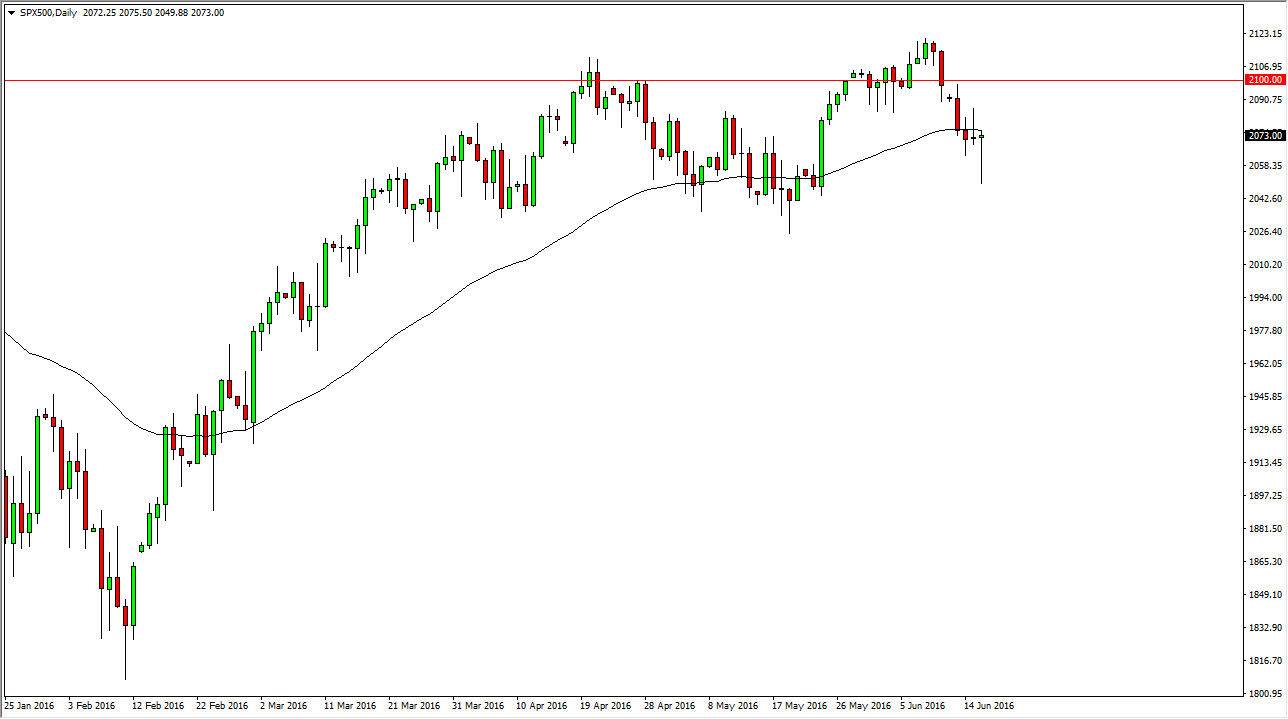

S&P 500

The S&P 500 initially fell rather significantly during the course of the session on Thursday, but bounced significantly from the 2040 level. With that being the case, the market looks as if it is going to remain volatile, as we have a shooting star from the previous session. Quite frankly, I feel that the markets have no idea what to do right now, mainly with all of the noise coming out of Great Britain. There is a general sense of fear, and as a result short-term trades will probably be about as good as this gets. I believe that short-term charts will have to be used in order to play this market, and expect a lot of movement. Ultimately though, there is still quite a bit of bullish bias in my opinion.

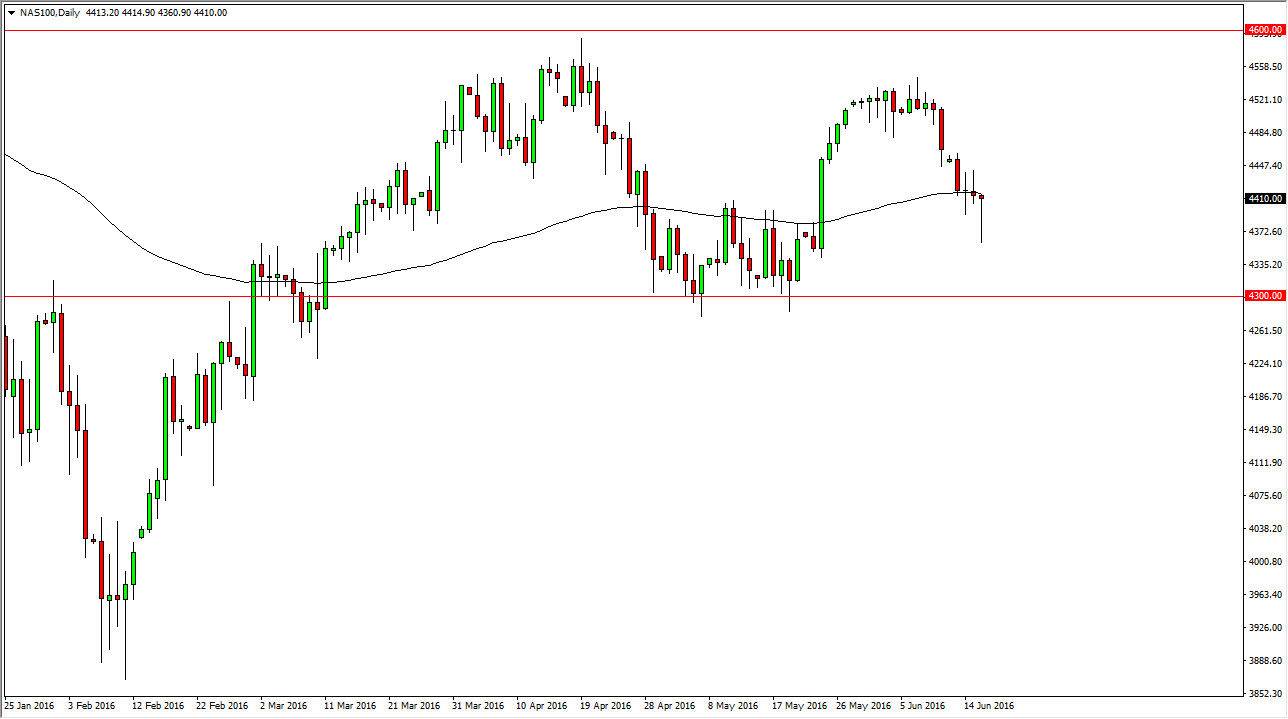

NASDAQ 100

The NASDAQ 100 fell as well, but has a significant amount of support extending all the way down to the 4300 level. That is an area that I think it’s essentially the “floor” in this market, and as a result I believe as long as we can see above there it’s probably safer to buy this market than sell it. However, that’s not to say that it's going to be easy. A break above the top the hammer is technically a buy signal, and of course the 100 day exponential moving average being in this area has a certain amount of significance as well. If we can break above the top of the 2 candles from the previous sessions, the market could very well find itself going towards the 4500 level, and then eventually the 4600 level. However, keep in mind that there is a lot of headline risk, especially coming out of the United Kingdom which is essentially making all markets freak out at the moment.