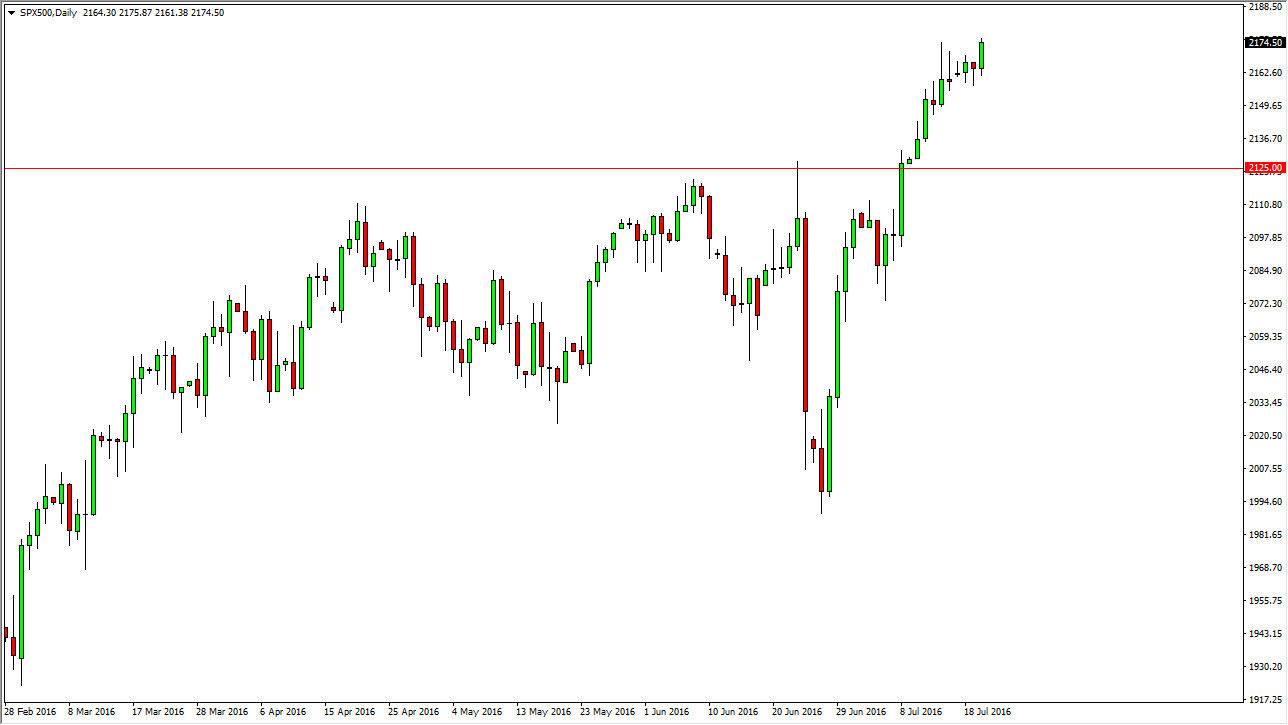

S&P 500

The S&P 500 broke higher during the course of the day on Wednesday, as we continue to see quite a bit of bullish pressure in this market. With this being the case, it looks as if we will probably try to continue to go higher over the longer term but it does appear also at the same time that you could make an argument for this market starting to run out of momentum. Nonetheless, I do believe that eventually this market finds buyers, and I still believe that the 2125 level below is essentially the “floor.” As it was so resistive previously, it should be just as supportive in the future. I don’t even think we get down that low, because I believe that any pullback will incite value buying.

NASDAQ 100

The NASDAQ 100 shot higher during the course of the day on Wednesday as well, as we broke the top of the hammer from the Tuesday session. The Tuesday session was sitting just on top of 4600, so quite frankly it’s not a surprise that we broke out to the upside. This is an area that should be supportive going forward, so any type of pullback towards that area will more than likely offer value that people will be interested in purchasing.

A break above the top of the candlestick for the session on Wednesday would also be very bullish, but quite frankly I think that the pullback is more likely than not. After all, there will be people interested in joining the party, but they will wait to see whether or not they can get a better price. Either way, I don’t really have any interest in selling this market, as I think that there is a huge “zone of support” underneath that level. As far as I can see, this is a “buy only” market at the moment.