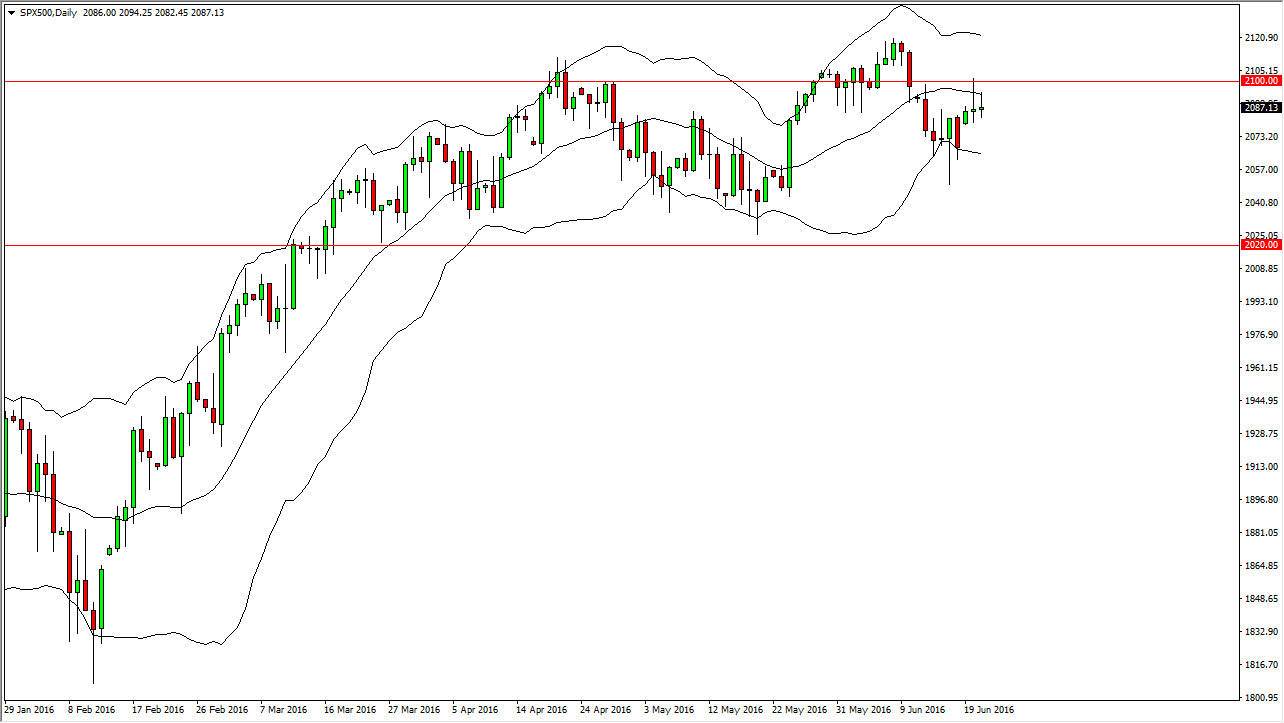

The S&P 500 initially tried to rally during the day on Tuesday, but as you can see failed at the moving average line in the middle, and as a result it looks like the market continues to simply go sideways and perhaps have a slightly negative connotation to it. However, the market will probably stay within the 2 standard deviations, which means the bottom part of the Bollinger Bands. On the other hand, if we break above the top of the shooting star from both Monday and Tuesday, the market would clear the 2100 level, and then perhaps reach towards the 2120 level. Keep in mind that the markets will probably be fairly hesitant to make big moves today, as the British are voting on the EU referendum.

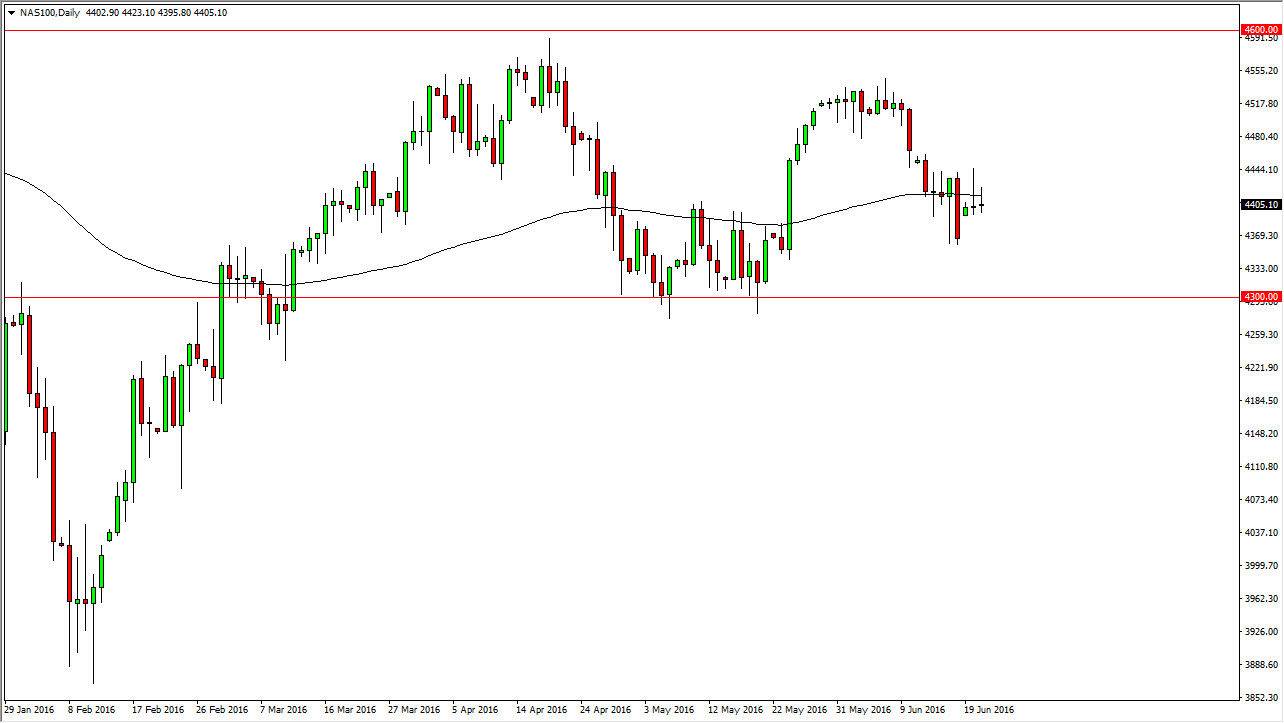

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Tuesday as well, but as you can see turned right back around to form a shooting star. The shooting star was preceded by the one on Monday, so that of course is a very negative sign but at the end of the day there’s a lot of noise underneath that could keep this market afloat. On the bigger picture, I believe that we are simply consolidating between the 4300 level on the bottom, and the 4600 level on the top. I think we get a little bit of a pullback today in a small attempt to take care of any risk that a lot of traders might have in the market, but I do not expect any major selloff. It’s really not until we get the answers from the EU referendum out of Great Britain that we get the big move in my estimation.

However, you have to keep in mind that Janet Yellen is speaking before Congress today, so you never now, she may say something that could move the markets in general. At this point though, it would have to be pretty significant just ahead of the vote count.