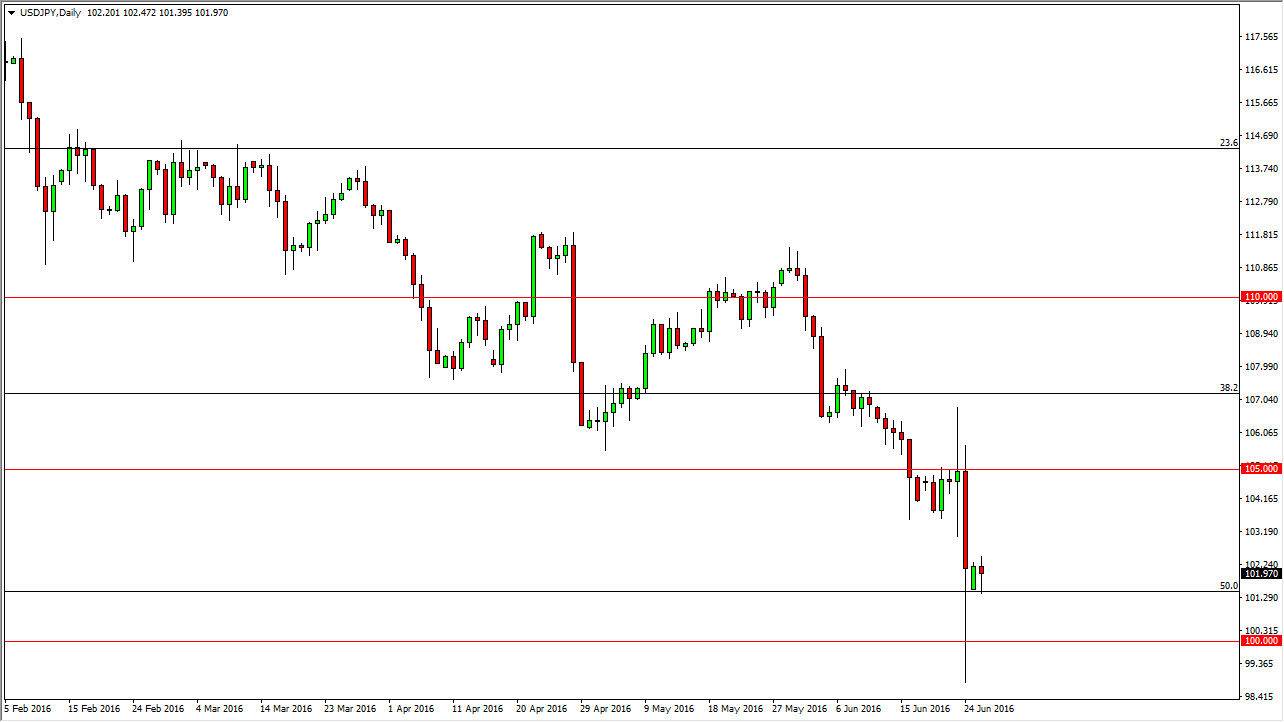

USD/JPY

The USD/JPY pair did very little during the day on Monday, which might be surprising for some out there, but the reality is that we are at such low levels that one has to wonder whether or not the Bank of Japan is going to get involved. They have already started discussing that they are paying attention to currency movements, so that of course is a sign that they are looking to intervene if we fall too far. I believe at this point in time that the 100 level is essentially the “line in the sand”, so if we break down below there I would be very concerned about central bank intervention. Because of this, I believe we essentially go sideways more than anything else, and as a result I believe that the market is going to be choppy at best.

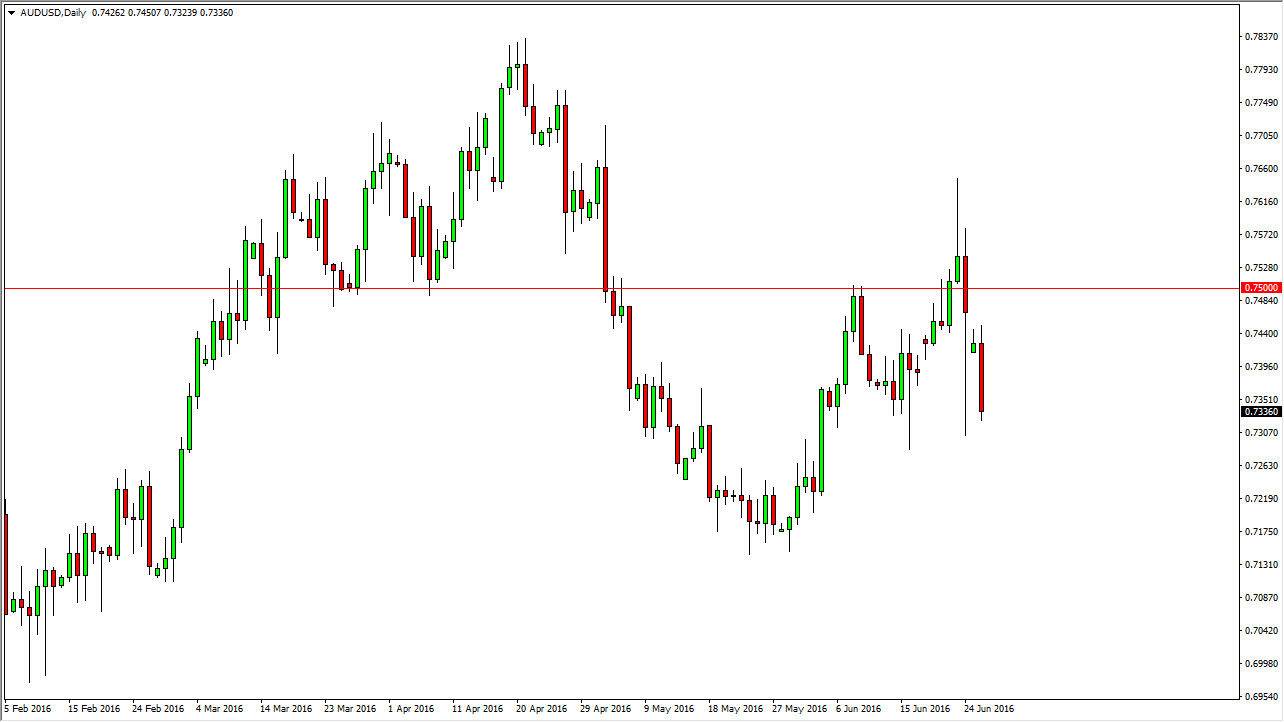

AUD/USD

The AUD/USD pair gapped lower at the open on Monday, and then fell rather significantly. Because of this, we tested the 0.73 level for support, and as a result it looks as if we may try to break down below there. I believe that short-term rallies will offer short-term selling opportunities given enough time, but at this point I believe that it’s also very likely that we could just as easily break down below the bottom of the Friday lows, which is of course a very negative sign as well. With this, I believe that the Australian dollar will continue to suffer at the hands of a “risk off” type of attitude out there, and of course the US dollar continues to strengthen overall. With this, I believe that we are going to eventually reach down to the 0.7150 level again which was the recent low.

Ultimately, this is a market that will continue to be bearish as long as we don’t have any clarity, and that of course should be the case going forward.