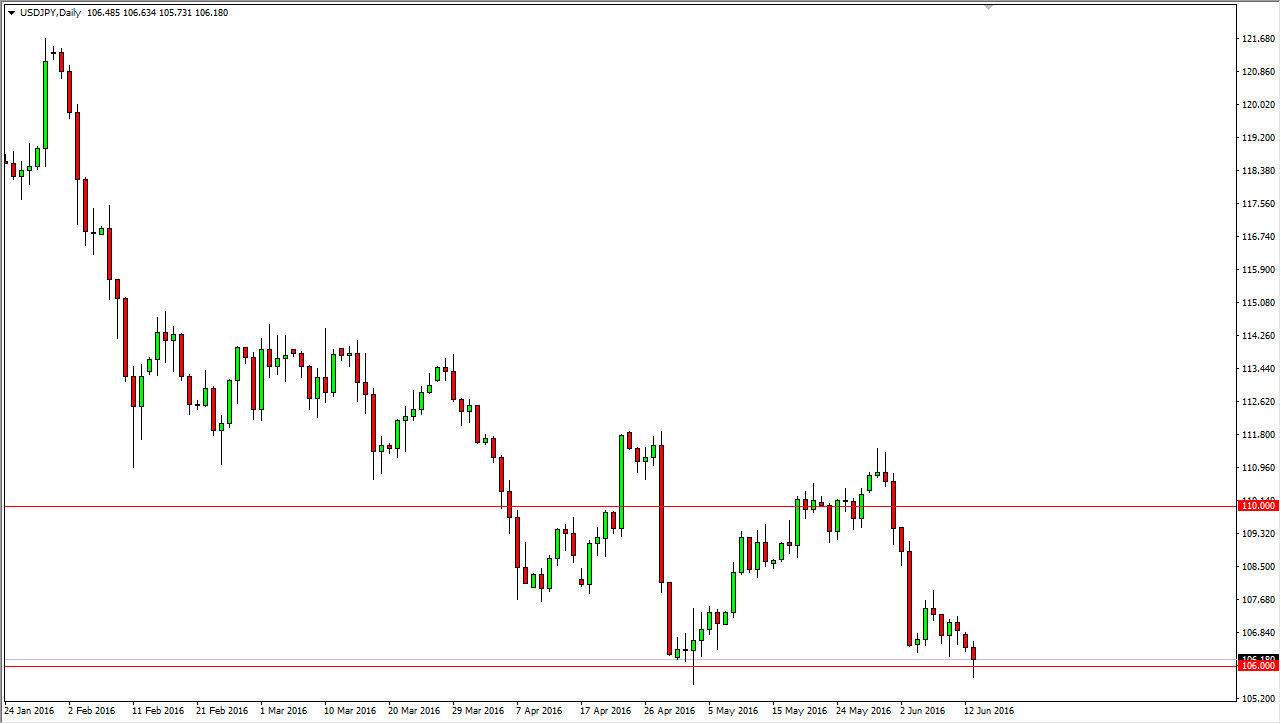

USD/JPY

The USD/JPY pair initially fell during the day on Monday, dipping below the 106 level. There is quite a bit of support in that area, and that being the case it’s not a big surprise that we turned around and formed a nice-looking hammer. The hammer of course is a bullish sign, so if we can break above the top of the hammer, I think that the market will then reach towards the 108 level. On the other hand, if we break down below the bottom of the hammer, it’s likely that we will drop down to the next large, round, psychologically significant number, the 105 level. Expect volatility, there’s a lot of concern out there about global markets and of course this pair tends to be very sensitive to risk appetite.

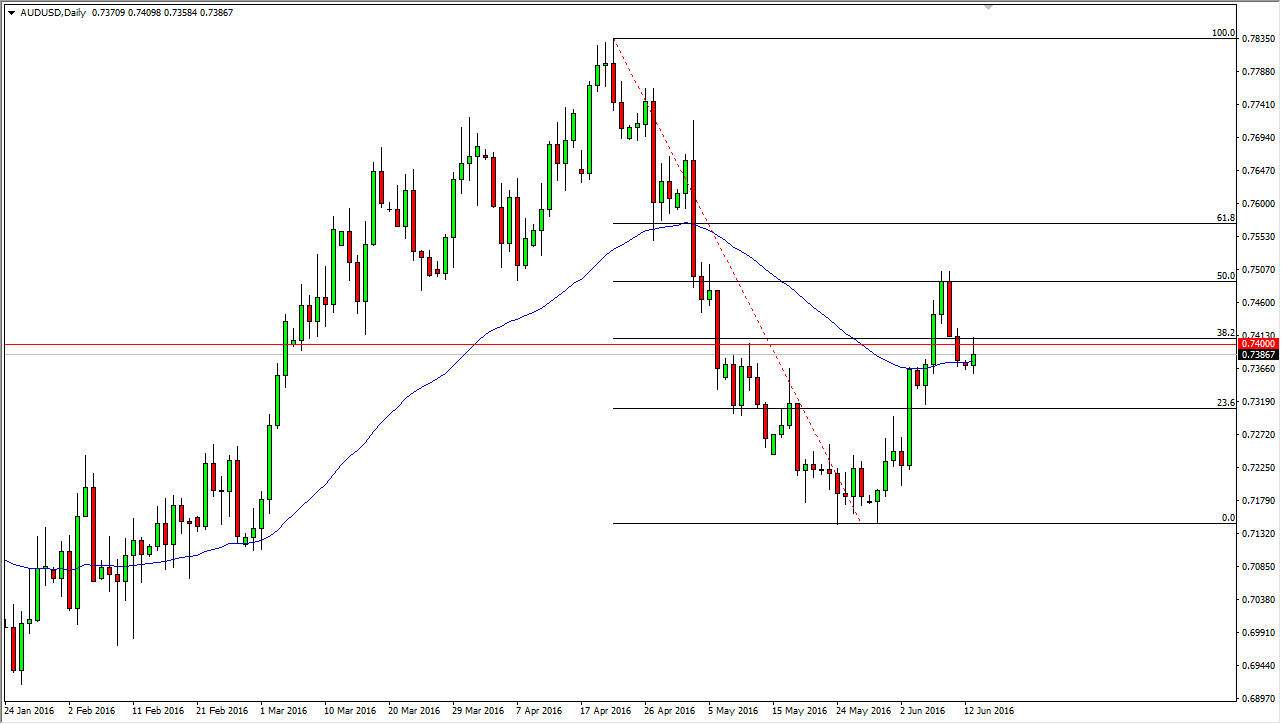

AUD/USD

The AUD/USD pair initially tried to rally during the course of the session on Monday, but turned around just above the 0.74 level to form a bit of a shooting star. We recently had bounced significantly and reach towards the 50% Fibonacci ratio, and then fell. We now have bounced a bit and failed again, so it looks as if the sellers are still very much in control. Interestingly enough, we are sitting right up on top of the 50 day exponential moving average. With this, I think that the market is going to continue to fall which I find very interesting considering that gold markets have done fairly well.

However, I am the first to admit that the old correlation between gold going higher and the Australian dollar following has broken down a bit over the last several months, so it looks like we are continuing to ignore that. Ultimately, I think that there will be a lot of volatility but sooner or later we will have to make an impulsive move. I think at this point in time there’s a lot of uncertainty out there, and that tends to favor the US dollar.