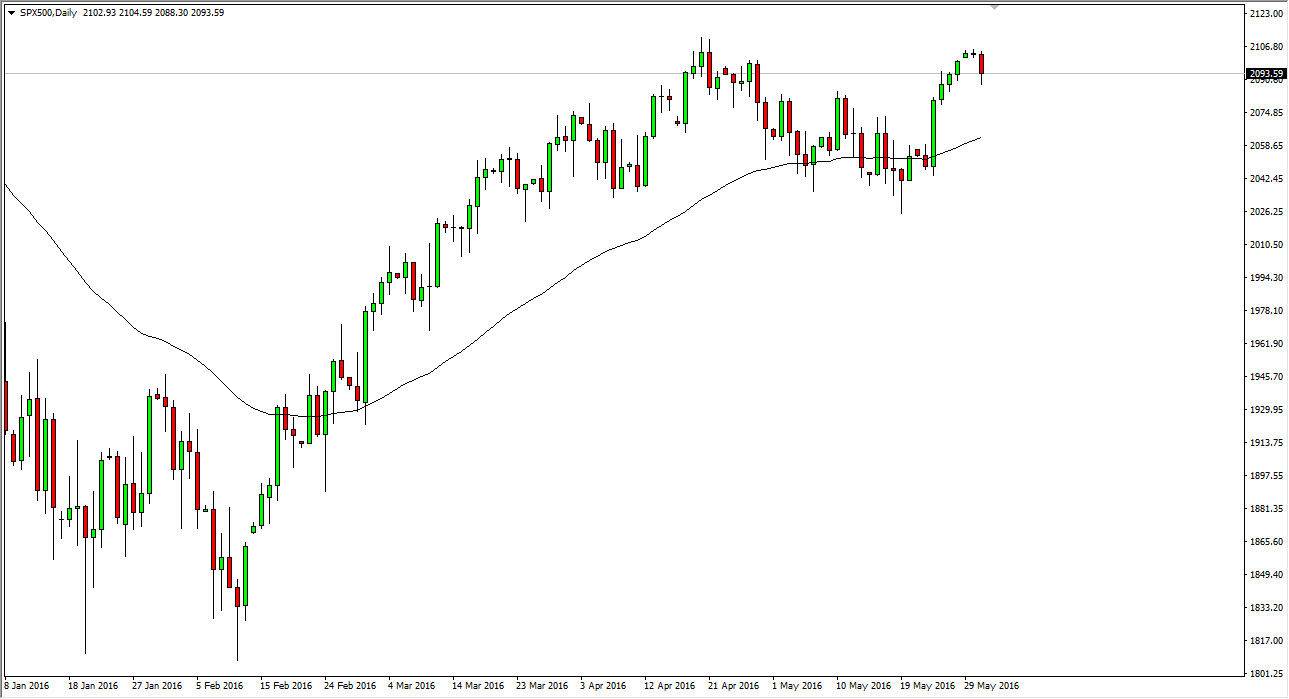

S&P 500

The S&P 500 fell slightly during the day on Tuesday, as we reached a pretty significant resistance barrier in the form of the 2100 level. However, I believe that there is a significant amount of support below so I’m simply waiting to see whether or not we get a bounce or a hammer or something like that in order to go long. A fresh, new high would also be reason enough to go long as far as I can tell. As you can see, I still have the 50 day exponential moving average on this chart, and it seems as if the buyers are very much in control as we started to turn higher. With this, it’s only a matter of time before I go long and I have no interest whatsoever in selling.

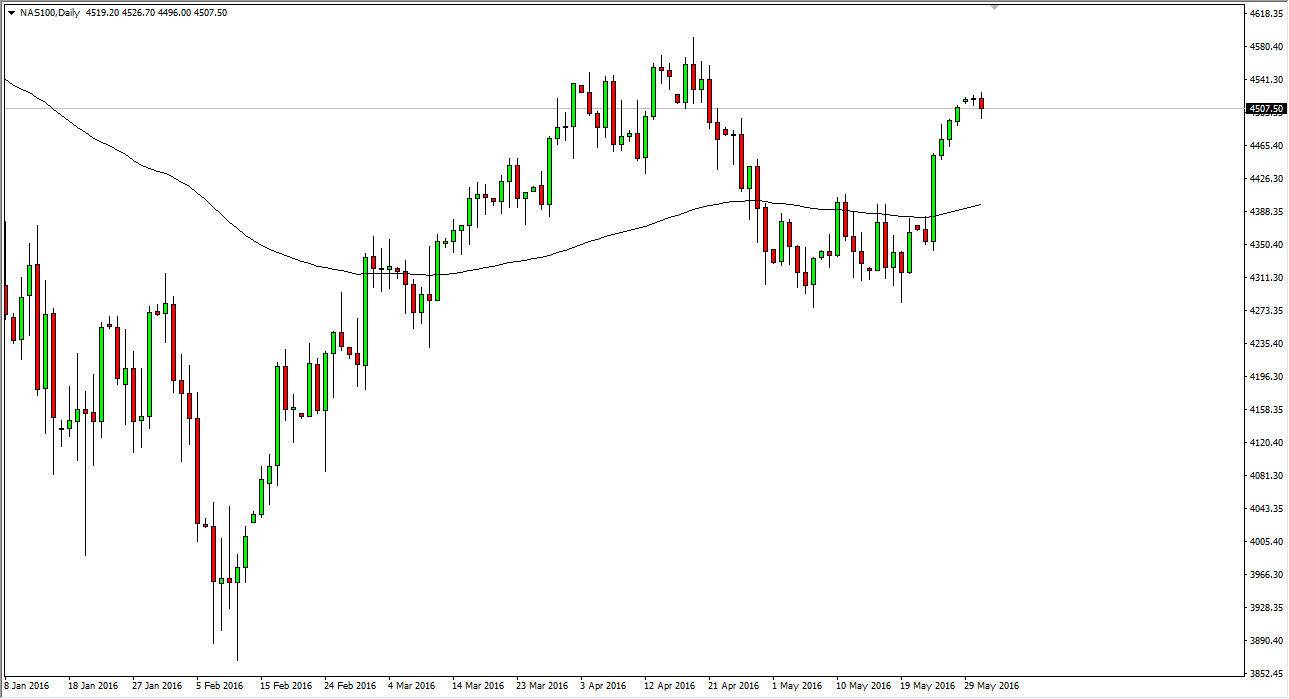

NASDAQ 100

The NASDAQ 100 initially fell during the day as well, but did bounce enough to form a bit of a hammer. I believe that if we can break of the top of the hammer, it’s a sign that we should continue to go higher, perhaps trying to reach the 4600 level. A break above there would be a longer-term “buy-and-hold” signal, and that’s what I’m hoping to see given enough time. Nonetheless, pullbacks from here should continue to find support as well, mainly because we have seen quite a bit of upward pressure recently.

Was the recent impulsivity that we seem to the upside in this market, I believe it’s only matter time before the buyers return to this market place, and continue to push towards the aforementioned 4600 level. A break above there is what I’m hoping to see but we may have to consolidate and build up momentum in the meantime in order to make that breakout. As long as we stay above the 100 day exponential moving average, I’m not even thinking about selling.