The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 24th July 2016

Last week I predicted that the best trade for this week was likely to be short GBP against long USD. The result of this trade was a small win of 0.49%.

The focus of the market has remained bullish on stocks and the U.S. Dollar.

Some poor British economic data was released, weakening the Pound on Friday and prompting fears that the U.K. may be on its way to a post-Brexit recession.

As the USD looks strong and the GBP has the greatest long-term weakness of all the major currencies, I forecast that the best trade for this week will again be short GBP/USD and also probably short GBP/JPY.

Fundamental Analysis & Market Sentiment

Fundamental analysis may be of some use this week, as it points towards a strong U.S. Dollar, which has been strengthening.

Gold and Silver continue to look relatively strong but they have suffered quite deep pullbacks (especially Gold), so the bullish run in these precious metals may be at an end already or close.

The British Pound is down sharply over the past few weeks and months, and on Friday resumed its fall.

The Japanese Yen has fallen following comments from the Governor of the Bank of Japan that while there will be stimulus if necessary, there will be no “helicopter money”. This led to the strong recent rise in the Japanese Yen being checked, with USD/JPY closing the week about 150 pips off its high.

Technical Analysis

USDX

The U.S. Dollar rose again last week, printing a strongly bullish break-out candle. The price has closed above its level of 13 weeks ago, suggesting that the downwards trend is over. The break of the resistant cap at 12000 suggests that the upwards move will continue to 12200 at least.

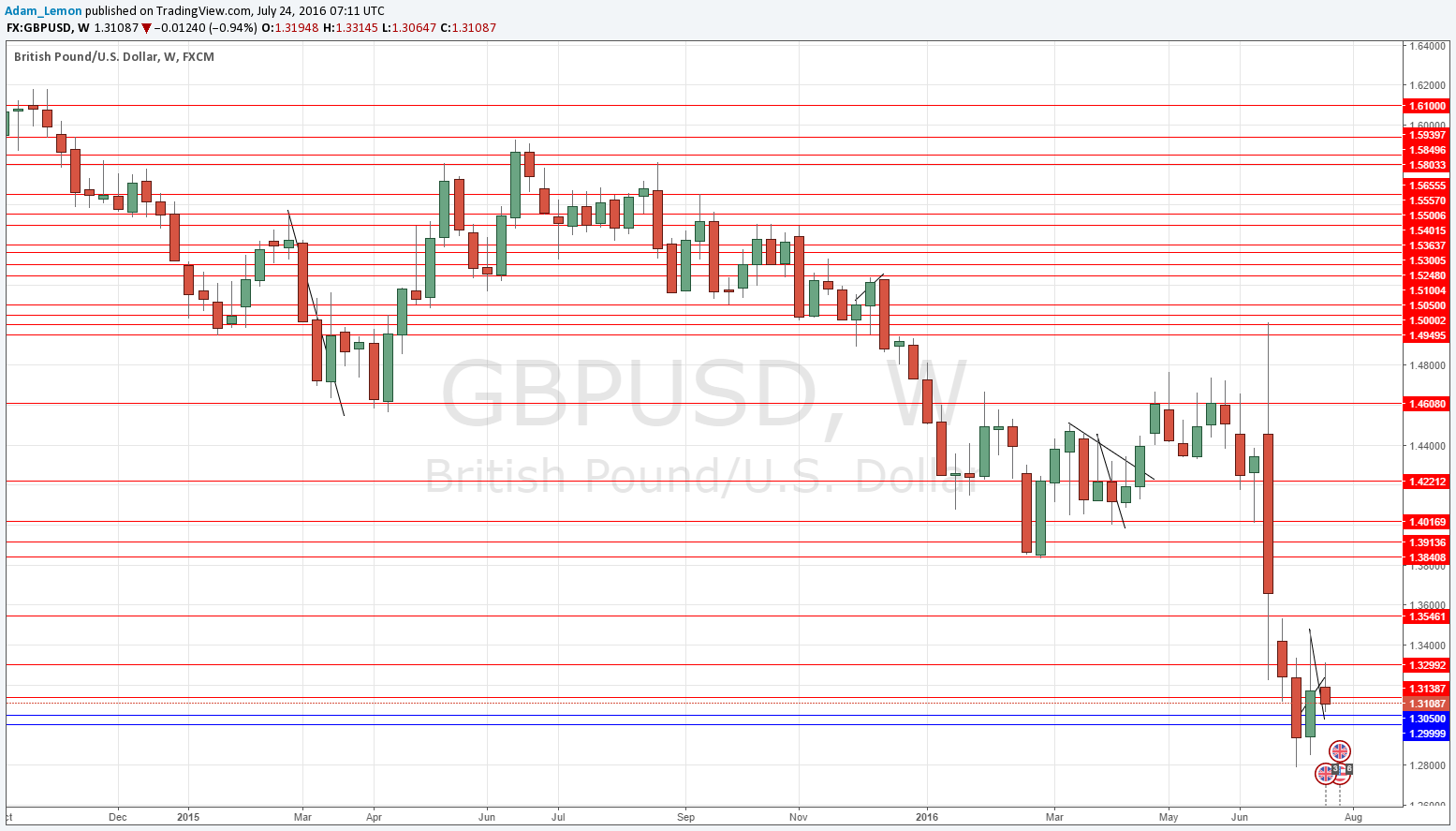

GBP/USD

Although we had a strong recovery last week following the U.K. getting a new government in place with a fairly clear policy of implementing a Brexit which is likely to be as soft as possible, the price fell strongly as it got close to recent highs close to 1.3300.

