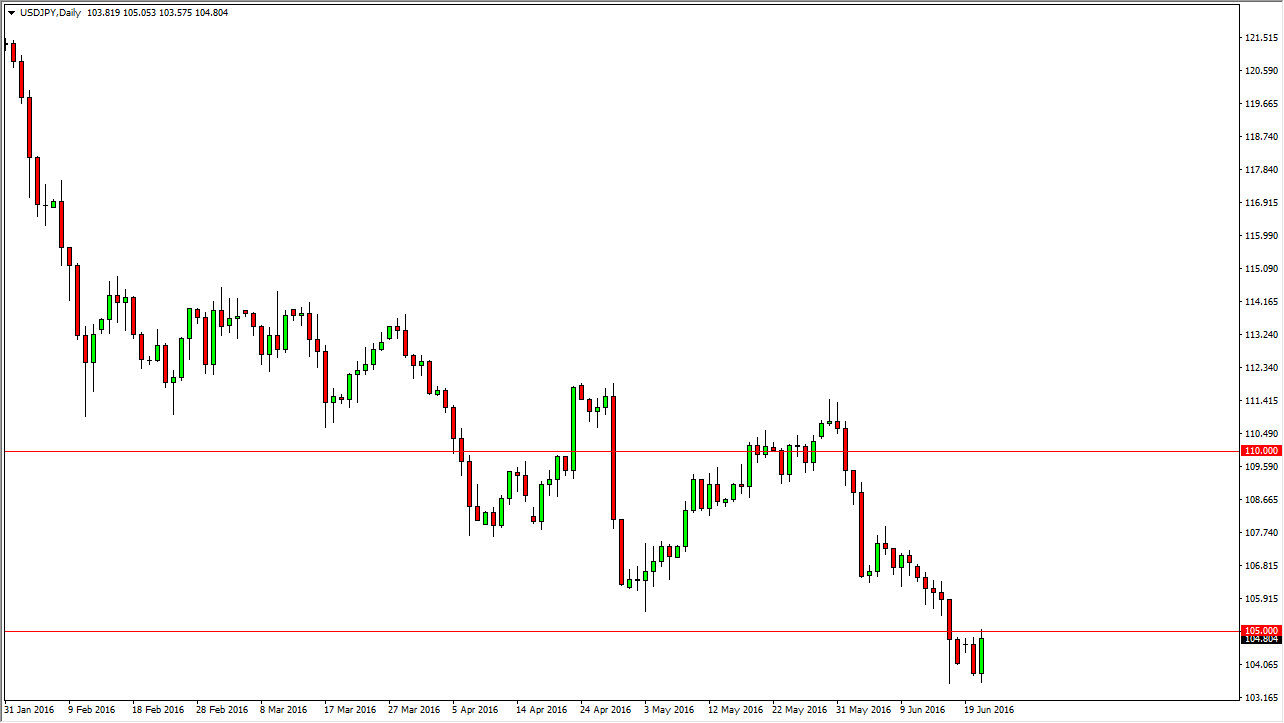

USD/JPY

The USD/JPY pair rallied during the course of the day on Tuesday, grinding all the way to the 105 level. The 105 level of course is a large, round, psychologically significant number, so it’s likely that the market will find a bit of resistance in this general vicinity. A fairly exhaustive candle would be an excellent opportunity to sell this pair. Ultimately, this market should drive down to the 103 level which has been supportive. Even if we break out above the 105 level, I would be a little bit hesitant to buy this market until we broke above the 106 level, as it would show a bit of bullish pressure. Keep in mind that this pair tends to be very sensitive to risk appetite, and that’s of course something that could have major implications.

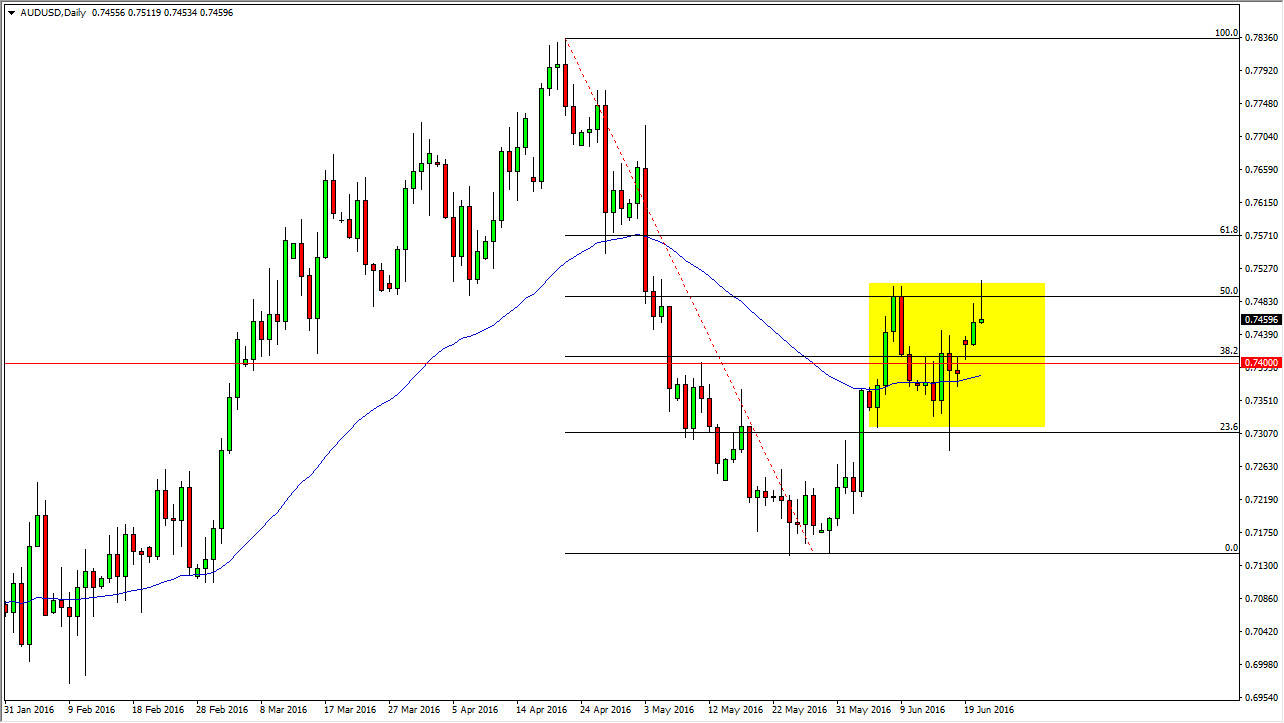

AUD/USD

The Australian dollar of course tried to rally during the course of the day on Tuesday, but struggled at the 0.75 level and turned right back around to form a shooting star. The shooting star of course is a very negative sign, and as a result I feel that the market will probably pull back from here. Ultimately though, I think that the 0.74 level is about as low as I’m willing to try to trade this market.

On the other hand, if we break above the top of the shooting star, we could see this market reach towards the 0.76 level next. Keep in mind that the Australian dollar is very sensitive to overall risk appetite as well, so this is a market that will probably be quite volatile as we await the results of the EU referendum that is going on in the United Kingdom right now. While this doesn’t directly affect the Australian dollar, and will affect all currencies to point. Given enough time, I think that we will break out and as soon as we break in one direction or the other out of the yellow box, I’m willing to trade for longer-term move. In the short-term though, I would have to suggests that the downside probably more likely.