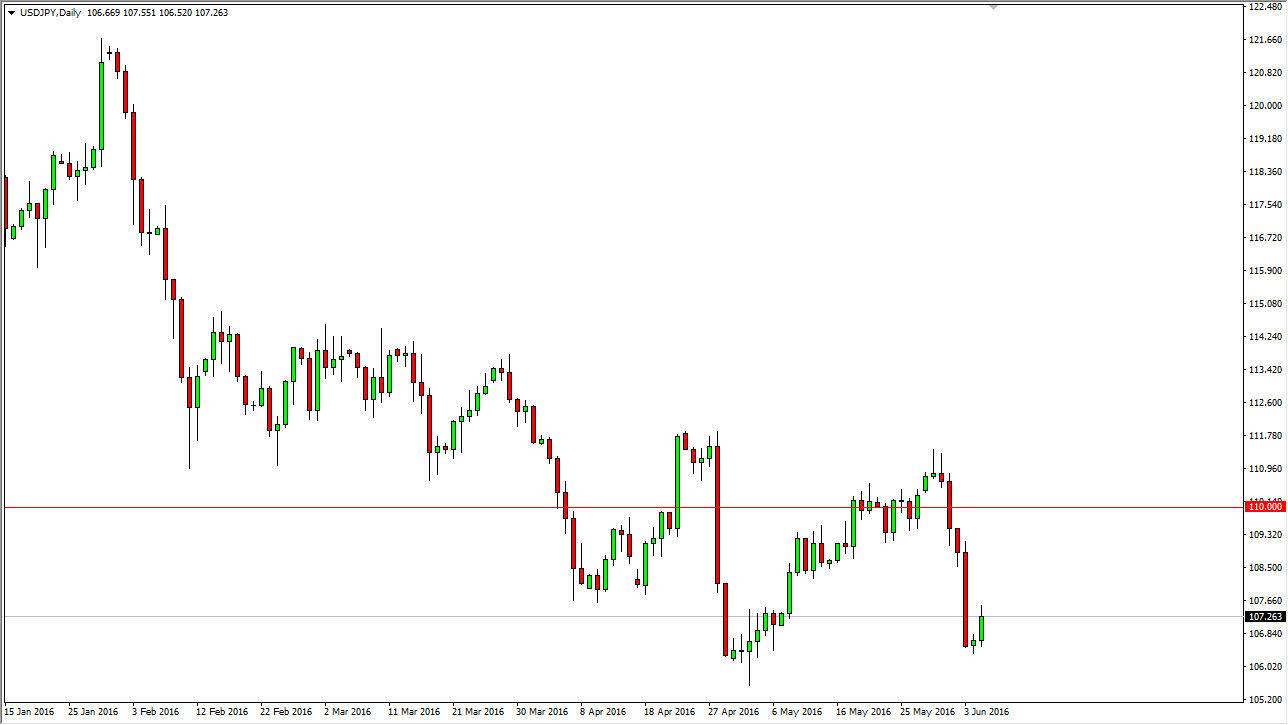

USD/JPY

The USD/JPY pair rallied during the day on Monday, bouncing off of the bottom of the candle on Friday. This is a market that of course is very sensitive to risk appetite, and the horrific jobs number coming out of America on Friday of course cause quite a bit of trouble for the US dollar in general. Because of this, we formed a massively negative candle during the course of the session on Friday, and as a result I believe that the sellers will return to this market given enough time. If we get an exhaustive candle, I would not hesitate at all to start selling. I don’t have any interest in buying, because there so much in the way of negativity in this market. With that being the case, I am simply sitting on the sidelines and waiting for an opportunity to start selling again.

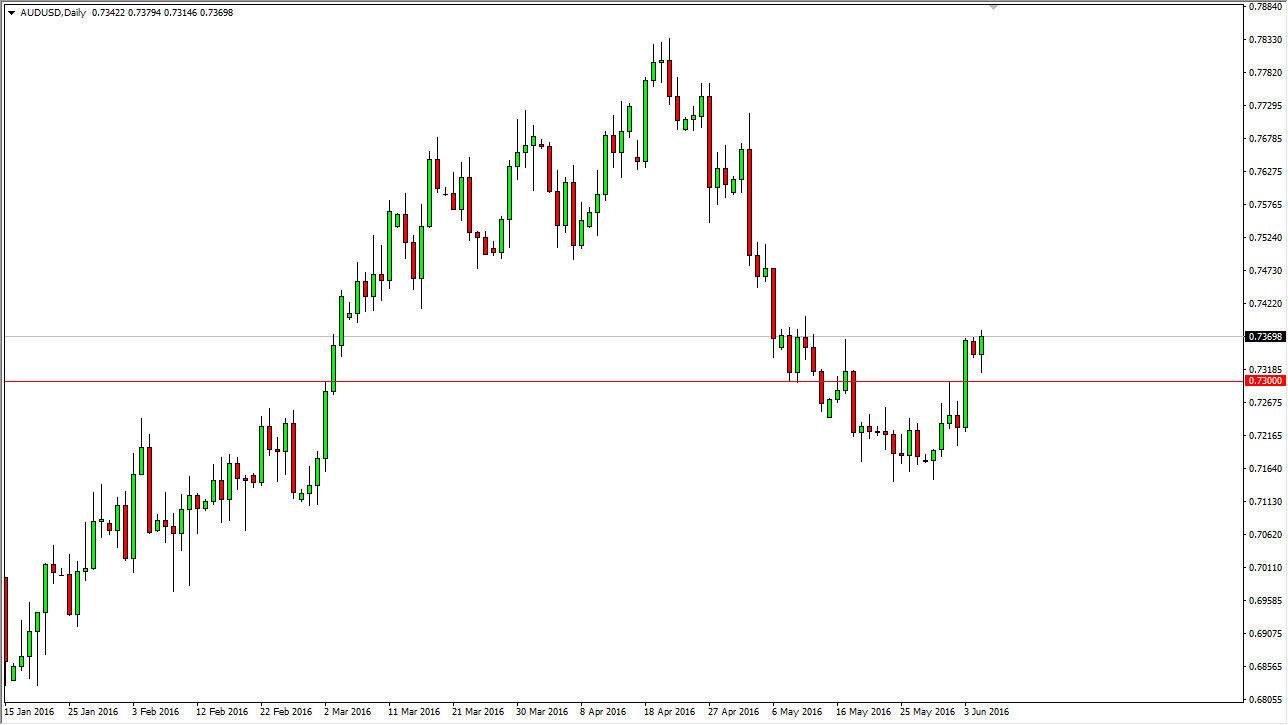

AUD/USD

The AUD/USD pair fell initially during the course of the day on Monday, testing the 0.73 level for support. We ended up bouncing a significant amount of distance off of that area, as we ended up forming a bit of a hammer. A break above the top the hammer, and more importantly the 0.74 level, would be a very bullish sign and I believe that the rest of the distance of the market would start buying. At that point in time, we should then reach towards the 0.75 level, which was previously supportive. If we can break above there, we will continue to go even higher. I do think that happens given enough time, but it will probably be a bumpy ride higher.

The gold markets of course are very heavily influential when it comes to the Australian dollar, and is starting to pressure the $1250 level above. If we can break above there, the market should continue to go much higher in the gold markets, and that of course should drive demand for the Australian dollar as well.