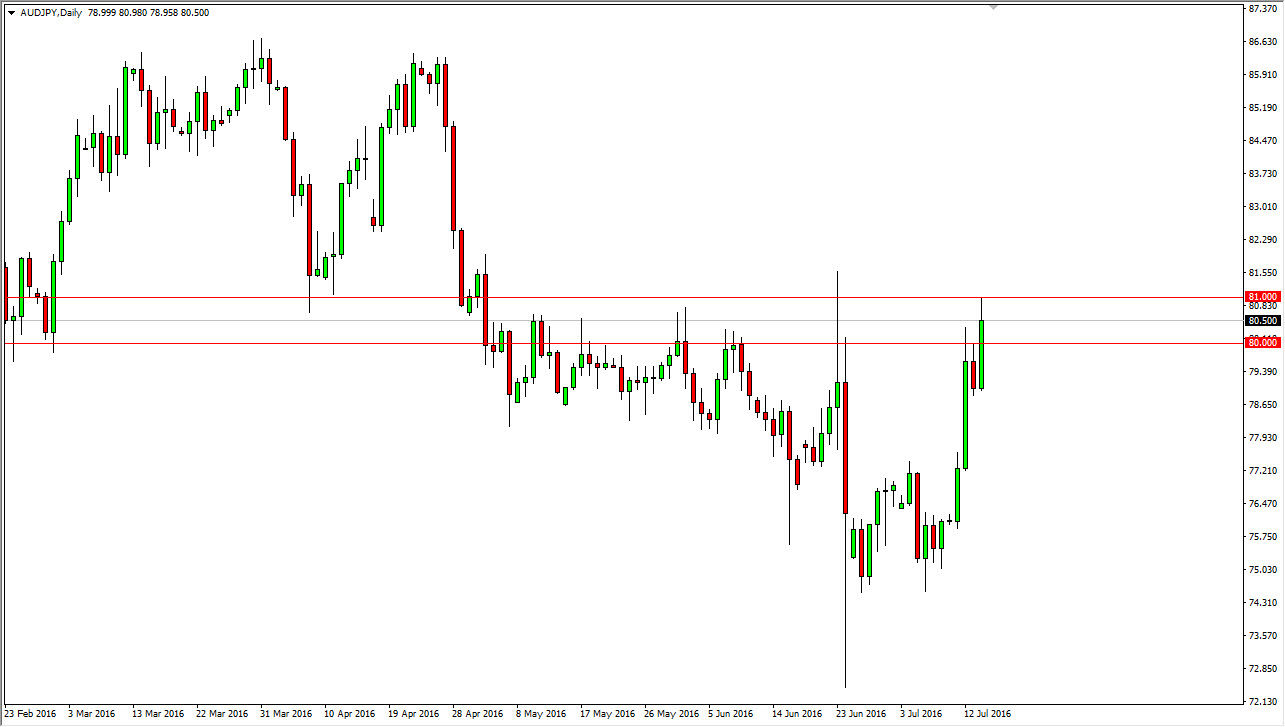

During the day on Thursday, the Australian dollar climbed rather drastically against the Japanese yen, slamming into the 81 handle. I believe that the 81 handle is significant, as it is the top of a “zone” of resistance that we’ve seen in this market previously. If you look at the chart, you can see that there have been several attempts to break above 80 over the last couple of months, but we couldn’t sustain the rally. Every time that we got above 80, we invariably fell back below it.

What makes the candle on Thursday little bit different as the fact that we are closing well above 80, and Rose all the way to anyone. While it is not a “higher high”, it does show that we are definitely starting to pick up momentum to the upside.

Bank of Japan

Keep in mind that a lot of people are afraid of the Bank of Japan and its potential actions. This is the first central bank that will intervene in the currency markets when it’s unhappy, and they have been unhappy lately. The Japanese yen has sold off rather drastically as a result. On top of that, they have begun to talk about possible stimulus again, and that of course devalues the Yen over time. With this, I think we have a little bit of a “perfect storm” in this particular currency. Having said this, it’s not necessarily the Australian dollar ally, is the Japanese yen that I really dislike. This is a “better of 2 bad currencies” type of situation.

Remember, the Forex market is essentially a relative market, meaning that one of the currencies will do better than the other. That doesn’t mean that you have to like either one, and quite frankly this is one of the few places I’m willing to buy the Aussie. However, I need to see this market break above the 81 handle on a daily close in order to do so. Nonetheless, we are going to have to make a decision soon I think.