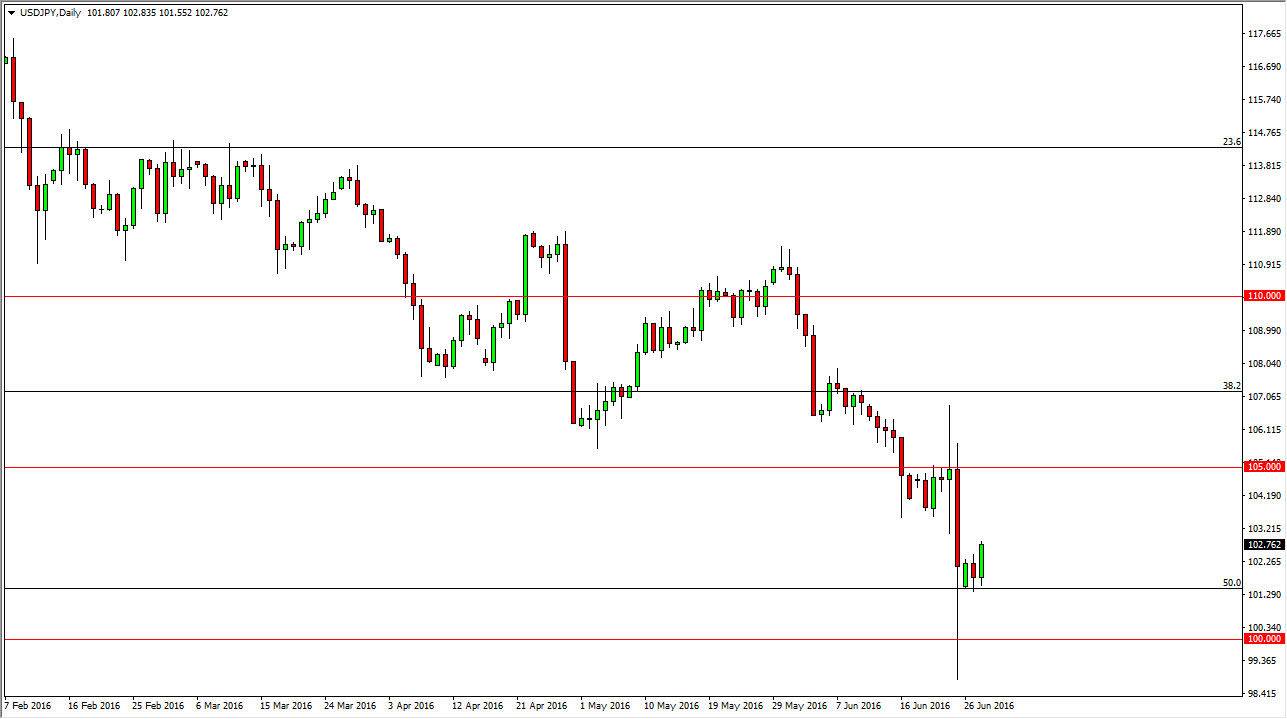

USD/JPY

The USD/JPY pair rose during the course of the day on Tuesday, bouncing off of the lows from the previous session. However, I’m not optimistic about this pair although I do recognize it has a bit of a “floor” built into it, as the Bank of Japan could very well get involved. I believe they will lose their sense of humor about things once we get below the 100 level, so I think that’s the absolute “floor” of this market.

Any rally at this point in time will have to deal with a significant amount of headwinds though, especially near the 105 level which has been resistive in the past. Because of this, I am not interested in trading this market at all right now as I think it will be choppy at best. Yes, I think a short-term move higher may happen, but it will be anything to write home about.

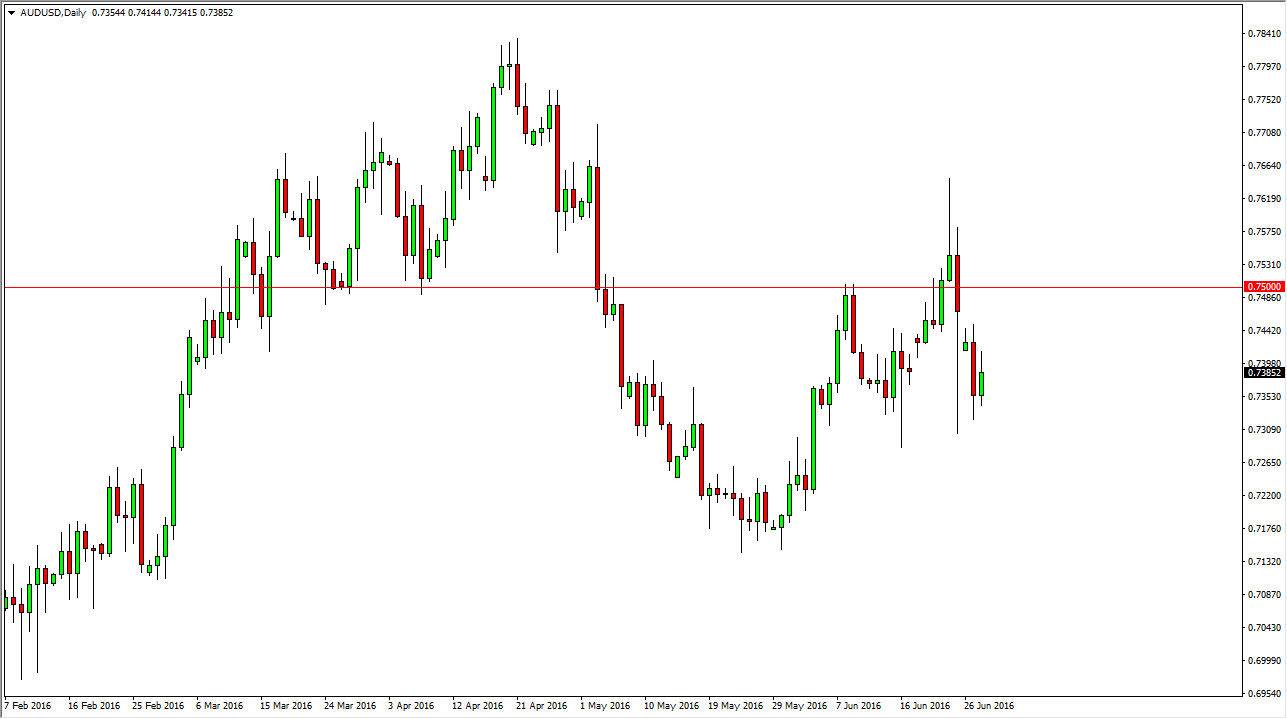

AUD/USD

The Australian dollar of course is very sensitive to risk appetite, and there isn’t much of that right now. Yes, we did have a little bit of a relief rally during the day on Tuesday, but at the end of the day I still see a significant amount of resistance above, especially once we get close to the 0.75 level. I believe that the only thing you can do at this point in time is sell this market, and I will do so every time it shows signs of weakness. I think short-term charts are probably the best way to look at this market, because it will be rather volatile.

We could get a bit of a boost in the gold market, but quite frankly I don’t know that that’s going to help the Australian dollar at the moment, as that might have more to do with safety than anything else. A break down below the bottom of the range for the day on Monday or even Friday of last week would be reason enough for me to start selling yet again as well.