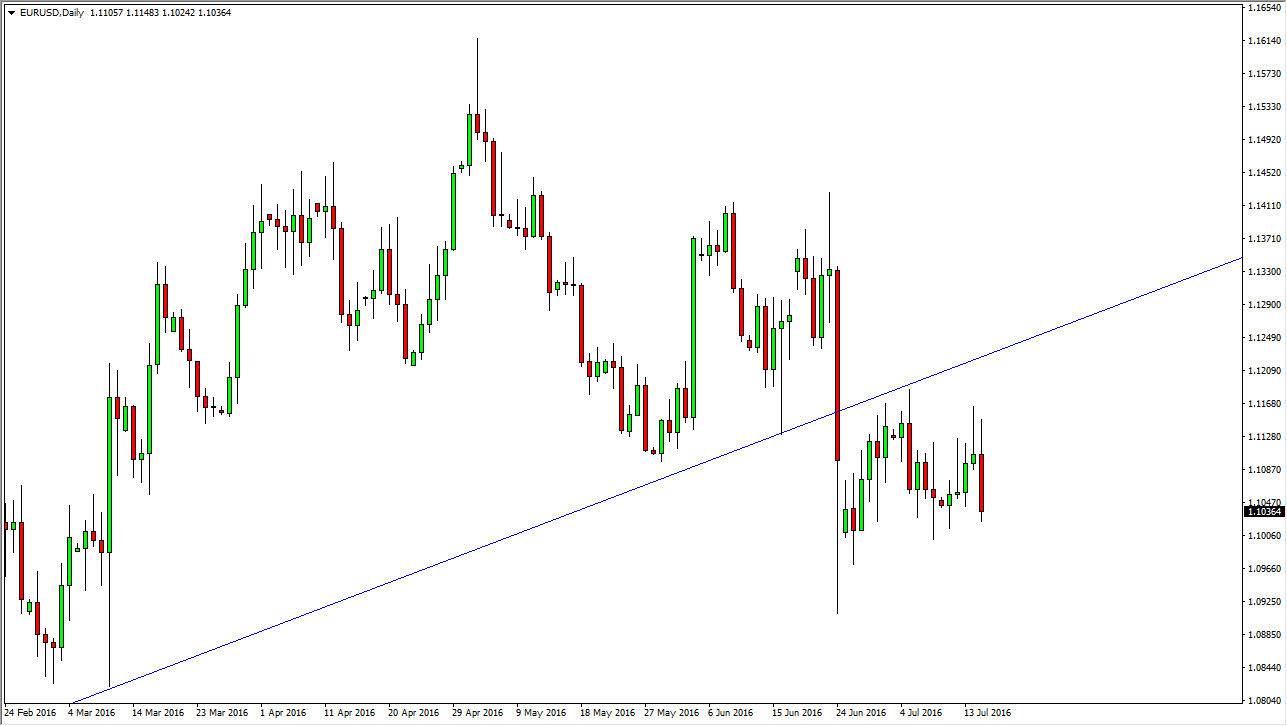

EUR/USD

The EUR/USD pair initially tried to rally on Friday, but turned right back around as we continue to see selling pressure above. By the end of the day, we had actually fallen quite a bit. We are still within the previous consolidation area though, so I do not believe that this market is going to break down significantly quite yet. If we can break down below the 1.10 level, then we could pick up some momentum to the downside. At this point, I have to believe that the consolidation will continue but I do favor selling this market more than anything else as there are so many uncertainties in the European Union. At the time of writing, we also have a potential military coup in the country of Turkey, and that of course will lead to a bit of safety trading, meaning that the US dollar gets a bit of a “knock on effect” at this point in time.

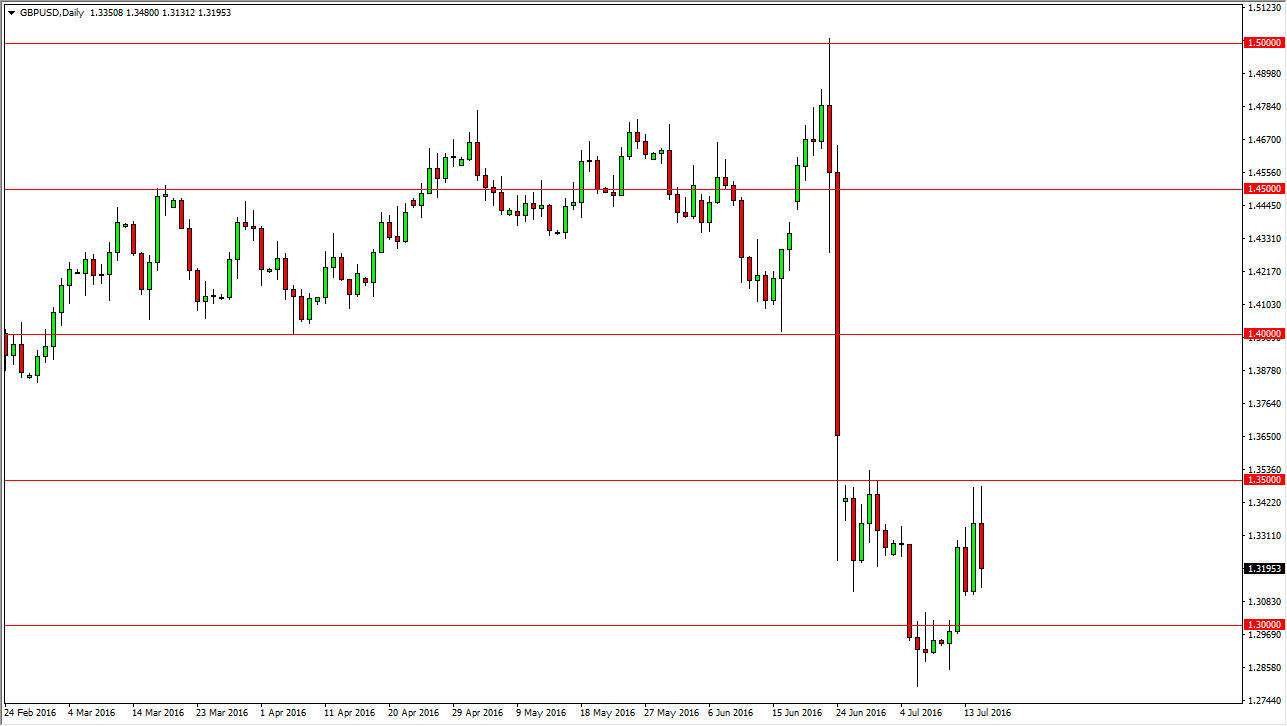

GBP/USD

The British pound initially tried to rally on Friday but found the 1.35 level be far too resistive again and then sold off somewhat stringently. This market looks as if it is going to try to reach towards the 1.30 handle, and as a result I feel that it’s only a matter of time before you can start selling on short-term rallies. I believe that the market then goes down to the 1.30 level, and possibly even below there. I also believe that there is a significant amount of resistance just above the 1.35 handle that is represented by a massive gap. It is not until we get above that gap that I would consider buying this pair. Until then, I sell rallies and breakdowns and will continue to do so. Quite frankly, I think we will reach towards the 1.25 level given enough time, but it is going to take a bit of momentum building.