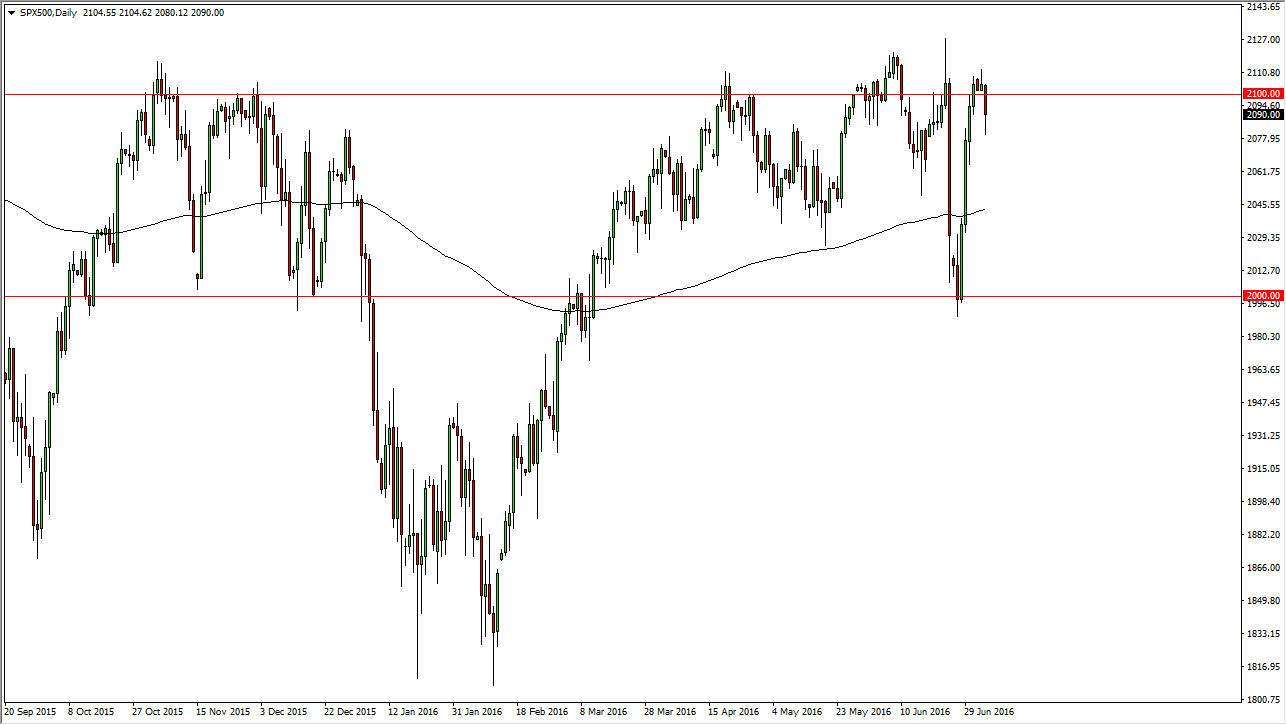

S&P 500

The S&P 500 fell significantly during the course of the session on Tuesday, but turn right back around to form a relatively interesting looking candle as we bounced nicely. With this, I believe that the buyers will continue to flock to this market, and with that being the case I am a buyer of pullbacks and sure signs of support. I think short-term charts will be used in order to go long, so having said that it’s likely that we will get choppiness, but ultimately it is a market that should continue to favor the upside in general and even if we do break down from here, I think that sooner or later the buyers will get involved, especially as the 200 day exponential moving average is below, and that of course is normally attracts quite a bit of interest by longer-term traders. I do think eventually we break out to the upside.

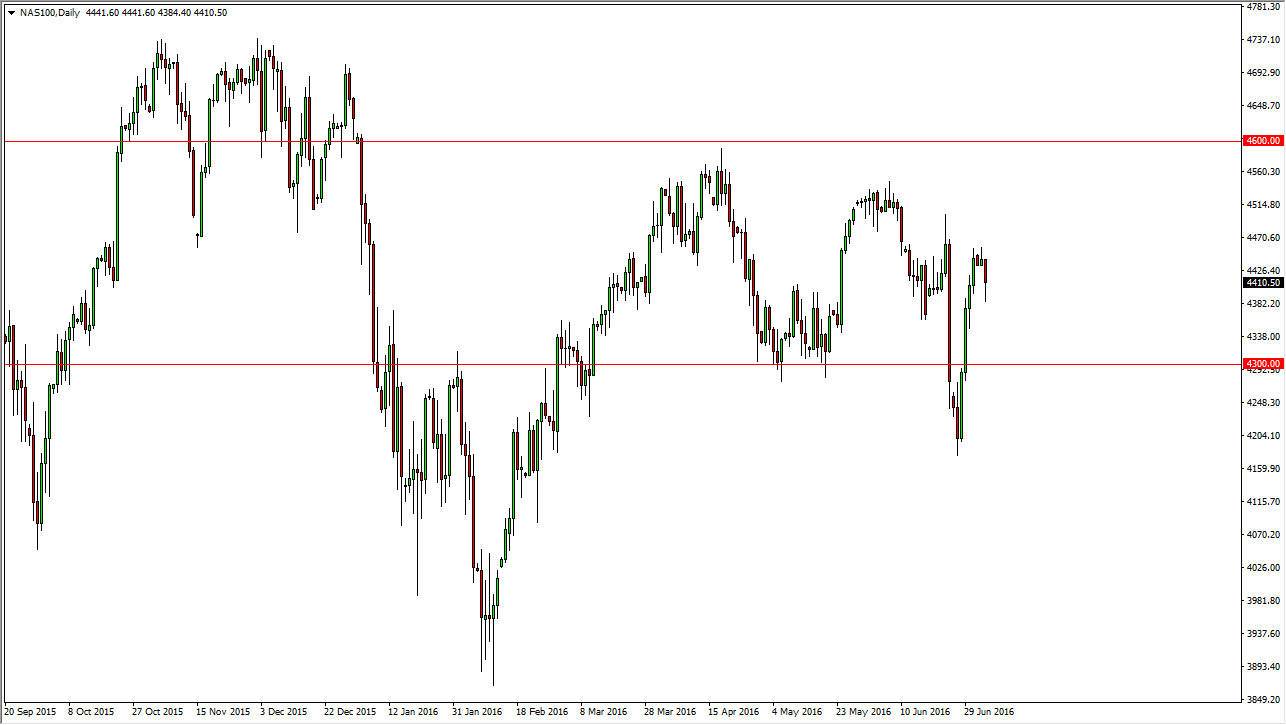

NASDAQ 100

The NASDAQ 100 initially fell during the day as well but turned around to form a little bit better looking hammer quite frankly, so having said that I think it’s only a matter of time before we break out to the upside. Even if we fall from here, I think that there is more than enough support to continue to offer buying opportunities on supportive candles. With this being the case, the market seems to be favoring the 4300 level as a “floor” in this market, and the 4600 level above as the “ceiling” in this market. I think we will continue to act fairly positive, but it will be choppy the same time. This being the case, I prefer short-term buying opportunities in a back-and-forth type of action as the market will continue to be favored over European indices, as money seems to be flowing into the United States after the recent UK referendum vote. With this, I do prefer buying on short-term dips as it gives us an opportunity to take advantage of value.