S&P 500

The S&P 500 went back and forth during the course of the session here on Tuesday, as we continue to grind sideways. With the FOMC Statement coming out during the day today, there could be a bit of volatility today, but at the end of the day I still believe that we will go higher given enough time. A pullback from here should be a nice buying opportunity, and I believe that the 2125 level continues to be the “floor” in this market. A break above the top of the candle should send this market much higher, perhaps reaching towards the 2250 level given enough time. I have no interest whatsoever in selling this market, as the interest-rate outlook for the United States is probably going to remain fairly low, but I am the first to admit that the market probably has needed to take this break after the impulsive move higher.

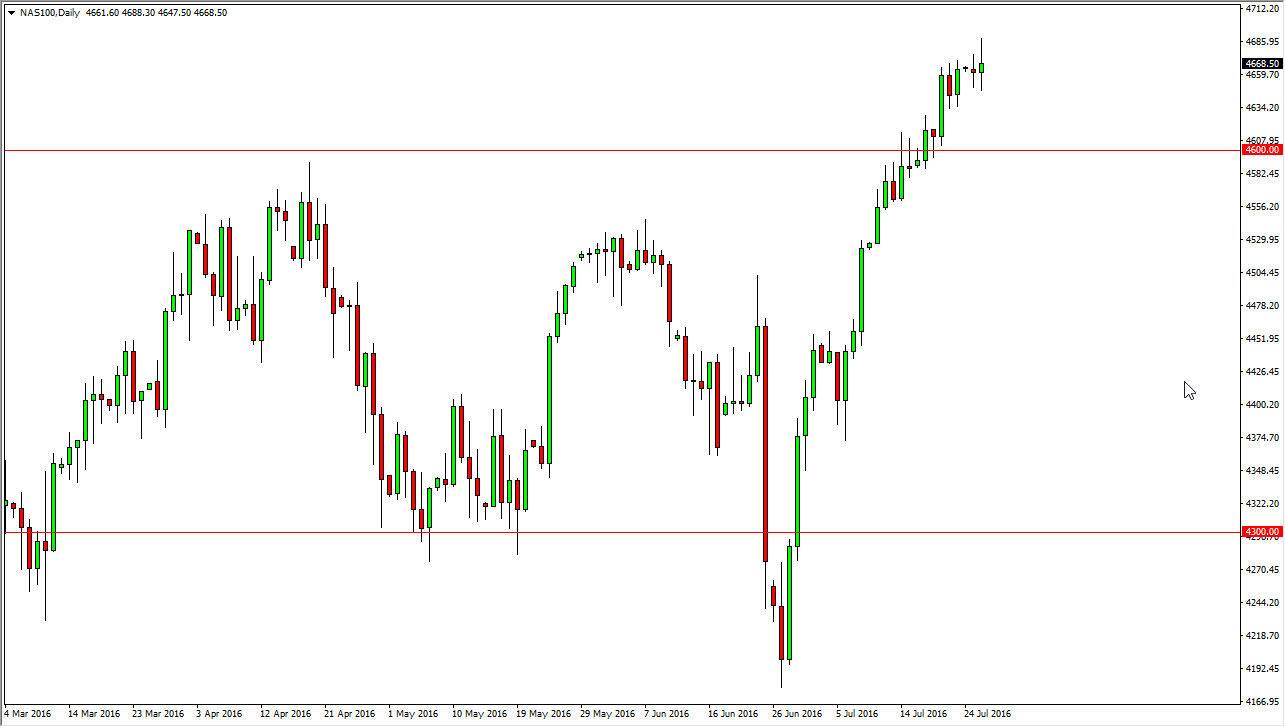

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the day on Tuesday, as we continue to see quite a bit of volatility. The NASDAQ 100 breaking out above the 4600 level was a sign that we were going higher, and now we may just simply be waiting for more momentum in order to go higher. If we pullback from here, I expect to see more than enough buying pressure underneath the keep this market afloat, and of course the FOMC Statement today could have a lot to do with what happens next.

A break above the top of the range for the session on Tuesday would send this market looking for higher levels, which I think will happen given enough time. I have no interest in selling, the NASDAQ 100 continues to be one of the better performing indices that I follow. With this, I continue higher prices given enough time and ignore sell signals.