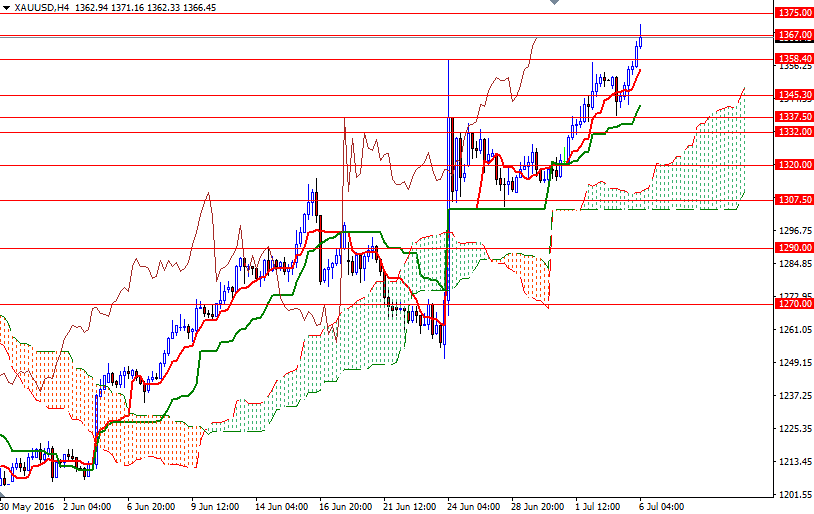

Gold prices ended Tuesday's session up $6.96, extending gains to a fifth-straight session, as declines in equity markets and ongoing uncertainty following the UK's vote to exit the European Union underpinned the precious metal. The XAU/USD pair initially retreated to the $1337.50 level but found enough support to turn things around and challenge the $1358.40 level. Not surprisingly, prices continued to advance after this key level was broken. Investors will now look to minutes of the Fed's June policy meeting in an attempt to glean clues on how concerned officials are about employment and the British referendum.

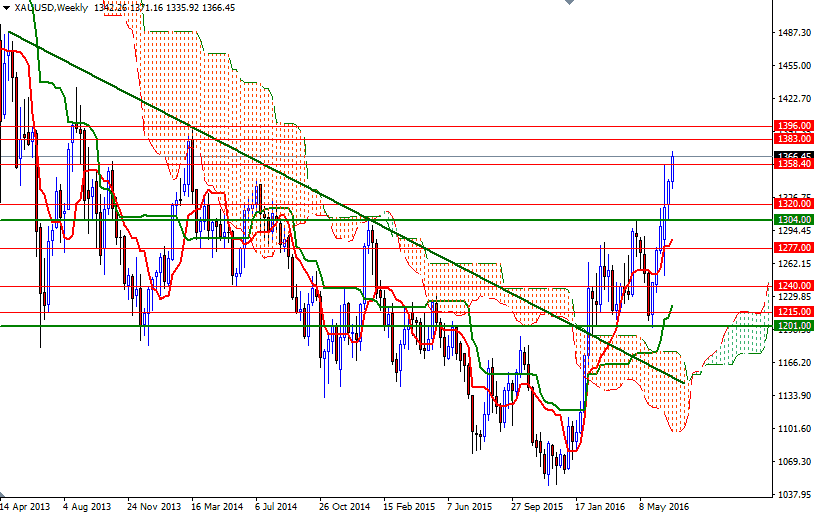

The market is trading above the Ichimoku clouds on almost all charts, plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines, along with Chikou Span/Price crosses in the same direction. The bulls have to push and hold prices beyond 1367 so that they can approach the next barrier waiting at 1375. If this resistance level is broken, it looks like XAU/USD will march towards the 1385/3 area. Once beyond that, there is little to slow down the bulls' progression until 1396/2.

On the other hand, if the bulls run out of fuel and can't climb above 1367, expect a pull-back to the 1358.40-1355. A break down below 1355 would suggest that we might revisit 1345.30 and 1340-1337.50. The bears will need to drag the market below 1337.50 so that they can make an assault on the 1332/1 support zone.