USD/CHF Signal Update

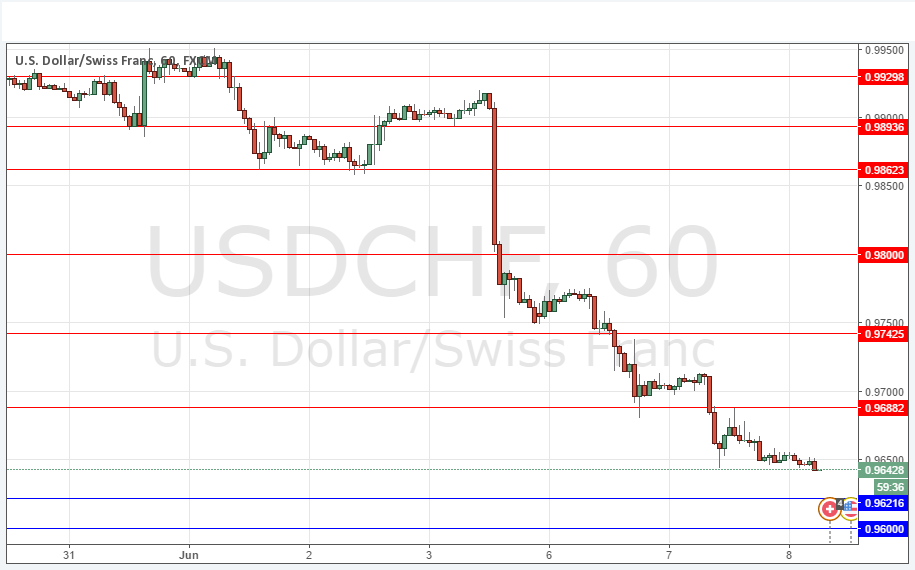

Yesterday’s signals produced a profitable long trade following the bullish bounce off the support level at 0.9650, but it was only good for about 20 pips.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 0.9622 or 0.9600.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9688 or 0.9742.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I wrote yesterday that this pair is having a more bearish picture but we could expect some kind of bounce off 0.9650. Both of these were borne out over the course of the past day, although the bounce was really quite small. That level at 0.9650 now looks to have been invalidated so the next key levels to be touched will probably be 0.9622 and especially 0.9600 which are quite close by at the time of writing.

There is a strong downwards trend in force.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.