USD/JPY Signal Update

Yesterday’s signals were not triggered.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time.

Short Trades

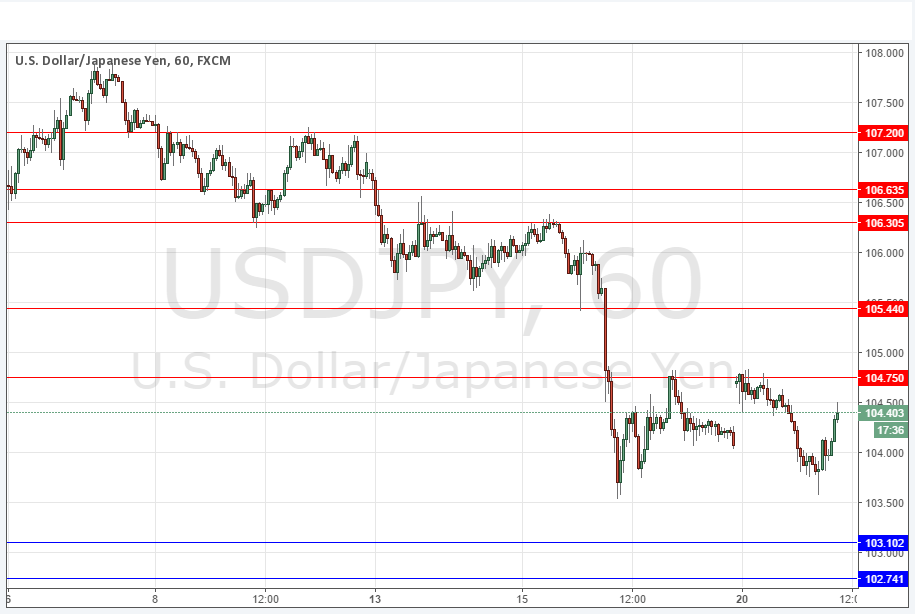

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 104.75 or 105.44.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 103.10 or 102.74.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair is in a strong long-term downwards trend and just couldn’t get above the resistance at 104.75 yesterday. For many hours it wouldn’t fall either, but late in the New York sentiment something of a minor risk-on sentiment shift occurred and this was enough to drive the price down to retest recent record lows, although not to exceed them.

However the price has rebounded strongly from the area below 104 and now looks set to retest the 104.75 area, having already reached 104.50 as at the time of writing.

Shorting this pair remains a great way to take advantage of any risk-on shift.

There is nothing due today concerning the JPY. Regarding the USD, the Chair of the Federal Reserve will be testifying before Congress at 3pm London time, followed later by FOMC Member Powell speaking at 7:30pm.