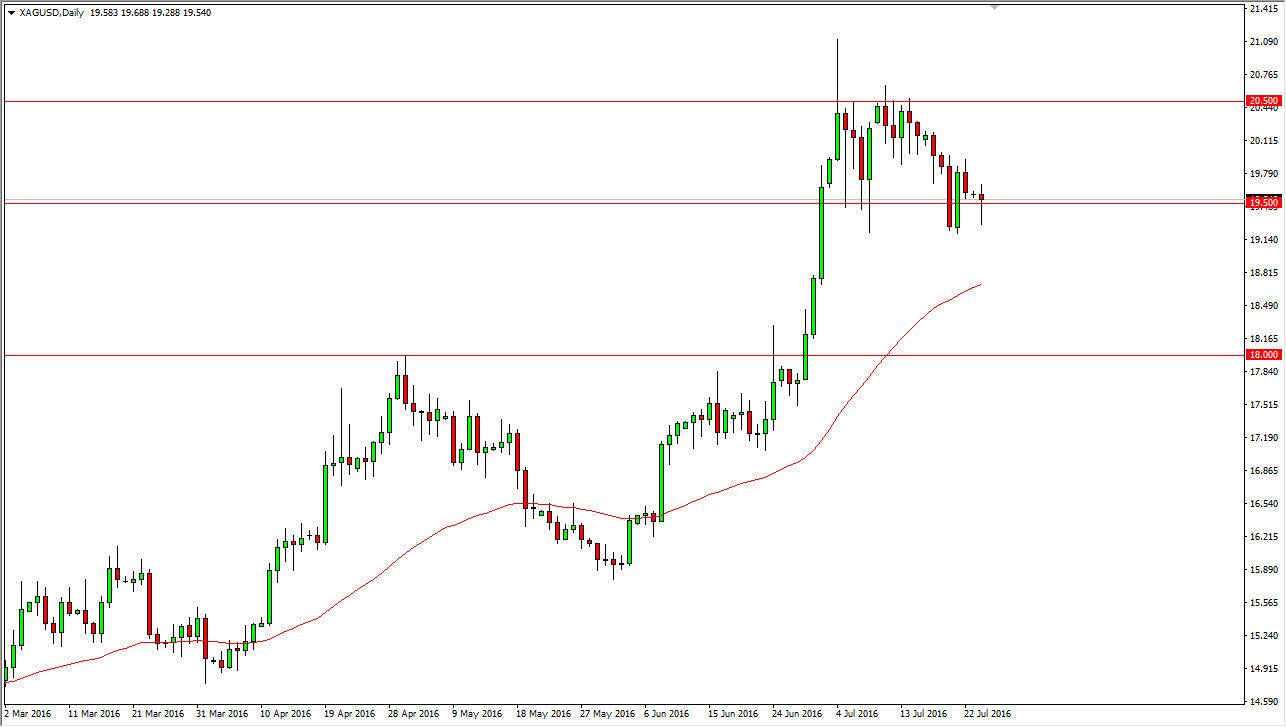

During the day on Monday, the Silver markets fell initially, but we did find enough support underneath the $19.50 level to turn around and form a hammer. The hammer is of course a very bullish sign, and I believe that a break above the top of this hammer should send this market higher. This is a market that has been consolidating between the $19.50 level on the bottom and the $20.50 level on the top. This is a market that continues to grind back and forth but given enough time we should continue to go much higher. The market continues to show strength, even though the US dollar has been strengthening overall.

Sometimes the US dollar doesn’t matter.

The conventional wisdom that a lot of you will here is that as the US dollar rises, precious metals will fall. After all, they are priced in US dollars, so it takes less of them to buy an ounce of gold or silver. However, a lot of it comes down to what the market is buying the US dollar for, or the reason. After all, it is considered to be the “safety currency”, and with that it’s likely that the US dollar rising in times of concern will be ignored buying the metals markets. After all, a lot of you may not know that both gold and silver can rise right along with the US dollar, because it hasn’t happened in wild. However, when you get a flight to safety, it makes sense that the US dollar rises, and you have to keep in mind that the hard currencies can be bought in Euros, Pounds, and of course Japanese yen. Because of this, we can have a little bit of a “knock on effect” when it comes to the futures markets based in US dollars, because the demand rises. Ultimately, this market can rise while the US dollar does, and I expect both to happen.