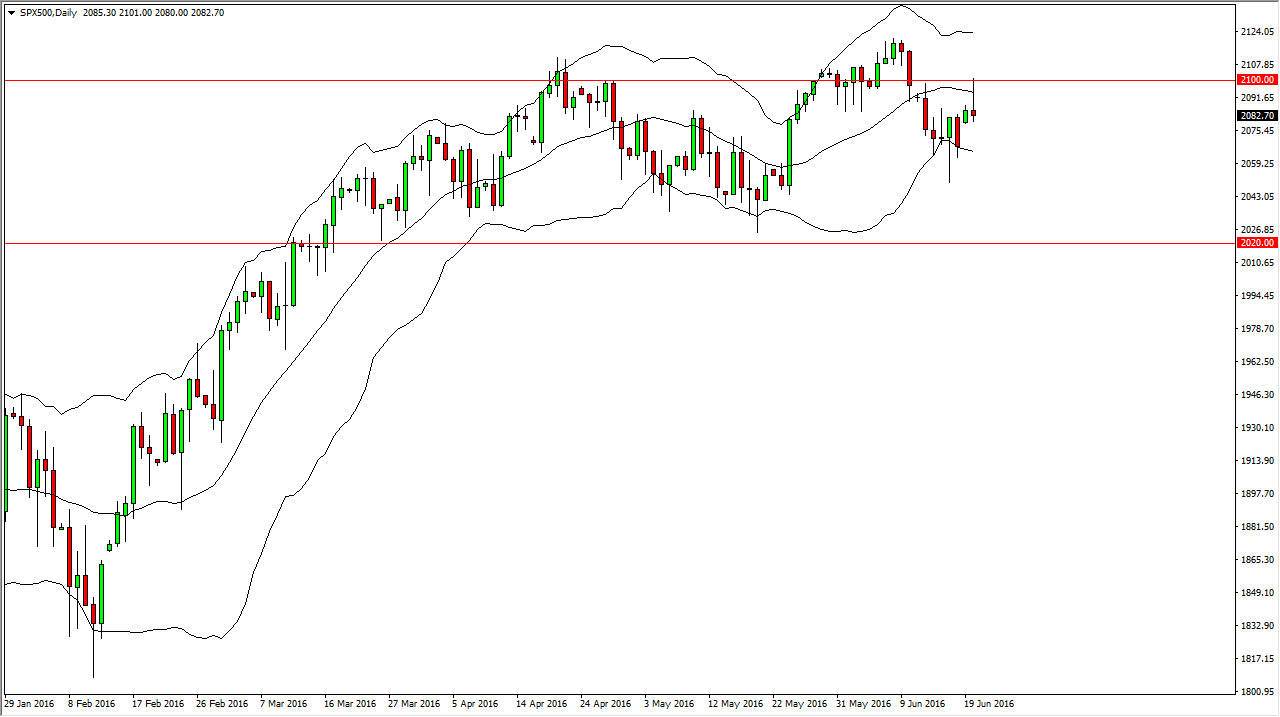

S&P 500

The S&P 500 initially rallied during the course of the session here on Monday, but then turned right back around. Initially, there was a “knee-jerk reaction” to the idea of that the polls in the United Kingdom are starting to swing back in the direction of “remain”, which of course is something that the financial markets like. On the other hand, the vote is still far too close to call, and as a result it’s very likely that this reaction will fail until we get true answers. This was shown by the fact that we ended up forming a shooting star, which happens to coincide with the median of the Ballinger Bands. Because of this, it appears that we will probably have a somewhat negative session in the S&P 500 today.

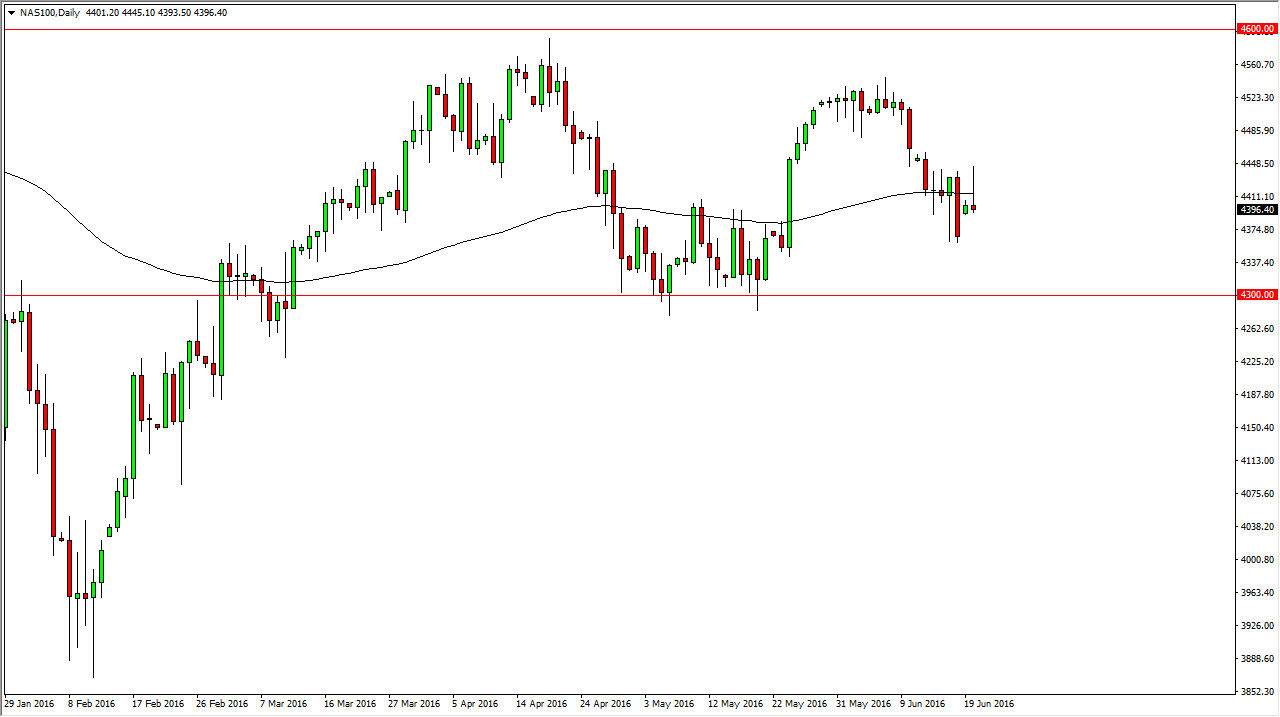

NASDAQ 100

The NASDAQ 100 initially rallied during the day as well, and for many of the same reasons when it comes to economic headlines. However, we also got a bit of a shooting star in this market as well as the 100 day exponential moving average moving sideways. Because of this, the market should continue to drop for the short-term, as it seems like we are running out of upward momentum. At the end of the day, the 4300 level is supportive on the bottom, and the 4600 level above is going to be resistive.

With this, I think that the market will continue to be very volatile due to the fact that the markets are moving basically on rumor and pull results at the moment, and because of this is going to be difficult to hang onto any trade for any real length of time. However, as the shooting star formed during the session on Monday, I believe that we will get a bit of a short-term move to the downside today as we continue to bounce around.