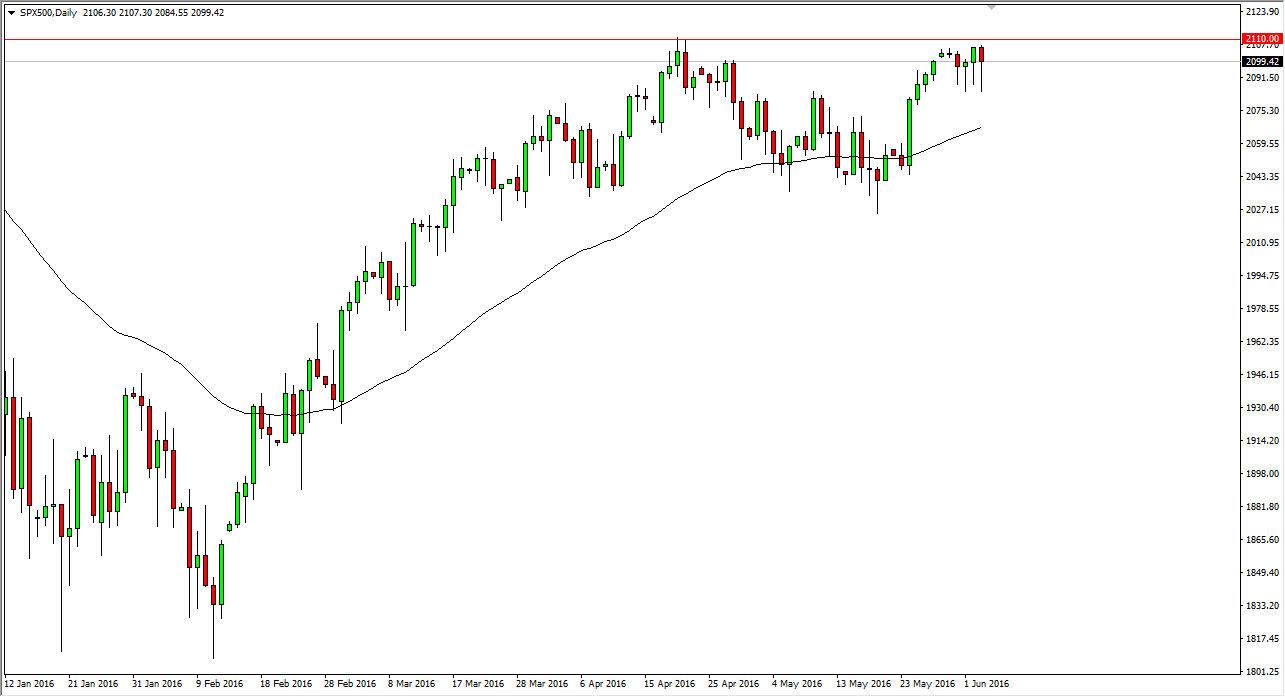

S&P 500

The S&P 500 initially fell during the day on Friday, in reaction to the poor jobs number coming out of America. However, we did turn right back around and form a hammer, which we also did for the Tuesday, Wednesday, and Thursday sessions. In other words, it seems like the matter what happens, this market is going to go higher. If we can break above the 2110 level, the market should continue to grind much higher, as it becomes more of a “buy-and-hold” type of situation. I have the 50 day exponential moving average below, and I think that is the “floor” in this market. It’s not until we break down below there that I would even consider selling this very strong market.

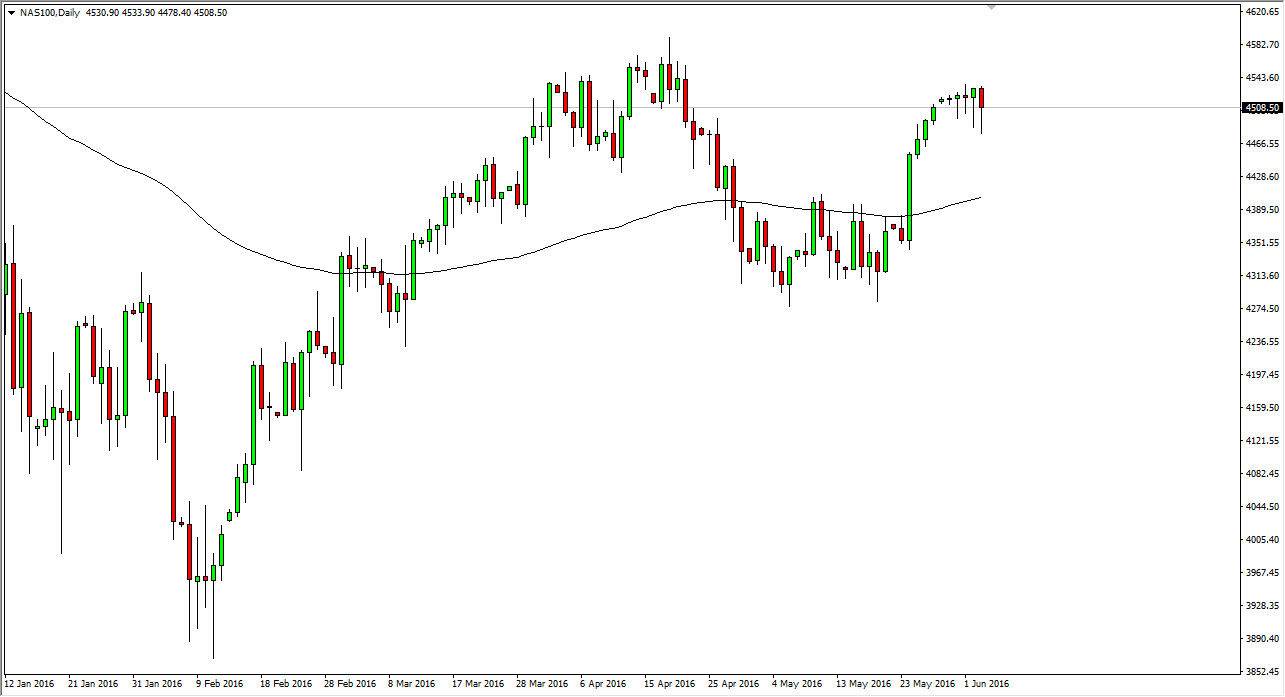

NASDAQ 100

The NASDAQ 100 also did the same thing, forming yet another hammer. That being the case, the market looks as if we are trying to break out to the upside. If we can get above the 4600 level, I think that the NASDAQ 100 becomes more of a “buy-and-hold” scenario as well. Once that happens, expect pullbacks to offer value that traders will continue to take advantage of.

It is not until we break down below the 100 day exponential moving average that I’m ready to start selling, and the fact that the jobs number was so poor during the day on Friday suggests that interest rates are going to have to remain low for quite some time, and that of course is very good for stocks markets as bond market simply offer nothing in return. With that, I think that this market continues to grind its way higher as well. However, the S&P 500 is closer to breaking out so that is my preferred stock index out of the United States right now but recognize that they should move in tandem going forward.