S&P 500

Initially, the S&P 500 rallied during the day on Monday but found the 2100 level to be far too resistive to continue going higher. Because of this, the market turned right back around and fell rather significantly. In fact, we ended up closing at the 50 day exponential moving average, and at the very bottom of the range for the day. With this being the case, I believe that the market will probably continue to go a little bit lower but should start to find support just below. At this point in time, it’s likely that the market is simply trying to build up enough momentum to finally break out to the upside, as we continue on with the longer-term uptrend. I’m not interested in selling quite yet.

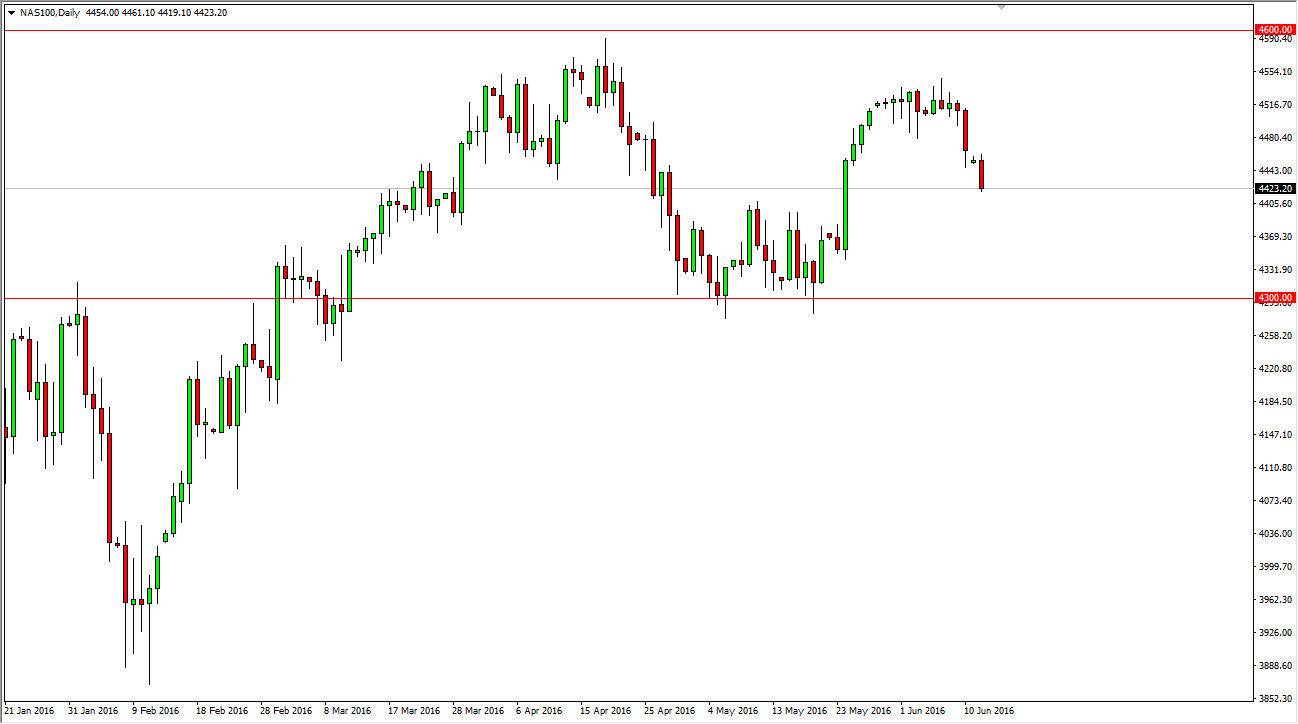

NASDAQ 100

The NASDAQ 100 fell during the day on Monday, as it fell like other indices in the United States. I believe that there is a significant amount of support just below, so having said that it’s difficult to imagine that we are going to fall apart from here. I believe it is only a matter of time before the buyers get back into this market, and as a result I’m waiting to see whether or not we get some type of supportive candle. On that supportive candle, I would be more than willing to go long in a situation that to me looks like it would be a return to the top of the previous range.

The question now is whether or not the Federal Reserve will be able to raise interest rates as quickly as once thought. If not, that should work against the value the US dollar, which should drive this market much higher as it tends to benefit stocks as exports become cheaper. Ultimately, I’m simply waiting for my opportunity to take advantage of value.