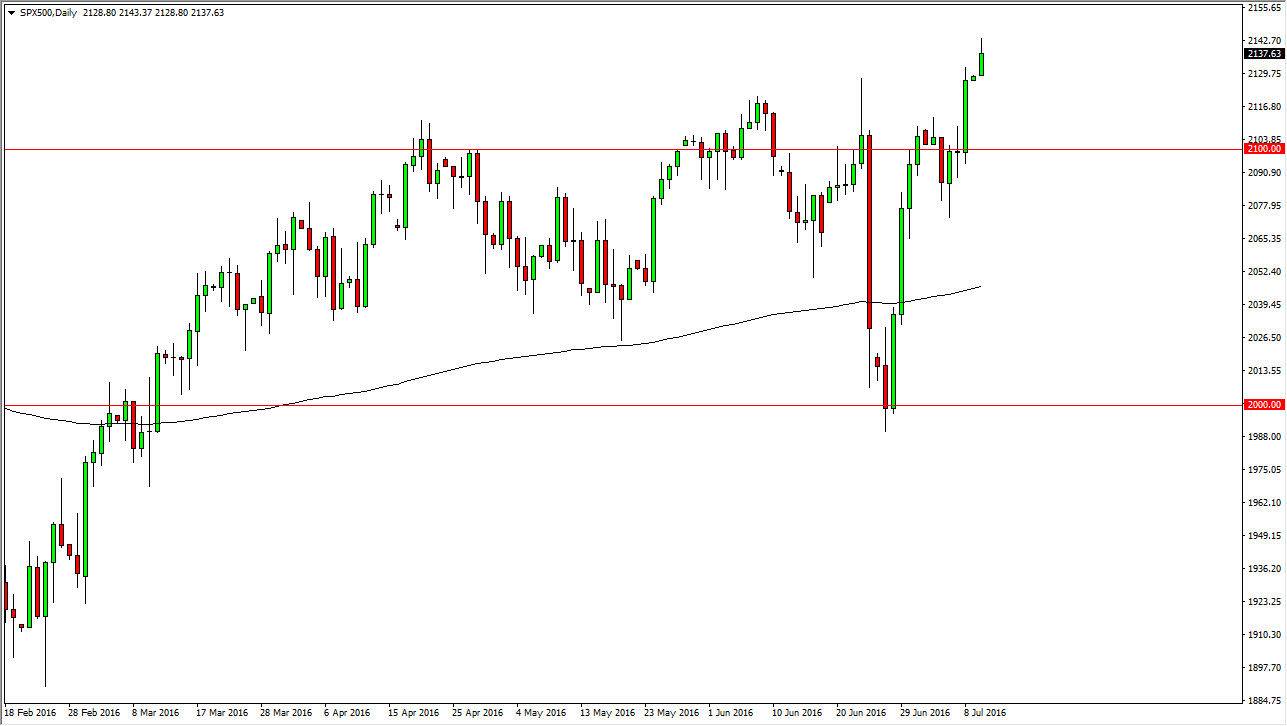

S&P 500

The S&P 500 rose during the day on Monday, as traders came back and reacted to the jobs number further from Friday. I believe that this market is now breaking out to the upside and now looks very likely to go even higher. I believe that short-term pullbacks continue to offer buying opportunities for several different reasons, and that the momentum should continue. After all, the Federal Reserve is on the sidelines as far as interest-rate hikes are concerned due to the “Brexit” vote, and even though we got a very strong jobs number, it’s difficult to imagine that the Federal Reserve will be comfortable getting extraordinarily hawkish. The stronger jobs number of course is also a good sign for the US economy, so you kind of have the best of all possibilities at this point in time when it comes to the S&P 500.

NASDAQ 100

The NASDAQ 100 rose as well, clearing a significant barrier at the 4500 level. However, I do see the 4600 level above as being somewhat resistive, so having said that it’s likely that the market could pull back, but it is probably only a matter of time before buyers would return. I think that the bullish attitude should continue due to the same reasons mentioned above for the S&P 500, but unlike the S&P 500, this market has been a bit of a laggard so it makes sense that we could have to play to “catch up” when it comes to the NASDAQ 100. If that’s the case, we should continue to break out and go much higher.

I think the pullbacks forward should be a nice buying opportunity as there is more than enough support below to keep this market going higher. Every time it falls, you have to start thinking about “value” instead of anything else. Given enough time, the NASDAQ 100 will continue to show bullish pressure and may even have to accelerate to catch up to the S&P 500.