The recent momentum suggests there is still immediate potential to the down side.

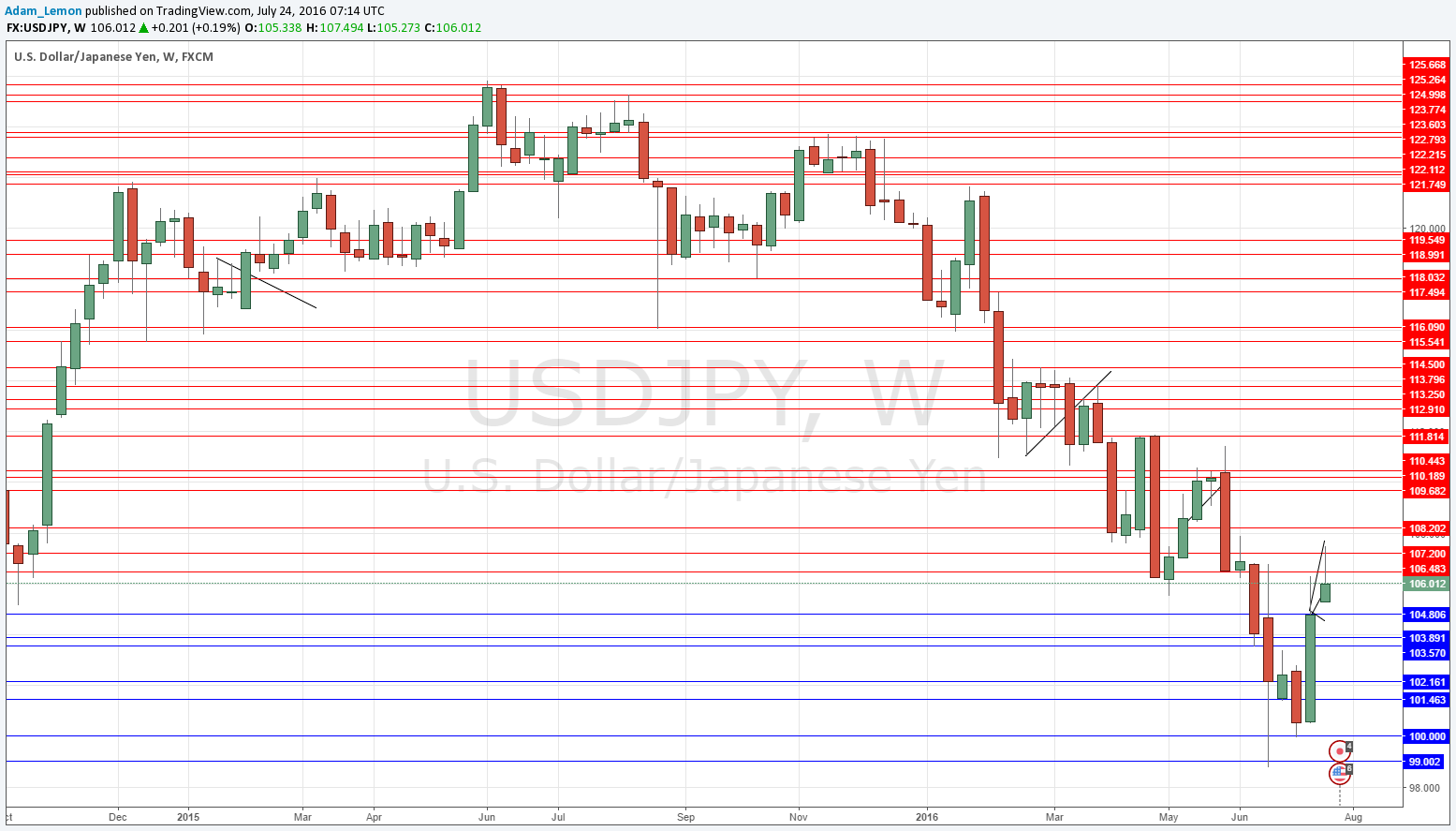

USD/JPY

Although I mentioned GBP/JPY, as we already looked at GBP/USD I prefer to examine the chart of USD/JPY as it is more important as a major pair than a cross such as GBP/JPY.

The chart below shows a strong recovery running out of steam as it hits a very key resistance zone above 106.00. A fall over the next week looks quite possible although GBP/USD looks like a better bet.

Conclusion

Bullish on the USD (and JPY to a lesser extent), bearish on the GBP.