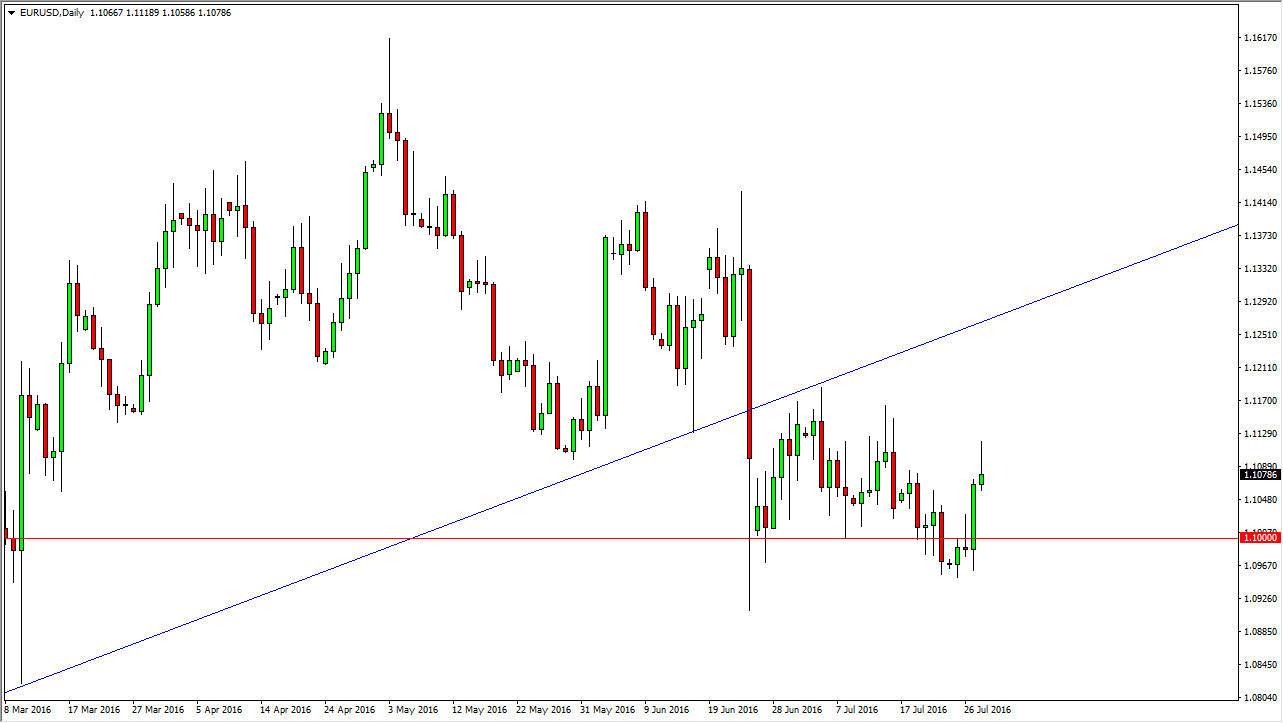

EUR/USD

The EUR/USD pair initially tried to rally during the course of the day on Thursday, but as you can see turned right back around for a bit of a shooting star. This is not a surprise to me, and I do believe that we continue to see quite a bit of bearish pressure on the Euro, due to all of the concerns with the European Union itself. Ultimately, I have looked at any rally in this market as an opportunity to sell, and the candle during the Thursday session certainly suggests that we may see some of the same going forward. I think if we can get below the 1.09 level, things get really ugly and we continue to grind our way lower for the longer term, with an ultimate target somewhere closer to the 1.05 level, or even possibly parity given enough time.

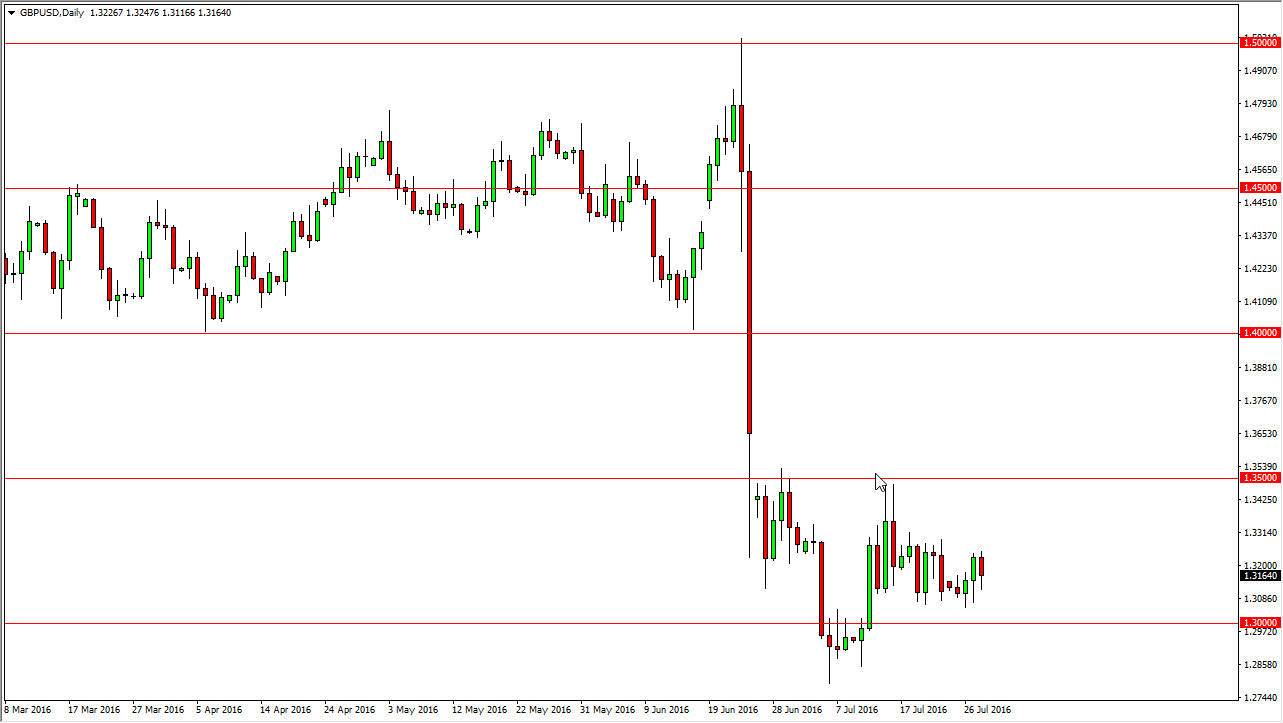

GBP/USD

The GBP/USD pair initially fell during the day but it did bounce towards the end and it showed a little bit of resiliency. Ultimately though, I think that this is a market that Sibley needs to go sideways for a while as we catch a breath after falling apart. Any rally at this point in time should be a selling opportunity on signs of exhaustion, and I believe that the 1.35 level above is a massively strong “ceiling.” Because of this, I believe that this market will selloff and finally break down, but it might take some time.

The 1.30 level below is supportive, but I think that support runs all the way down to the 1.28 level. If we break down below there we should see the market resource 1.25 handle, and that is my longer-term outlook. Because of this, I am “sell only” when it comes to the British pound but I recognize that I need to see rallies and show signs of exhaustion or breakdowns before we can actually do that.