Gold prices ended slightly lower Thursday, ending a six-day streak of gains, as the dollar strengthened on the back of the stronger-than-expected U.S. data. The ADP Research Institute said businesses added 172K employees in June after a downwardly revised 168K gain in the prior month and the Labor Department reported that the number of first-time applicants for jobless benefits declined 16K to 254K. People tend to use ADP’s data to get a feeling for the Labor Department’s report, though these figures aren't always accurate in predicting the outcome.

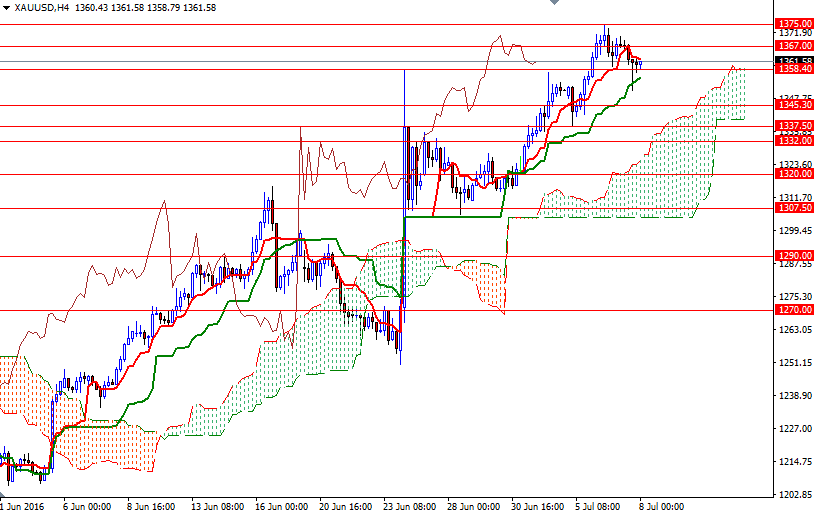

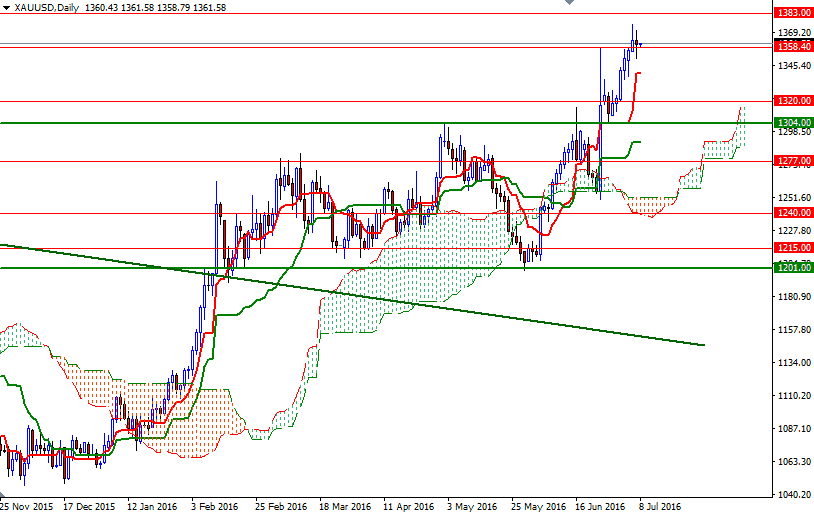

The XAU/USD pair is currently hovering just above the 1358.40-1355 support but the short-term outlook is poor, with negatively aligned Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses on the 1-hour and 30-minute charts. We will probably have to wait for the release of the NFP data before prices get anywhere interesting. The key intra-day levels all remain the same as yesterday as the market remained within a relatively narrow range.

To the upside, the initial resistance stands in the 1364/2 area. Passing through this area would suggest an extension to 1368/7. If prices break above 1368, the possibility of an attempt to revisit the 1375 level would increase. Once beyond 1375, the market will be targeting the 1385/3 area. On the other hand, if XAU/USD drops through 1358.40-1355, then the market will have a tendency to fall further. In that case, the bears will be aiming for 1352 and 1345.30-1342.50. Breaking down below 1342.50 would indicate that the 1337.50 level -which also happens to be the top of the 4-hourly Ichimoku cloud- might be the next stop.