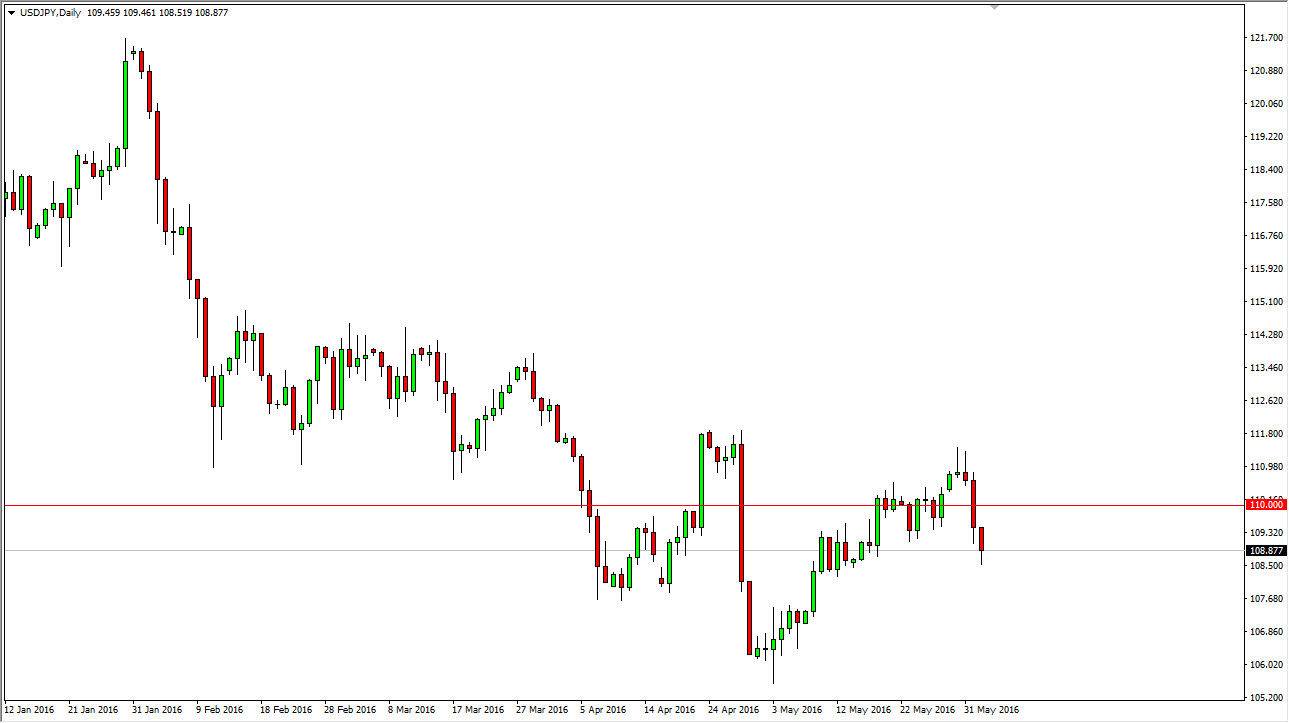

USD/JPY

The USD/JPY pair fell during the course of the day on Thursday, testing the $108.50 level. With this, it appears that the market is testing pretty significant support, and with the fact that we have the Nonfarm Payroll Numbers coming out during the day today, we could get quite a bit of volatility. This pair tends to be very sensitive to that particular market, and as a result I like the idea of waiting to see what the daily candle brings. With that being the case, the market is one that I will be avoiding until closing time, and at that point in time I will reassess the entire situation, and perhaps try to place some type of longer-term trade.

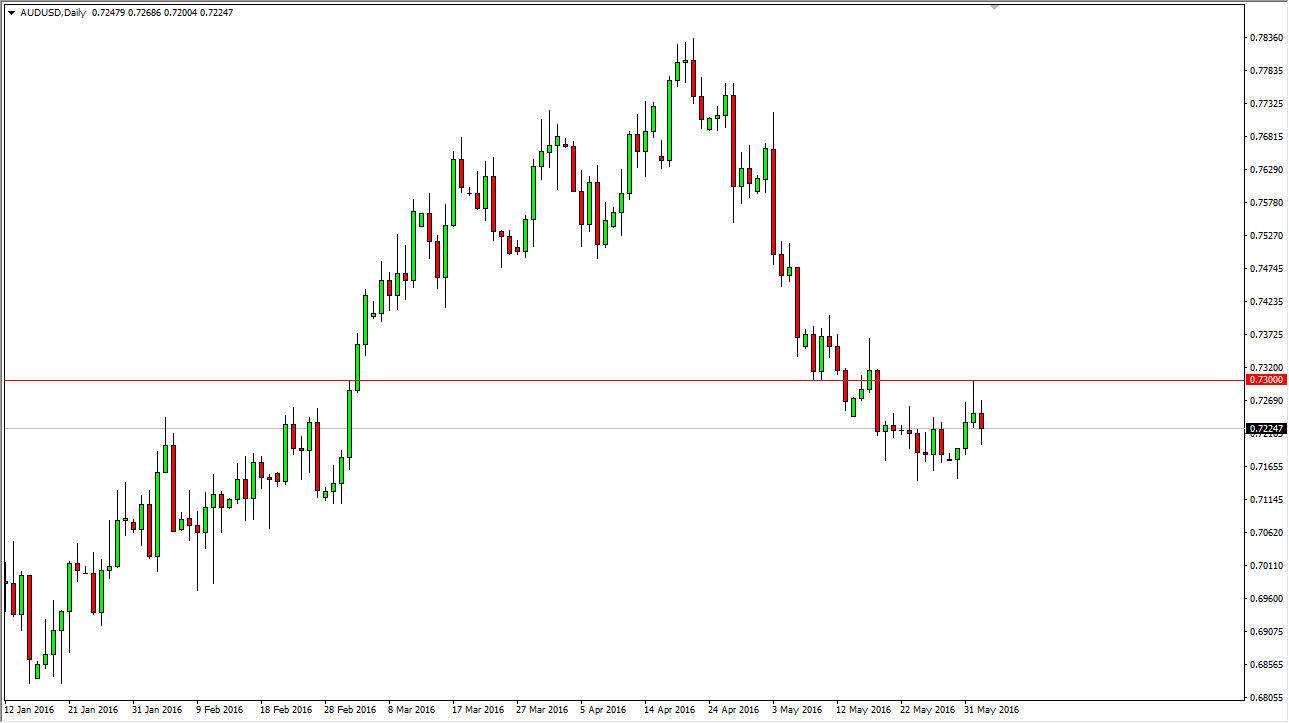

AUD/USD

The AUD/USD pair fell during the course of the day on Thursday, but found enough support near the 0.72 level to turn things around and form a hammer. There is a significant amount of resistance above, extending all the way to the 0.73 level. That’s an area that has caused quite a bit of resistance, so at this point in time I think that the market will struggle to get above there. The 0.73 level is the beginning of resistance all the way to the 0.74 level, and it’s not until we break above there that I am comfortable buying the Aussie.

A break down below the bottom of the hammer would be reason enough to start selling, and with that being the case I think that we would probably reach towards the 0.70 level underneath. The Australian dollar continues to struggle due to the fact that the Reserve Bank of Australia recently cut interest rates, and of course there’s quite a bit of concern when it comes to the economic conditions around the world, and as a result it looks like the commodity markets will continue to struggle.