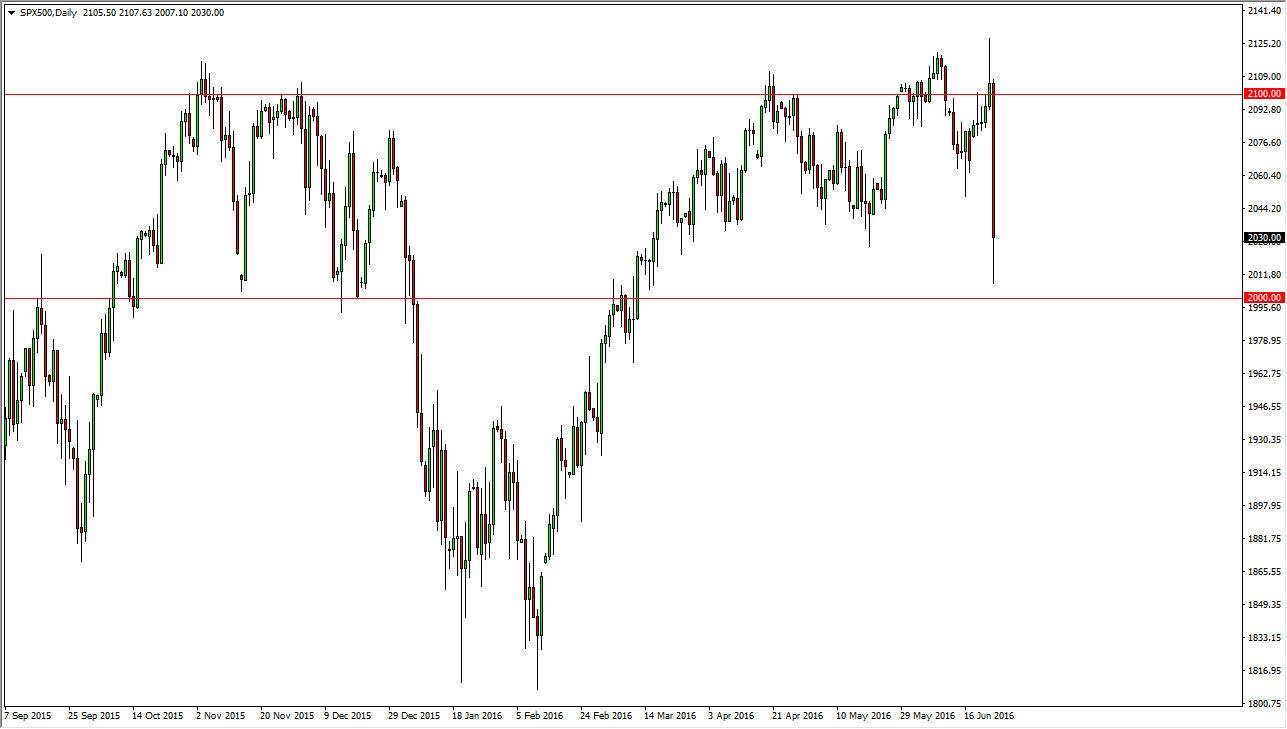

S&P 500

The S&P 500 fell rather significantly during the course of the day on Friday in reaction to the United Kingdom leaving the European Union. In fact, we almost reached the 2000 level which of course is a large, round, psychologically significant number. This is an area that had been supportive in the past, so the fact that we bounce from there is not a huge surprise. However, this is a very negative candle, and it’s likely that the market will continue to go lower over the longer term. If we break down below the 2000 level, that is going to be very negative. On the other hand, if we get a short-term rally that shows signs of exhaustion, that should be a nice selling opportunity as well. At this point in time it’s not a market that I have a whole lot of interest in being long in.

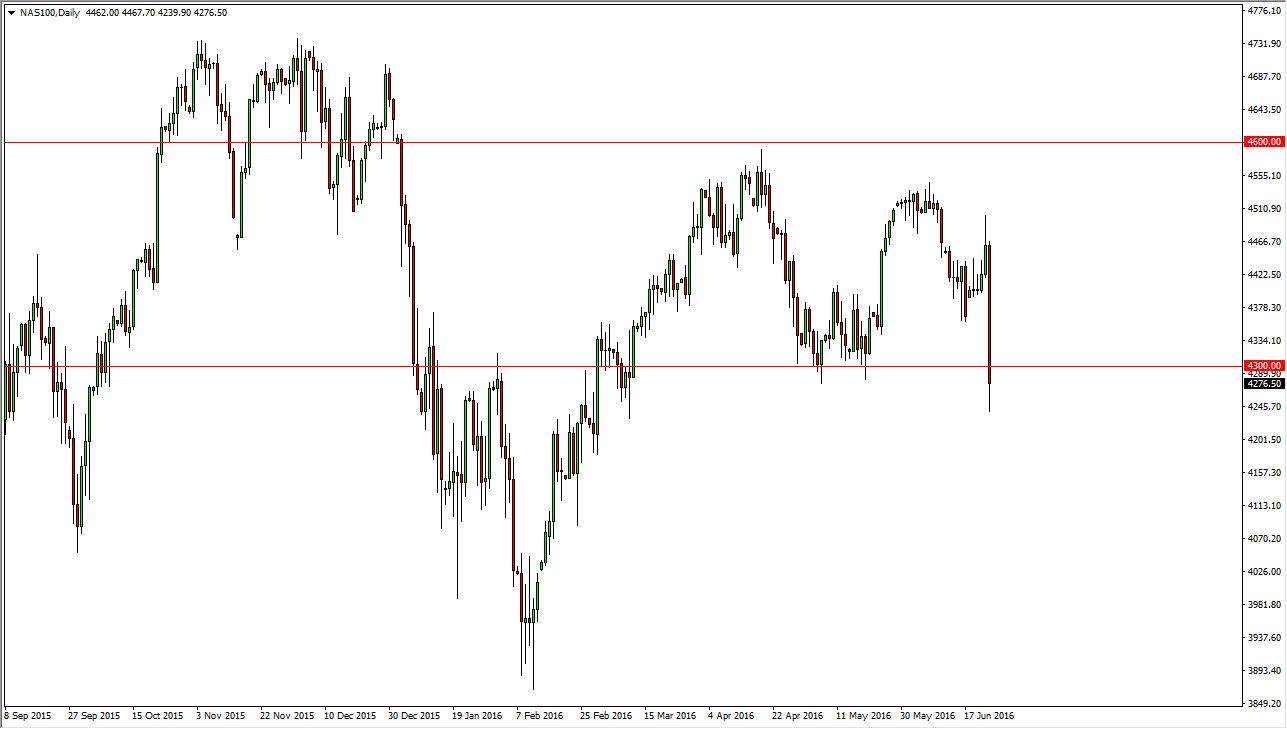

NASDAQ 100

The NASDAQ 100 not only sell, but it actually fell through a large, round number in the form of 4300. With this being the case, it looks as if we could continue to go much lower if we can break down below the bottom of the range for the day on Friday, as it would show a momentum of negativity building up. There is a lot of noise just below though, extending all the way down to the 4100 level. With this, it’s possible that if we fall it could be very choppy and therefore the NASDAQ 100 might not be my favorite short at this point in time.

I would be much more comfortable selling exhaustive candles after short-term rallies which should present themselves fairly often and frequently due to the fact that there will be a lot of noise as there is quite a bit of uncertainty out there. Not only do we have the concerns in the European Union, but we also have recently received quite negative economic numbers out of the United States.