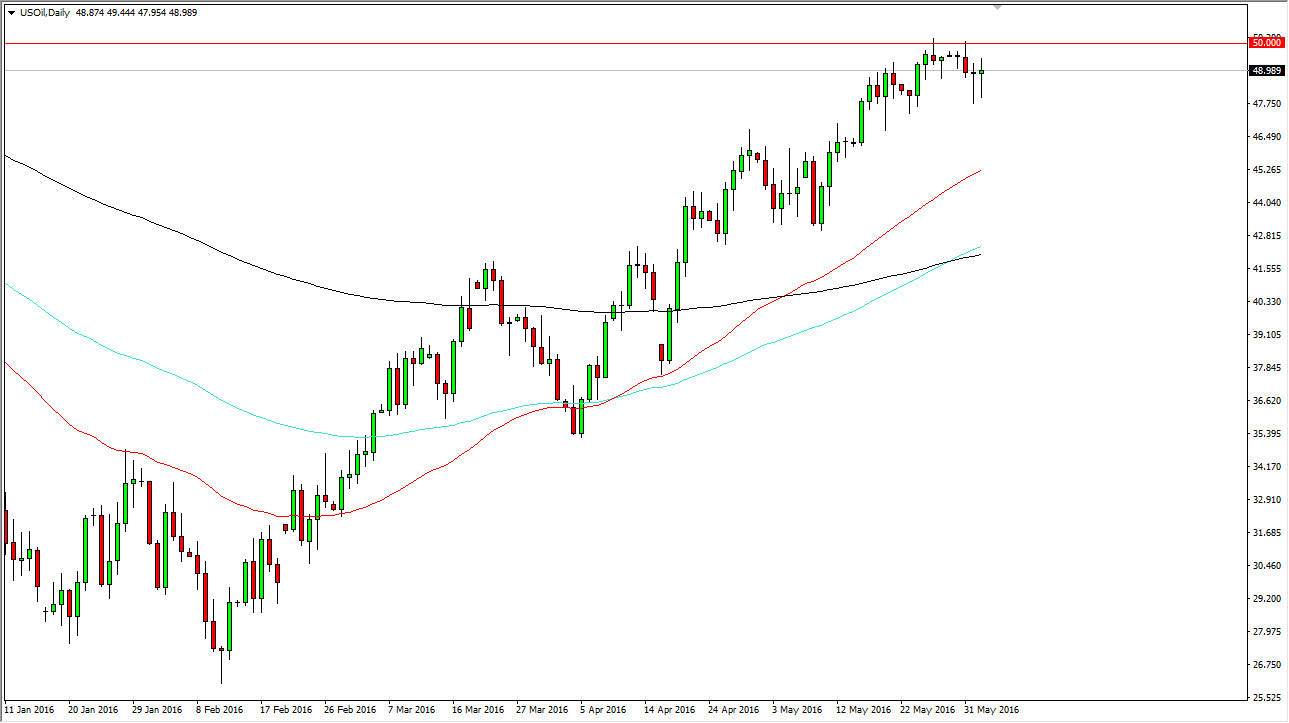

WTI Crude Oil

The Thursday session was more of the same in the WTI Crude Oil market, as we fell initially and then turned right back around to bounce and form a hammer. The hammer of course is a very bullish sign, and it is just below the $50 level. That’s an area that has been important for some time now, and I think it will continue to be so basically because of the large round number aspect. I think today could be crucial, because the Nonfarm Payroll Numbers coming out will of course have a massive influence on the US dollar. By implementing the US dollar, it’s very likely will influence what happens in commodities. Ultimately, it comes down to a higher dollar and lower oil price possibility, or course exact opposite. At this point in time though, it looks like the market wants to go higher so I think pullbacks will be buying opportunities just as a break above the $50 level will be.

Natural Gas

The natural gas markets rose again during the day on Thursday, but pulled back in order to form a bit of a shooting star at the $2.40 handle. This is a market that has broken out drastically during the last several sessions, as we broke well above the 200 day exponential moving average and of course the $2.20 level which had been acting as resistance. On the chart, I also have the Bollinger Bands drawn out in red, just to show exactly how overextended we are at the moment. I would anticipate that a pullback is coming. Short-term traders may take advantage of this, but then again I also believe that buyers will take advantage of it at lower levels.

If we break above the top of the shooting star, that all but ensures that we will reach towards the $2.50 level, which I see as significantly resistance based upon historical precedence. At this point in time, it looks like a bit of a 2 speed market.