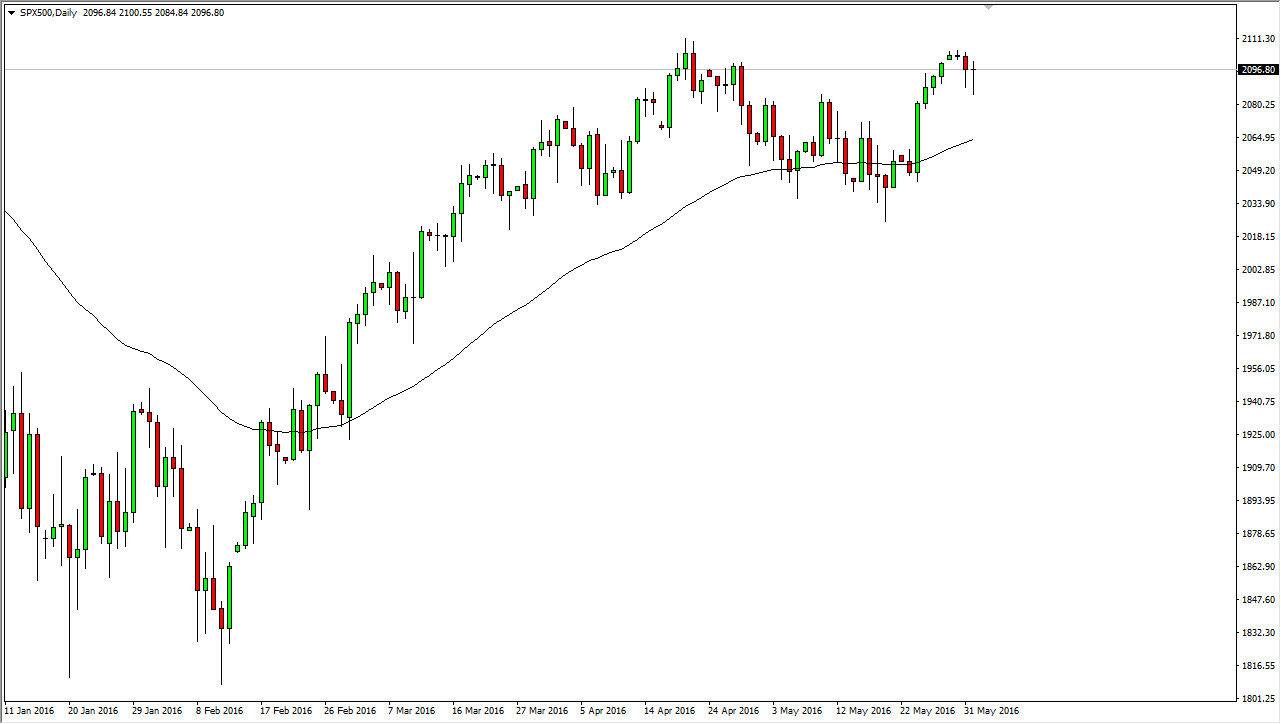

S&P 500

The S&P 500 initially fell during the day on Wednesday, but turned around to form a bit of a hammer. This is almost identical to what we did on Tuesday, so I think that there is quite a bit of bullish pressure building up underneath. We are facing a relatively formidable barrier in the form of 2110, but once we break out to the “fresh new high”, I think that it will be more or less a buy-and-hold type situation. I believe the pullbacks will continue to be supportive, and as a result I think we are simply trying to build up momentum at this point in time in order to make that massive push higher. The 50 day exponential moving averages plodded on the chart, and it’s not until we get below there that I feel I can sell.

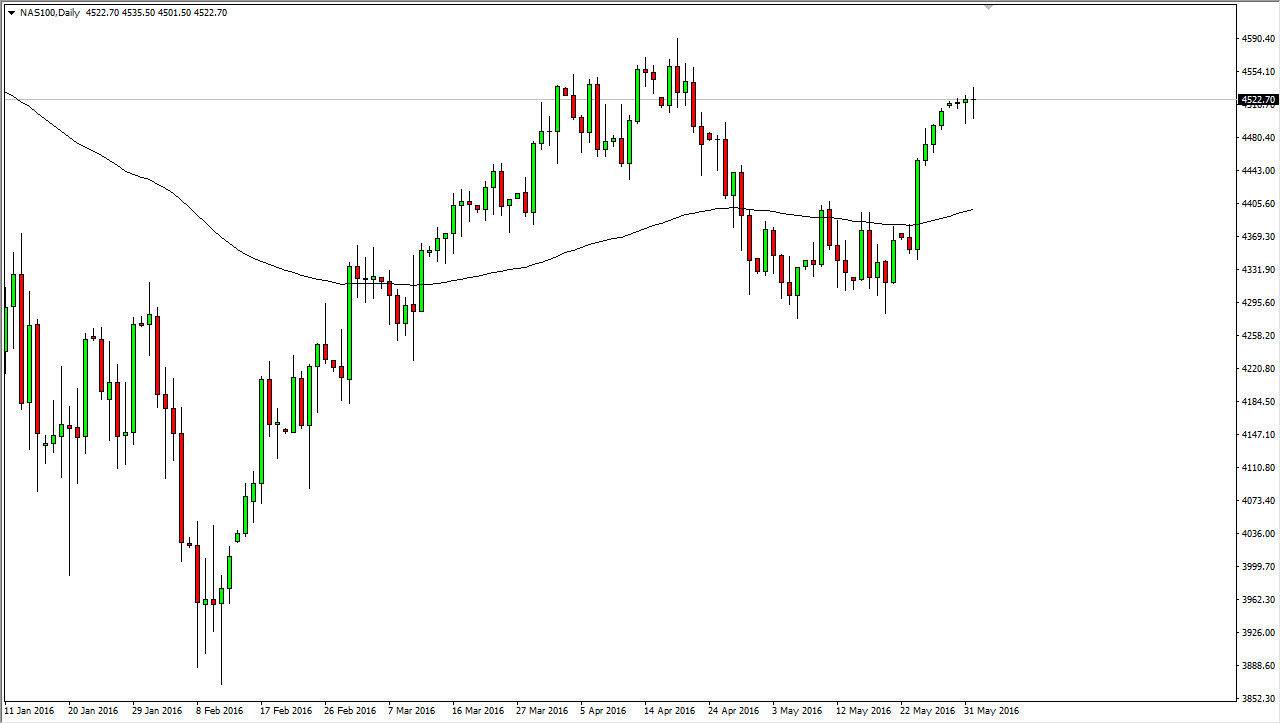

NASDAQ 100

The NASDAQ 100 been a bit more flats in the S&P 500 but we are essentially telling the same story here. I have the 100 day exponential moving average plodded on the chart and it has been a relatively important moving average lately. After all, it caused quite a bit of resistance, and now that we have impulsively broken above there I feel that any pullback at this point in time will more than likely find quite a bit of interest by the bullish traders online. There is a significant amount of resistance of the 4600 level though, so having said that it’s difficult to imagine that we are just going to shoot straight up. I think we are trying to build momentum at the moment, just as we are in the S&P 500. With that, I’m looking at pullbacks as potential value whent I am only trading them for short-term bursts out this point in time as I think we could be stuck in this general vicinity for a minute.