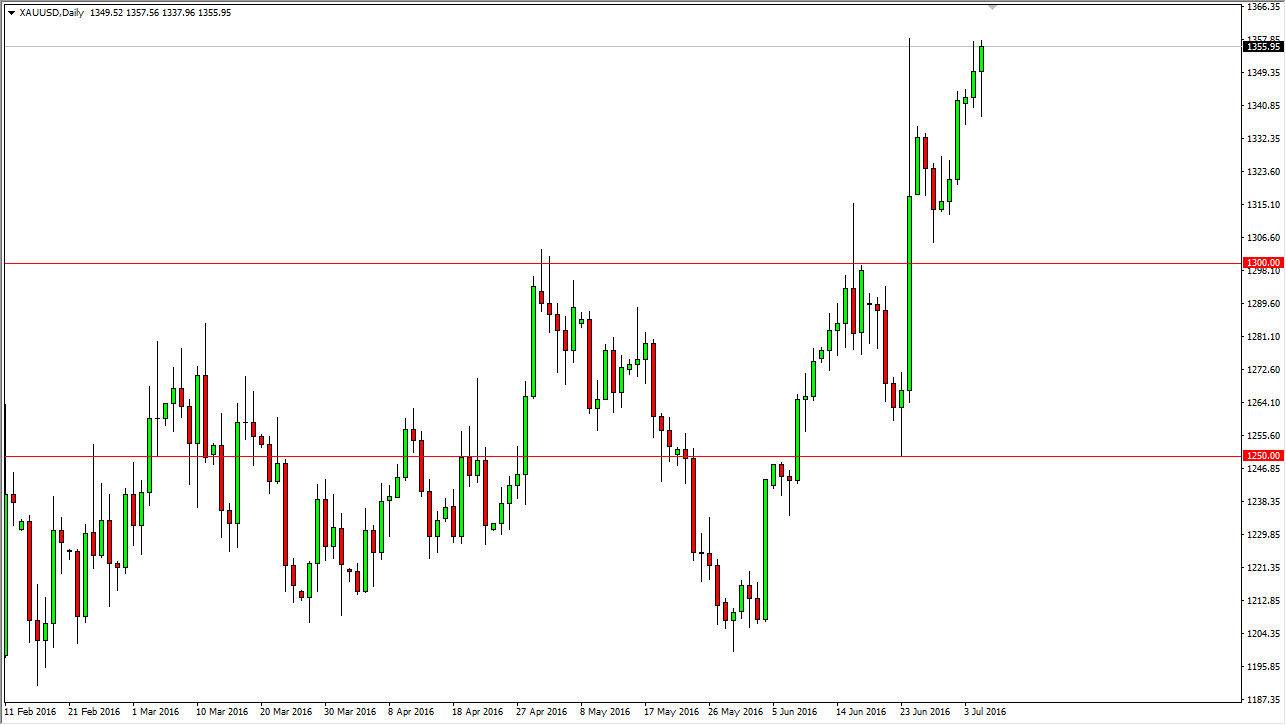

Gold markets initially fell during the day on Tuesday as traders returned from the independent holiday in America. Now that we have sufficient liquidity, it shows that we still have quite a bit of support for this market. After all, the $1340 level offered enough support to turn things back around and form a hammer. The hammer at the very top of the uptrend suggests that we are we are more than bullish, and that there is more than enough support below to continue going higher. I think if we can make a fresh, new high, there’s no reason why the gold market can continue to go higher.

No possibility of selling

I have no interest whatsoever in selling this market, and quite frankly if it sells off, I just look for buying opportunities at lower levels. I think the $1300 level is essentially the “floor” in this market, and that we will continue to see buyers again and again in this market. After all, there’s a large amount of uncertainty out there when it comes to currencies, especially in the Euro and the Pound, so it makes sense that gold continues to attract attention.

Silver markets have already broken out to fresh new highs, so it would also make sense that gold markets eventually continue to go higher. After all, the two markets tend to follow each other, and although I have found that typically gold leads Silver, it can work in both directions. With this, I believe that it is only a matter of time before we break out to the upside. I have no interest whatsoever in selling gold or silver, and believe that it is an excellent opportunity for a longer-term trade, and have been personally buying physical metal for retirement accounts and longer-term accounts.

CFD markets make an excellent opportunity just as futures markets do, if your trading account is sufficiently capitalized. Nonetheless, it appears that the yellow metal will continue to be very strong in the foreseeable future.