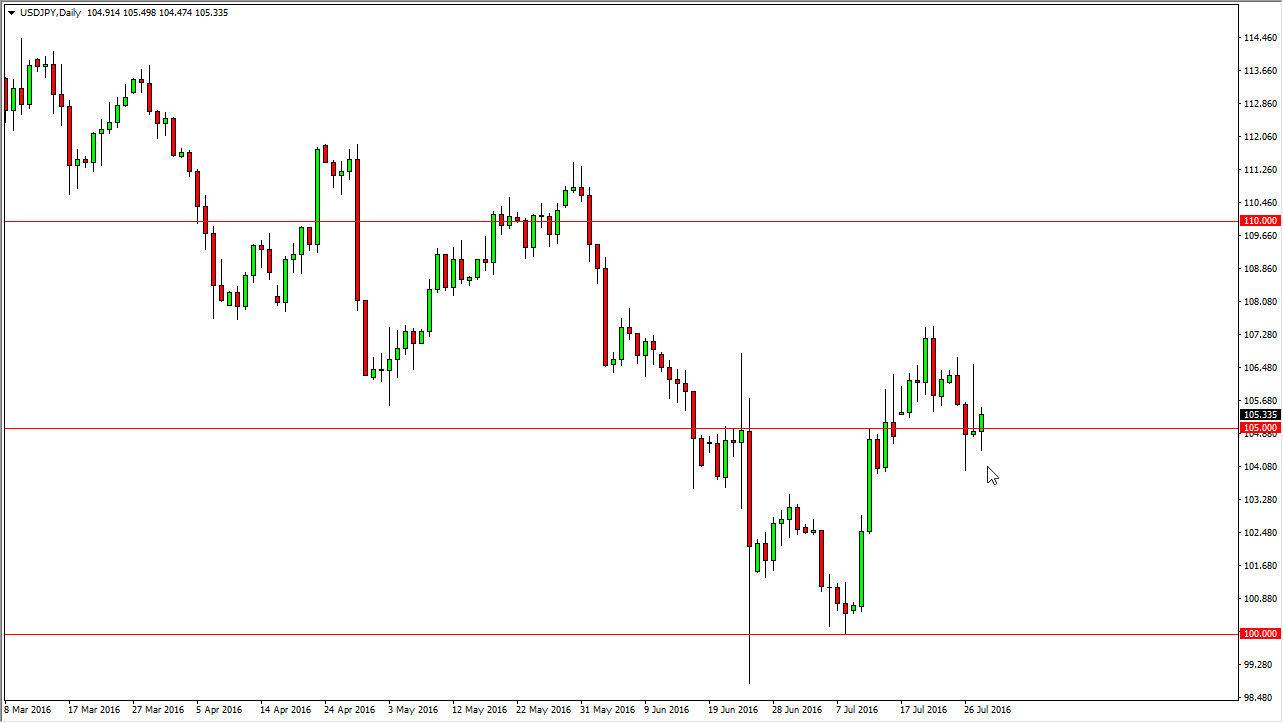

USD/JPY

The US dollar initially fell against the Japanese yen during the day on Thursday but we bounced back above the 105 level. The 105 level is a bit of a fulcrum when it comes to the back and forth action in this market, and I believe that no matter what happens next, the Bank of Japan is going to be very influential. With this being said, I think pullbacks should very well be considered buying opportunities. I don’t necessarily like trading this market at the moment, but I do recognize that there is quite a bit of likelihood that the buyers will return as the Bank of Japan has threatened more than once that they might have to get involved.

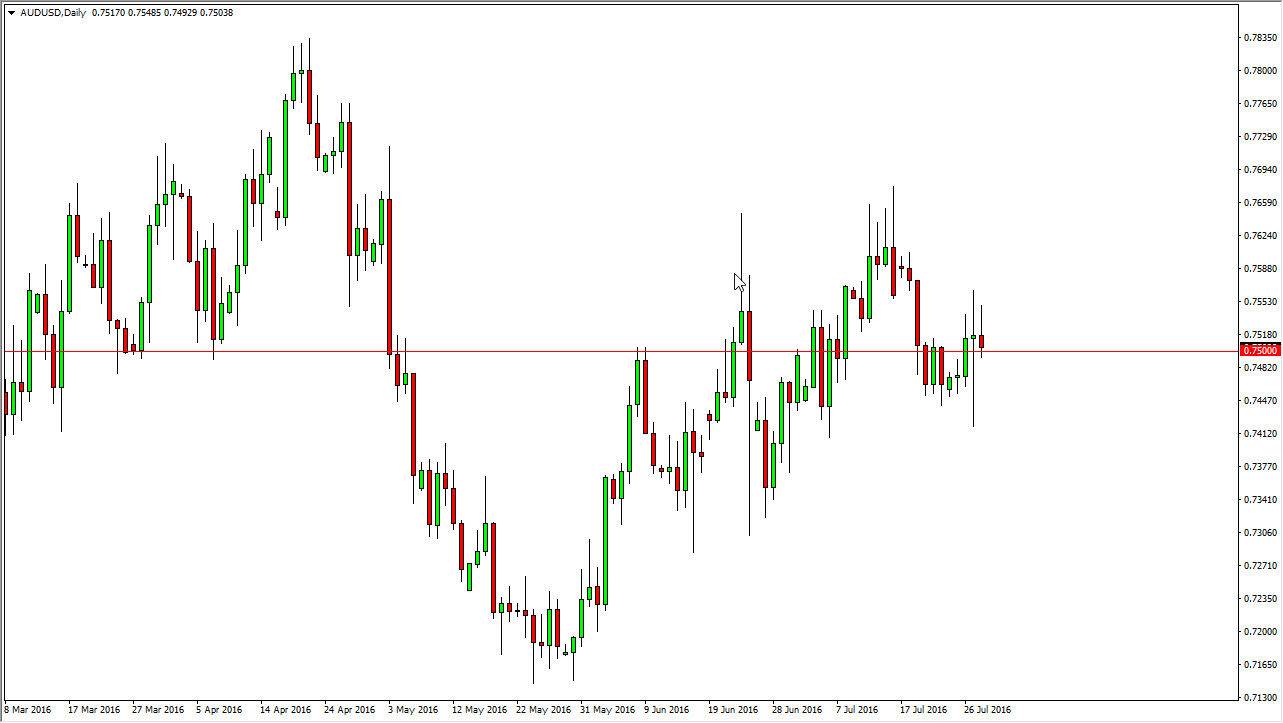

AUD/USD

Originally during the Thursday session, the Australian dollar rallied. However, we turn right back around to form a bit of a shooting star, which sits right on the 0.75 handle. Because of this, it looks as if the market could fall from here, but there also has been a significant amount of support below, somewhere near the 0.7425 handle. With this, I believe that it is going to be very back and forth, very volatile if you will. I think if we can break above the top of the hammer from the Wednesday session, we would see quite a bit of bullish pressure. With this, I believe that pullbacks continue to offer value of the longer-term, but do recognize that we very well could fall significantly. However, I see several small supportive levels below that keep me from shorting. In other words, I am essentially “buy only” when it comes the Australian dollar, but recognize that it’s going to be very difficult to hang onto any type of position.

Pay attention to the gold markets, if they show some type of massive support and move higher, that could be reason enough for the Australian dollar to continue to go higher. With this, we could very well reach towards the 0.77 handle.