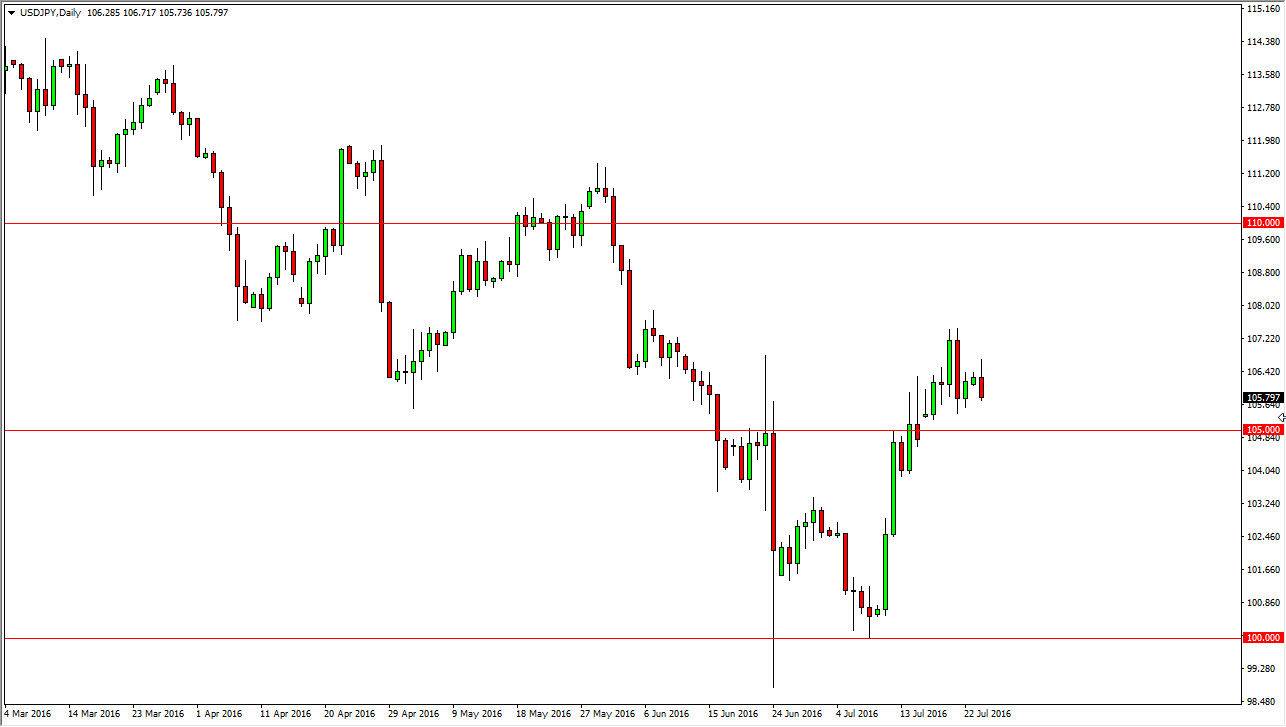

USD/JPY

The US dollar initially rose against the Japanese yen but turned right back around to form a bit of a shooting star during the day on Monday. I believe that there is a significant amount of support below at the 105 level, so I do not anticipate that selling this market is in a be easy to do. In fact, I believe that a supportive candle below will be reason enough to start going long. I believe at that point in time, the market will continue to grind its way towards the 108 level, and then eventually the 110 level. I believe that the Bank of Japan will continue to do what it can to support this market, and therefore it’s only a matter of time before we get the complete turnaround that I am expecting.

AUD/USD

The AUD/USD pair went back and forth during the course of the Monday session, as the 0.75 level continues offer quite a bit of resistance. I believe that this market will be highly influenced by gold, which seems to be making a bit of a bottom at the moment. With this being the case, I feel that it’s only a matter of time before we can start buying the Aussie dollar again. Even if we did break down, there so much in the way of noise below that I don’t have any interest in selling at the moment. A sustained move above the 0.75 level is probably reason enough to go long, and that should send this market looking for the 0.7650 level above, possibly even higher than that if we get a little bit of momentum built up.

Nonetheless, the one thing I think you can count on in this particular market is going to be volatility. The Australian dollar is highly influenced by not only gold, but commodities in general so therefore it’s likely that the market will continue to go back and forth in the meantime.