S&P 500

The S&P 500 fell during the course of the day, but bounced slightly to form a bit of a hammer. It looks as if we are going to continue to fight our way higher, but at this point time I would love to see some type of short-term pullbacks I can take advantage of “value.” I believe that the 2125 level is roughly the beginning of the “floor” in this market, so the closer we get to that area, the more interested I become in buying. Ultimately, I do think that this market goes much higher, and if we can break above the top of the couple of shooting stars from last week, I’d be a buyer there as well. Ultimately, I have no interest whatsoever in selling this market currently.

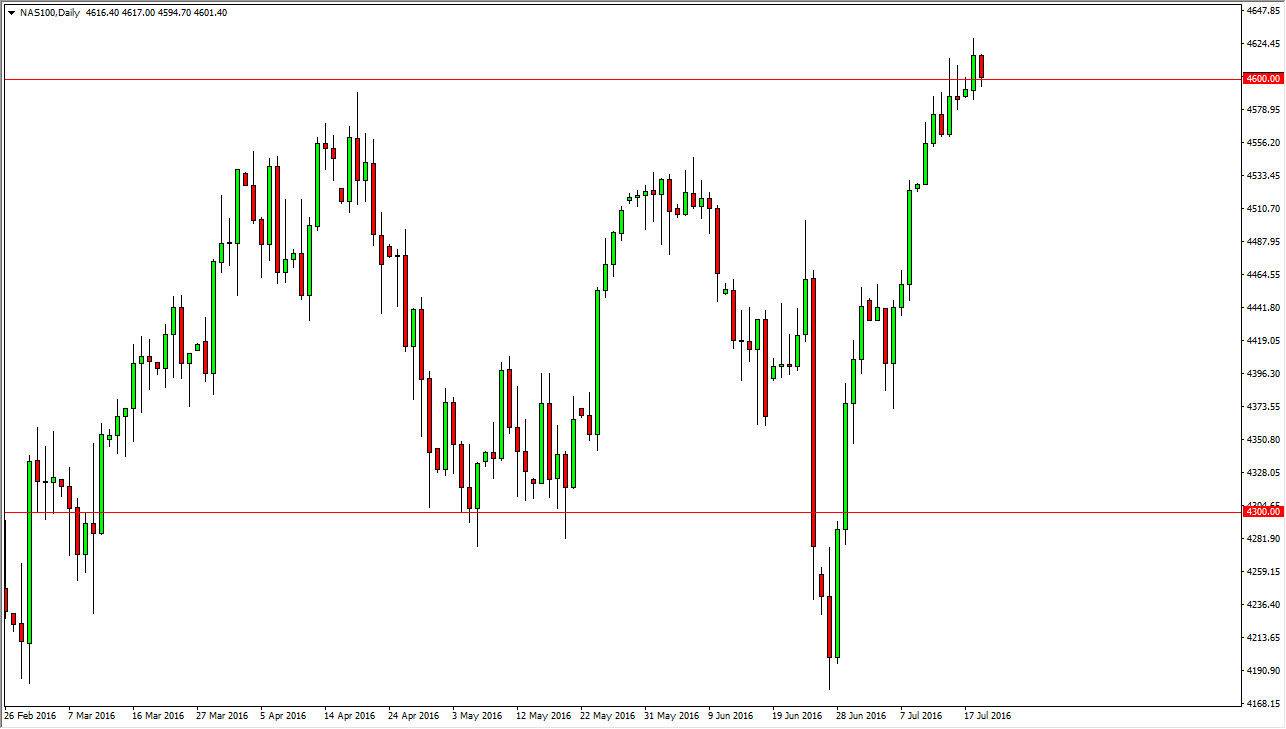

NASDAQ 100

The NASDAQ 100 fell slightly during the course of the session on Tuesday, breaking down below the 4600 level. With this, the 4600 level which had recently been resistance should now continue to be very supportive. I think if we can break above the highs from the Monday session, that’s reason enough to think that this market will continue to go higher as it shows a continuation of the strong move that we’ve seen recently, but quite frankly this is also a market that has been extraordinarily bullish lately, so you could make a real argument for this market has been a bit overbought. With this, I think that a pullback is something that you can’t necessarily rule out, and you have to look at it as it typically offering you value.

I have no interest in selling this market at all right now, and the impulsive move that we’ve seen recently is indeed very convincing. With this, I think that we continue to see buyers and are this market over the longer term and push this market towards the 5000 level given enough time.