EUR/USD

The EUR/USD pair initially fell during the day on Wednesday, but turned around and formed a hammer. While this is a bullish sign in and of itself, the reality is that there is a significant amount of resistance above, not to mention quite a bit of uncertainty when it comes to the European Union itself. Because of this, I believe that any rally at this point in time should offer a selling opportunity, especially if we get close to the previous uptrend line that I think now offers quite a bit of resistance. With this, I am simply waiting for exhaustion above in order to start selling, or a break down below the bottom of the hammer which of course would be bearish as well.

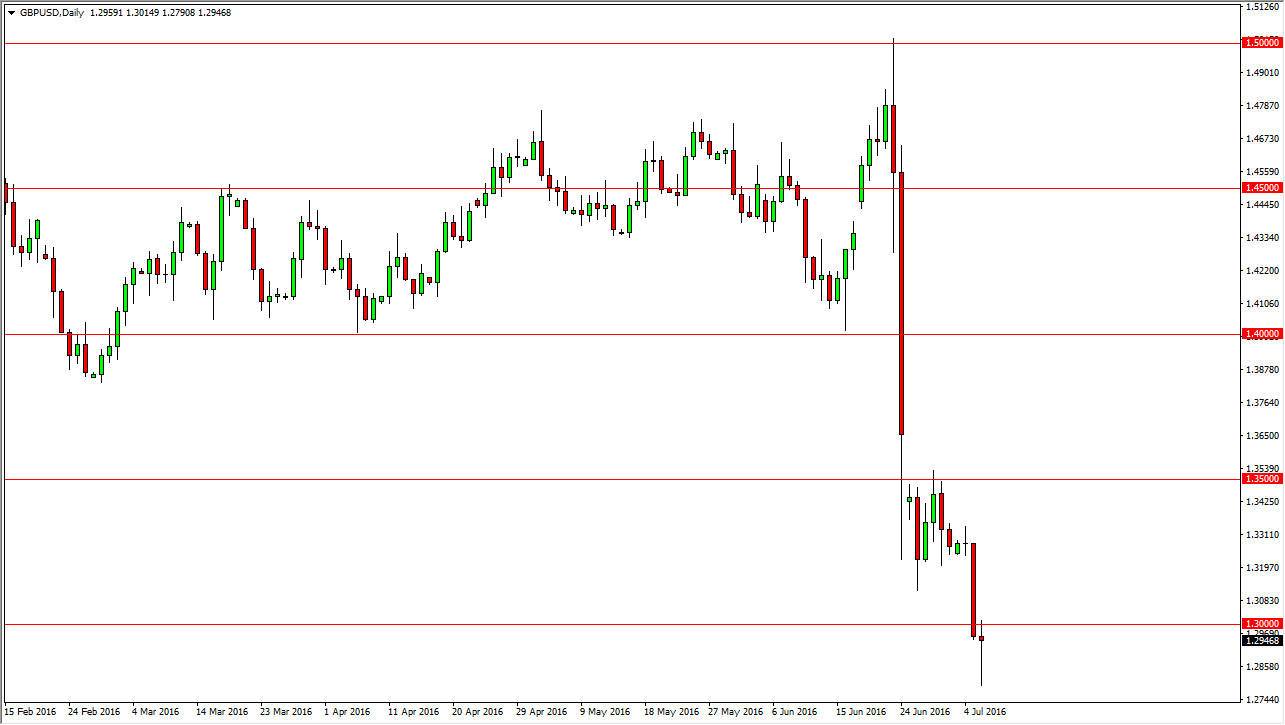

GBP/USD

The GBP/USD pair initially fell during the day on Wednesday but snapped to the upside in order to form a massive hammer. Break above the top of the hammer, and of sensibly the 1.30 level, since this market going higher, perhaps reaching towards the 1.33 level. After that, we will more than likely reach towards the 1.35 handle, where the gap finds itself. With this, I believe that this is a market that continues to show quite a bit of volatility, and an exhaustive candle above should more than likely serve as another opportunity to short the British pound which of course is going to struggle due to the uncertainty involving the United Kingdom and its divorce from the European Union.

Alternately, if we break down below the bottom of the hammer that would of course be a nice selling opportunity as the market should continue to punish the Pound due to recent voting actions. At this point in time, I have no interest whatsoever in buying the British pound, and believe that shorting it will be the longer-term move for the foreseeable future. At this point though, we are a bit oversold and a bounce is probably necessary.