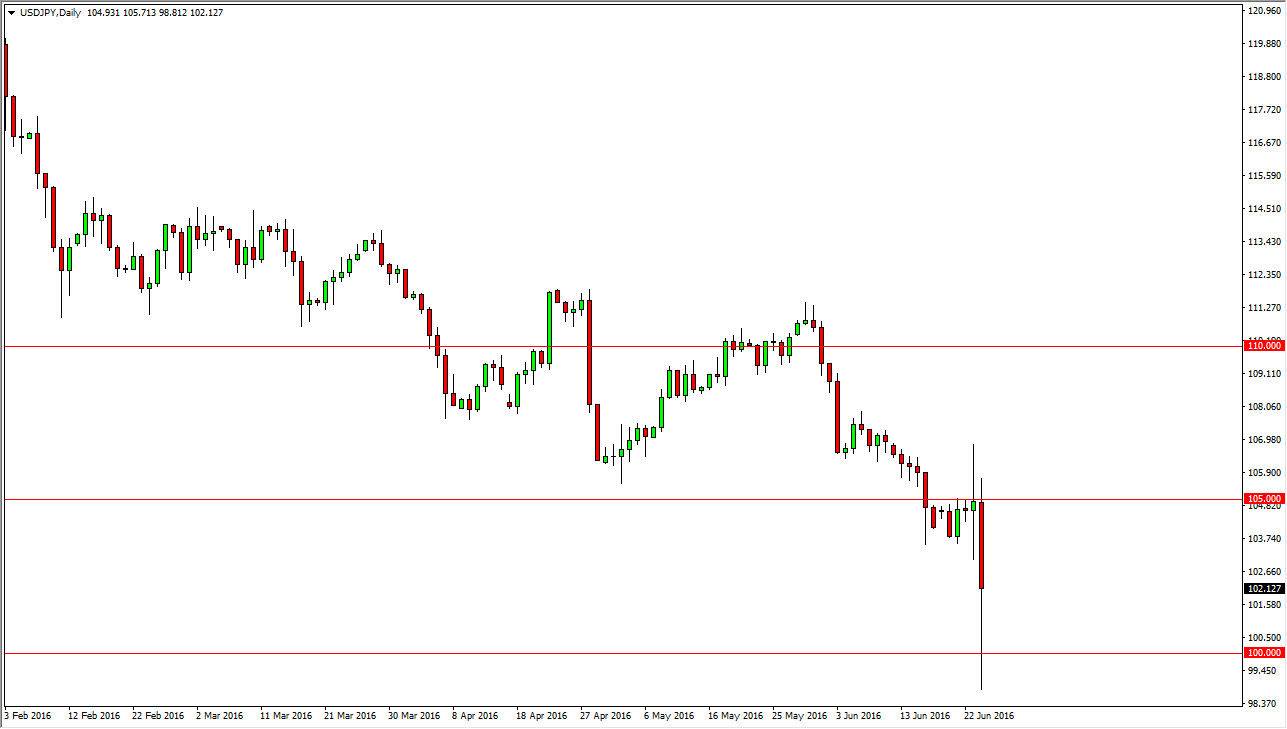

USD/JPY

The USD/JPY pair fell significantly during the course of the day on Friday as we ended up slicing through the 100 level at one point in time. Because of this, it looks as if this market is very negative, but we did get a significant bounce. The question is whether or not the Bank of Japan had anything to do with it. After all, the Swiss National Bank did in fact get involved to stabilize the Swiss franc, so it is possible that the Japanese did the same with their own currency. Looking at this chart, it’s obvious that there was a bit of a “risk off” move during the day on Friday as the United Kingdom left the European Union. Ultimately, this market is still fairly negative in my opinion, but I’m looking for short-term selling opportunities, and not long-term ones. Exhaustive candles on short-term charts should be selling opportunities.

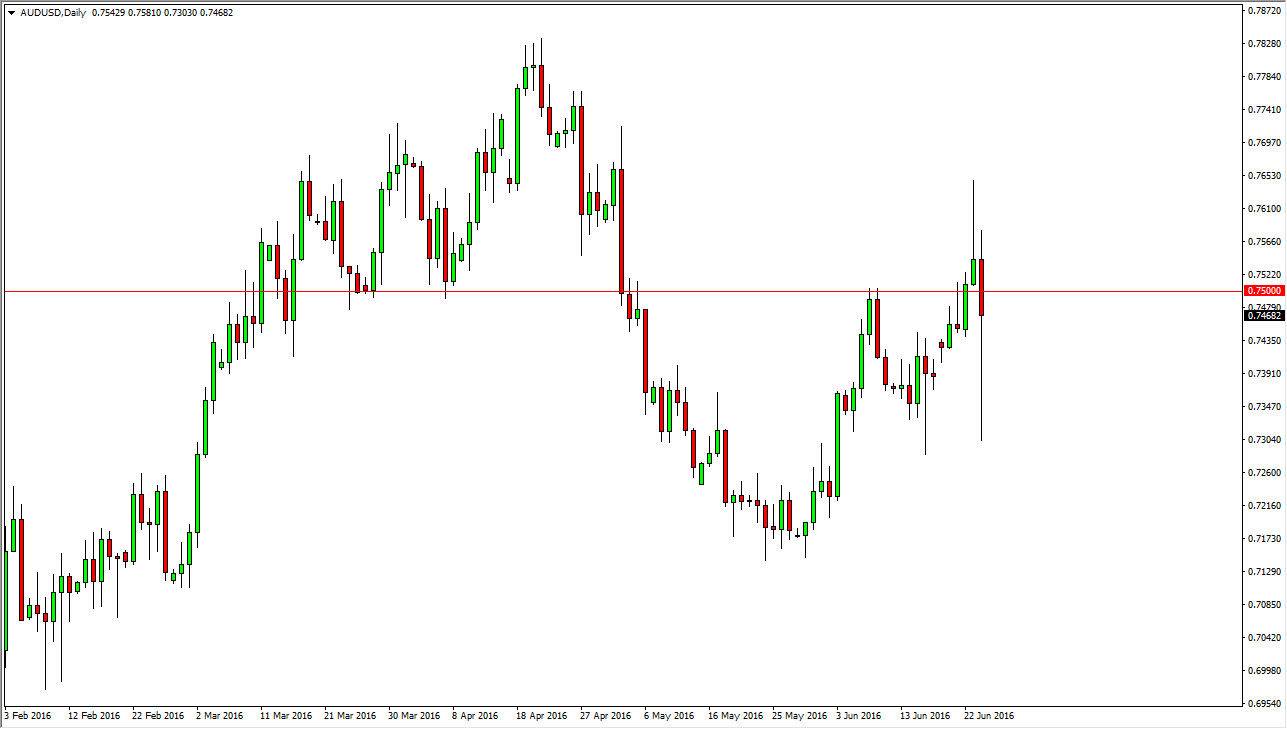

AUD/USD

The AUD/USD pair fell significantly during the course of the day as well, as the risk off move pummeled the so-called “risky” currency in this pair. However, we did see markets turn right back around and start buying the Australian dollar as it was thought of as “value.” This is a market that has formed a hammer, and as a result it appears that we will test the upside yet again. If we break above the top of the hammer, we should continue to go towards the 0.77 level.

Pullbacks at this point in time should continue to find buying opportunities as well, as supportive short-term candles will be potential value buying opportunities and it now looks as if the gold markets are going to rally as well, which is quite often a driver of the Australian dollar in one direction or another. Ultimately, the Australian dollar has been pummeled for such a long time, it looks as if we are trying to change the longer-term trend.