S&P 500

The S&P 500 shot higher during the course of the session on Wednesday, breaking well above the 200 day exponential moving average. Because of this, I feel that the US stock markets will probably continue to go higher. I think that pullbacks in the S&P 500 will offer buying opportunities as we continue to see quite a bit of bullish pressure. After all, most people overseas will look at the United States as a potential opportunity now that European indices should underperform. On top of that, it appears that the markets have calmed down and recognize that the United States should be fairly insulated against the breakup between the United Kingdom and the European Union. The size of the candle is very bullish, and as a result it looks as if the buyers are going to continue to push this market.

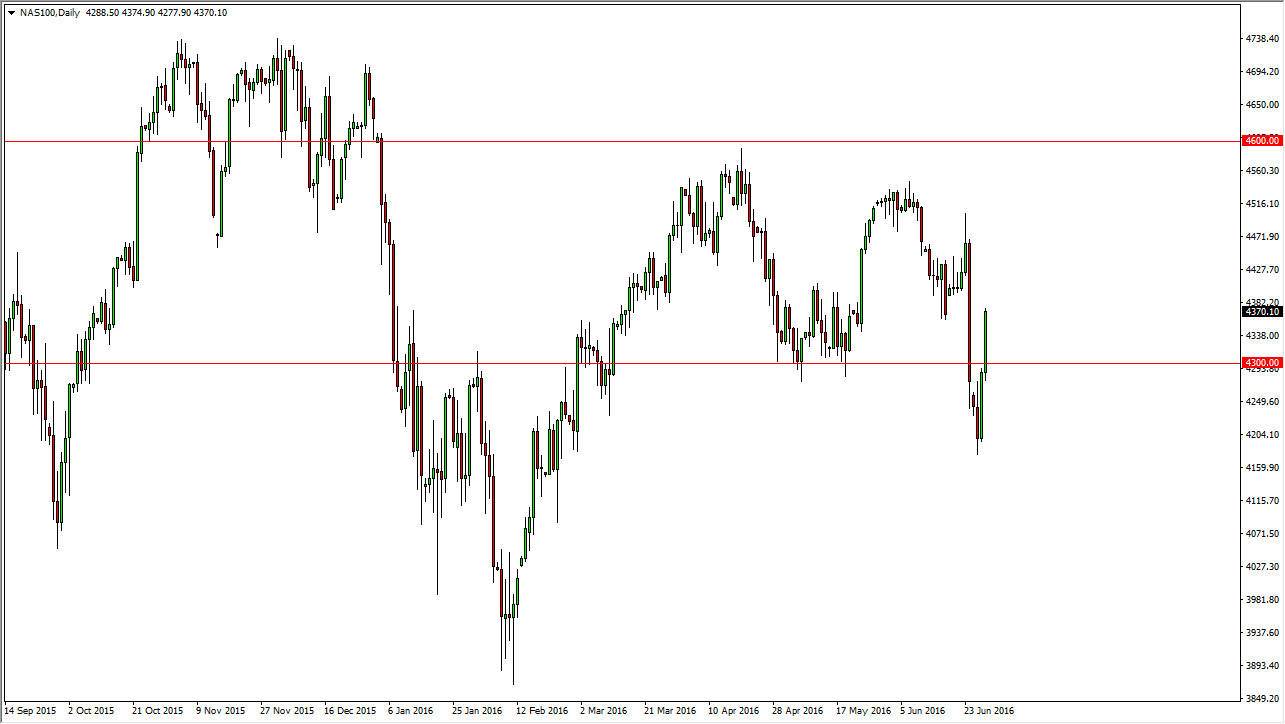

NASDAQ 100

The NASDAQ 100 rallied during the day as well, breaking above the important 4300 level. With this, and the fact that we are closing towards the top of the candle, I believe that we will continue to see bullish pressure in this market, and with that being the case it looks as if any pullback will more than likely be an opportunity to pick up value and could very well test the 4300 level given which should be massively supportive.

There is quite a bit of noise above, but at this point in time I feel that the resistance will probably continue to be relatively strong. Ultimately, this is a market that will try to reach towards the 4500 handle, but do recognize that if we close on a daily chart below the 4300 level, that could turn things around and get the sellers involved again. Ultimately, I believe that sooner or later the markets will start favoring the United States in general, and we should see a continuation of the bullish pressure that had been part of the NASDAQ last year.