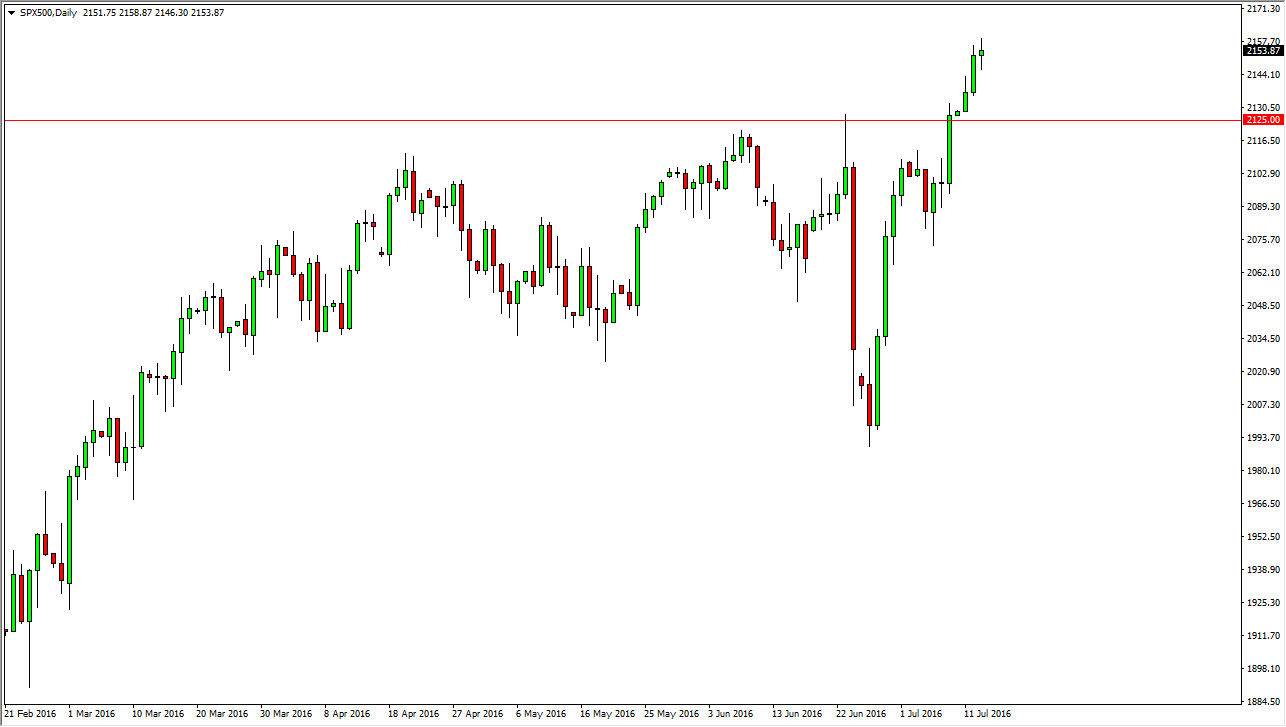

S&P 500

The S&P 500 went back and forth during the course of the session on Wednesday, forming a neutral candle. It appears that we are hugging the 2150 handle, but at this point in time I would not be surprise at all if we had a little bit of a pullback in order to build up momentum to the upside. The 2125 level below should be supportive, and as a result I would love to see a pullback that shows either support or strength that I can start buying. On the other hand, I would buy a break out above the top of the range for the day on Wednesday, as it should send this market looking for higher levels. Either way, I have no interest whatsoever in selling the S&P 500 as it looks very strong at this point in time.

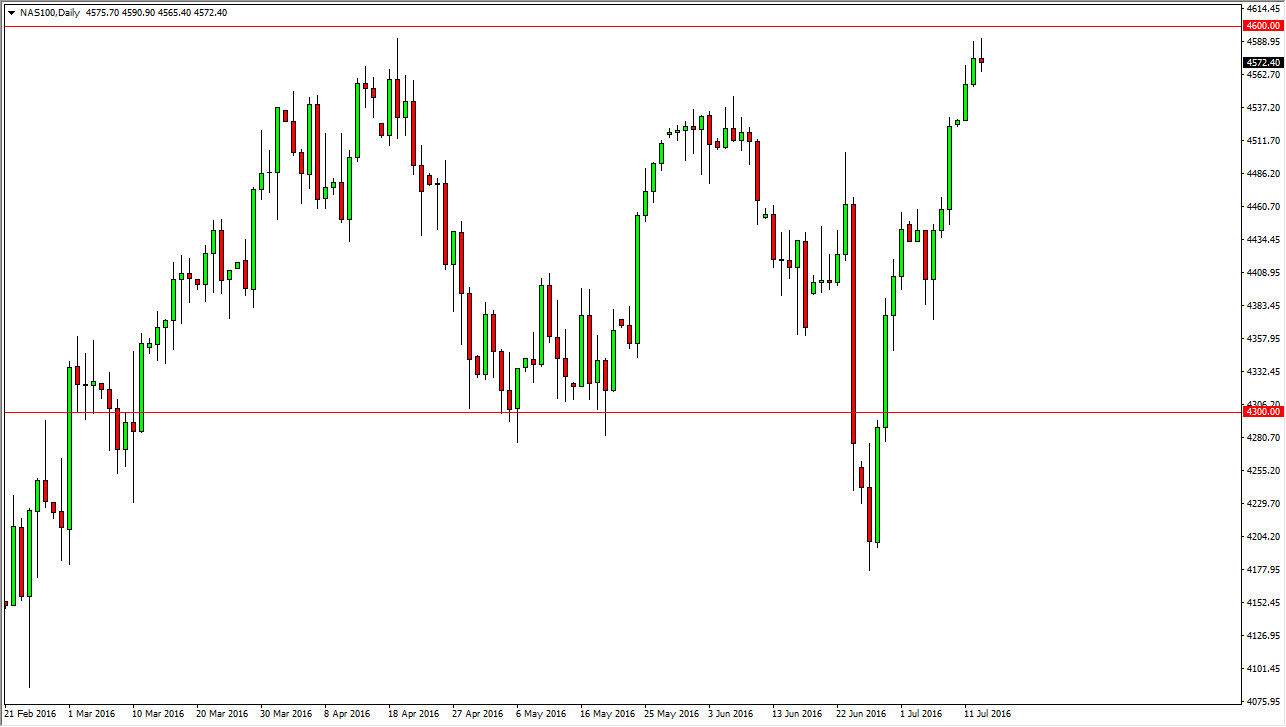

NASDAQ 100

The NASDAQ 100 initially rallied during the course of the session on Wednesday, trying to break above the 4600 level. However, we failed and we turn right back around to form a shooting star. The shooting star of course is a negative sign and therefore I feel that the market will trying to find support below in order to continue going higher. If we can break above the 4600 level, I feel that the market then breaks out to the upside for a much larger move. However, we are bit overextended at this point so I feel that the pullback is not only overdue, but quite healthy. Sooner or later, the buyers will fight back in order to continue the longer-term move.

Ultimately, this is a market that has the upward bias due to the fact of a better than anticipated jobs market, and of course the lack of ability for the Federal Reserve to raise interest rates in the uncertain environment globally. Because of this, the stock markets look very attractive in the United States.