EUR/USD

The Euro rallied initially during the day on Tuesday, but found the area above the 1.10 level to be a bit too resistive. With the FOMC Statement coming out today, we could get a bit of volatility in the US dollar, but I believe at this point in time this is a one-way market, in the sense that I can only sell. The problems in the European Union will continue to hamper growth in the value of the Euro, and of course the US dollar is the logical place money will flow. The fact that we formed a shooting star is of course a negative sign as well, and we have recently broken down below the bottom of the rectangle which measured 200 pips. With this, I believe that we will reach towards the 1.08 level given enough time.

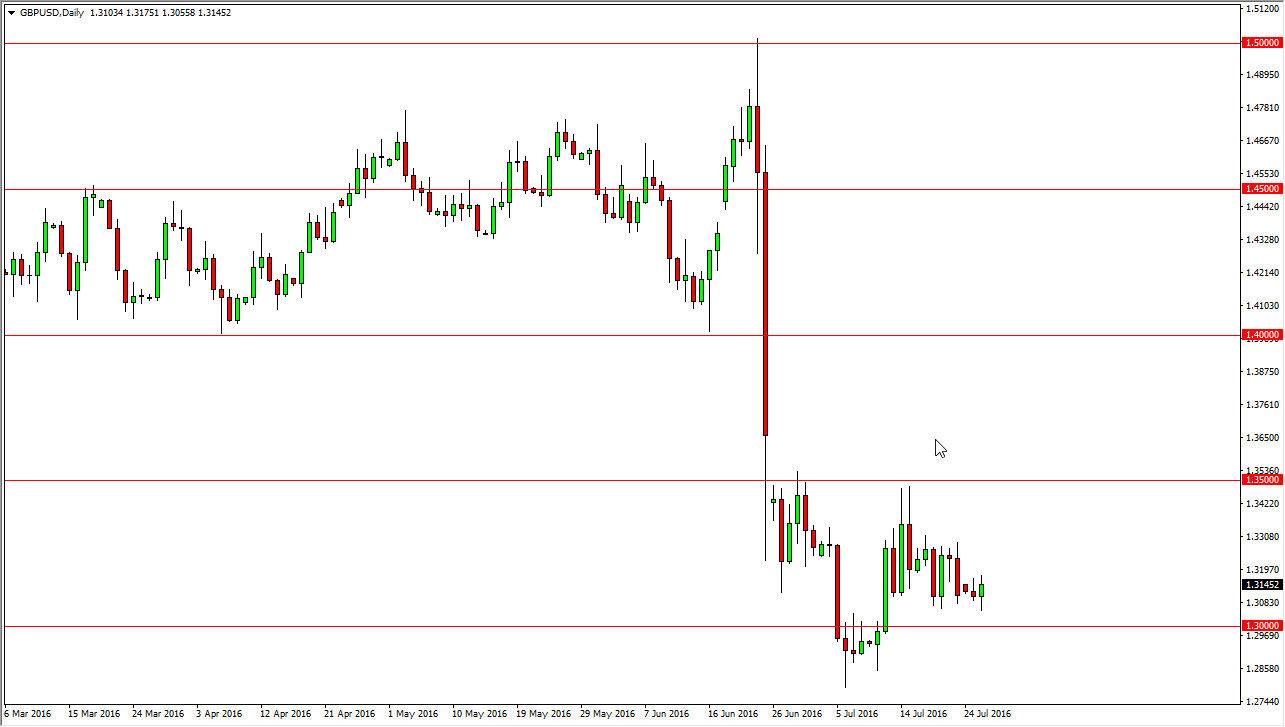

GBP/USD

The British pound get a little bit of a bounce during the day, but it isn’t much to write home about. On top of that, it’s keep in mind that we are still very much in a consolidation area, so we could bounce and simply return to what we have been doing for some time. I believe that the bottom of the consolidation is close to the 1.30 level, while the top of the consolidation area is the 1.35 handle. I still think at this point in time that every time this market rallies, you have to look at it as “value” in the greenback, and start selling. After all, the United Kingdom is going to continue to struggle economically in the short-term as they have recently voted to leave the European Union.

The US dollar of course is considered to be one of the premier safety currencies, so it makes a lot of sense that money would flow from the UK to the USA in this moment. I continue to sell exhaustion after short-term rallies.