Gold prices ended Wednesday's session up 1.4%, or $18.33, to settle at $1338.45 an ounce as the U.S. dollar weakened after the Federal Reserve kept rates steady and signaled a cautious approach to future rate increases. The Federal Open Market Committee said that it “expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.” People were hoping that the central bank would give a clearer indication whether it would tighten policy at its next policy meeting in September.

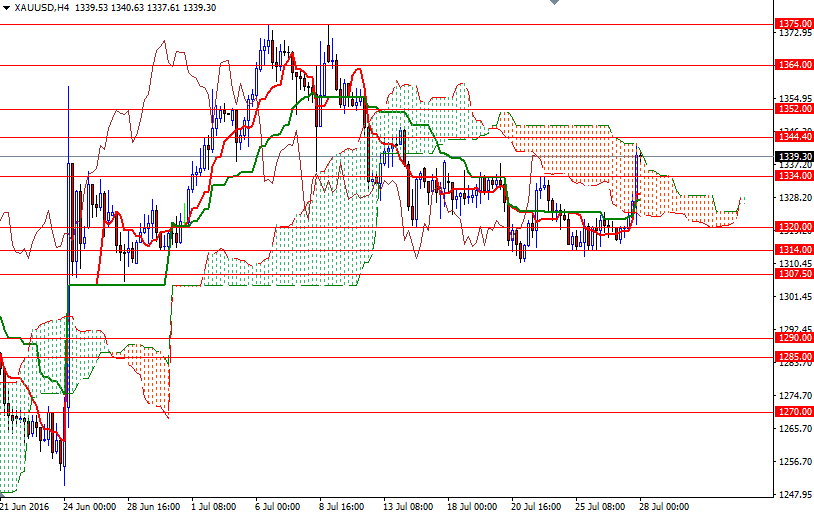

After breaking through the 1334 level, the XAU/USD pair reached the top of the 4-hourly Ichimoku cloud as expected. From an intra-day perspective, the key areas to watch will be 1335/4 and 1344-1342.90. XAU/USD is currently trading above Ichimoku clouds on the 1-hour and 30-minute charts but I wouldn't be surprised if the market returned to the 1334 region (a classic break and retest breakout pattern) for a bullish bounce.

If the market breaks up above 1344, I think the next stop will be 1347.60. The bulls will have to overcome this barrier in order to set sail for the 1356/2 region. A daily close beyond 1356 would imply that the 1364 level might be the next port of call. On the other hand, if prices drop through 1335/4, then the 1331.71-1330 zone could be visited. Breaking below 1330 would set the XAU/USD pair up for a test of the support at around 1325.