Gold started the week under pressure, with prices returning the $1314 area, as caution set in ahead of a big batch of news on the U.S. economy. The XAU/USD pair traded as low as $1312.34 an ounce but managed to climb back above the $1314 level. Federal Open Market Committee’s two-day policy meeting kicks off today. No rate changes are seen as likely, although a slightly more hawkish tone is seen as probable following better than expected data over the past few weeks which suggest the U.S. economy entered the third quarter with solid momentum.

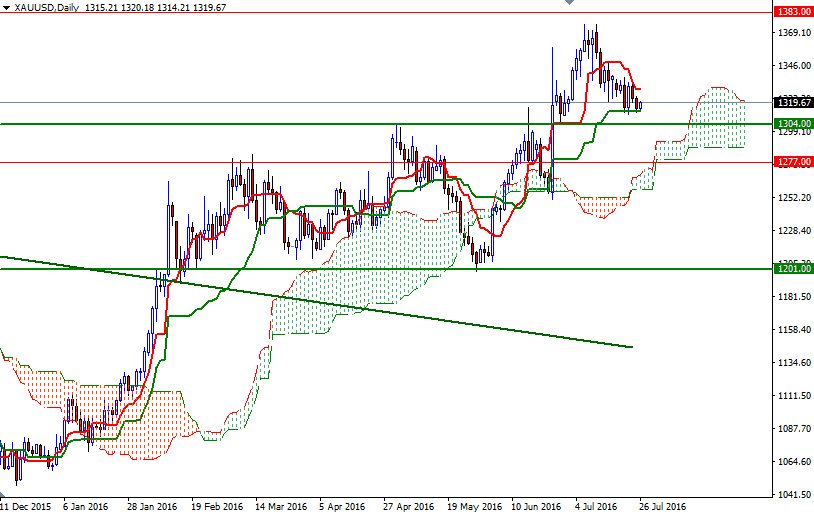

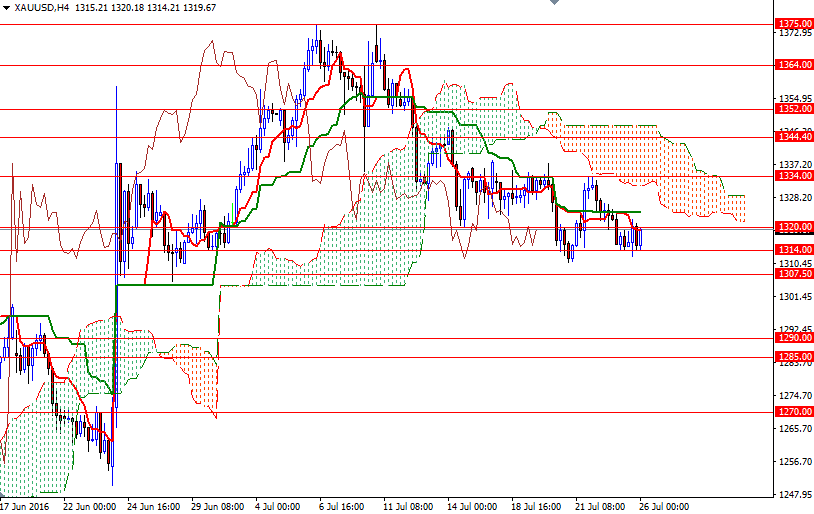

The charts are still giving us mixed signals from a technical point of view, with prices residing on different sides of the Ichimoku clouds on the daily and 4-hourly charts. In addition to that, the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines are flat, indicating lack of real momentum. That said, I think the market may remain range-bound (between the 1304 and 1334 levels).

However, keep in mind that the downside risks will remain unless prices push through the 4-hourly Ichimoku cloud. While clearing the resistance at 1334 might prolong the bullish momentum and start a journey to the 1347.60-1344 region, dropping below the 1307.50-1304 area could open up the risk of a move towards 1299/7. Once beyond 1347.60, the bulls will have another chance to tackle the 1356/2 resistance. A daily close below the 1297 level would make me think that the market is heading to the 1290/85 zone.