Gold prices rose $7.72 an ounce on Wednesday, up for the sixth straight session to $1355.60, as investors looked for a safe investment amid continued fallout from Britain's vote to quit the European Union. The XAU/USD pair hit $1375.10 an ounce yesterday, the highest level since March 19 2014, after the $1367 resistance gave way. In economic news, the Commerce Department reported that the U.S. trade deficit widened in May and data from the Institute for Supply Management showed the U.S. services sector picked up in June. The minutes of the Federal Open Market Committee's (FOMC) June policy meeting were a bit disappointing for those expected a dovish Fed.

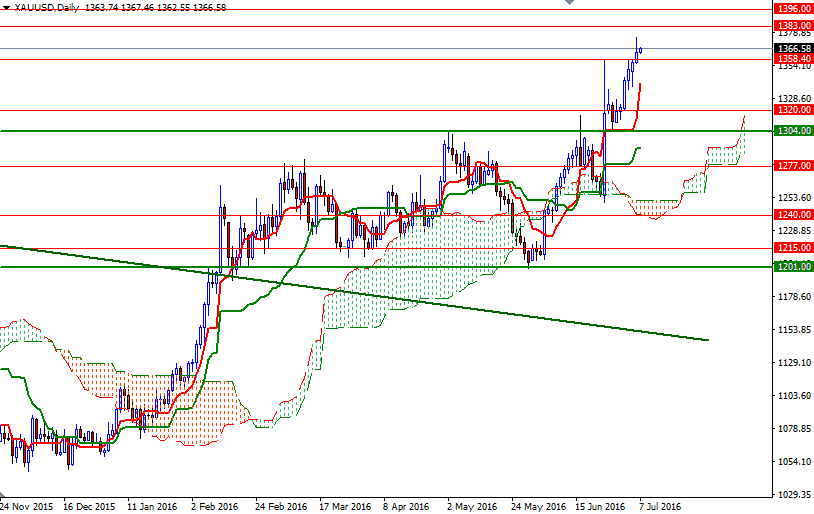

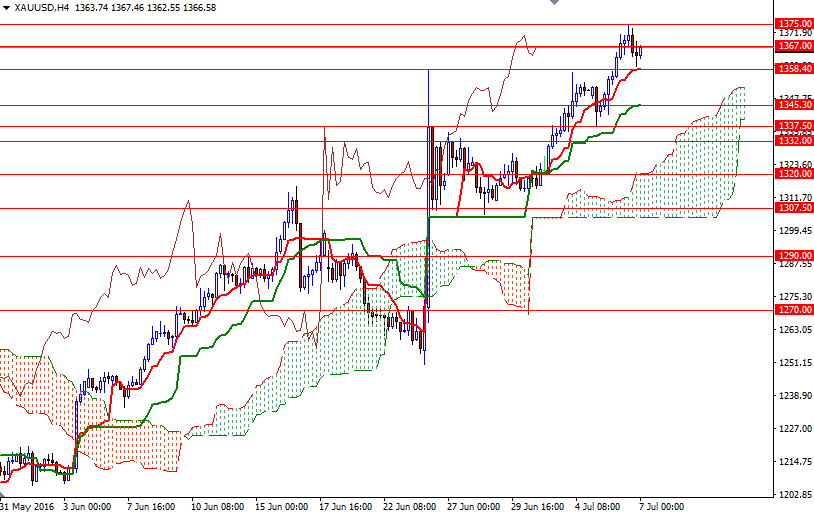

The XAU/USD is currently trading at 1366.58, slightly higher than the opening price of 1363.74. The technical picture remains positive, with the market trading above the Ichimoku clouds on the weekly, daily and 4-hour time frames. However, the tightening trading range suggests some people are cautious and hesitant to make aggressive bets ahead of Friday’s jobs report.

From an intra-day perspective, I think the XAU/USD pair has to push its way through 1375 in order to go higher. If that is the case, the bulls may have a chance to test the 1385/3 area. Beyond that, the bears will be waiting in the 1396/2 zone. To the downside, the initial support stands in the 1358.40-1355 zone. If the bears increases the downward pressure and prices fall through, we will probably see the market testing the next support at around 1345.30. A successful break below 1345.30-1343.50 would set XAU/USD up for a test of the support at 1337.50.