Gold prices settled at $1274.75 an ounce on Friday, making a gain of 2.26% on the week, as market participants continued to price out a June U.S. interest rate rise. Expectations that the Fed will raise rates in the near term have been dealt a blow by an abrupt slowdown in job growth in May. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 228619 contracts, from 197135 a week earlier. The market is now predicting a rate hike won't happen until at least September.

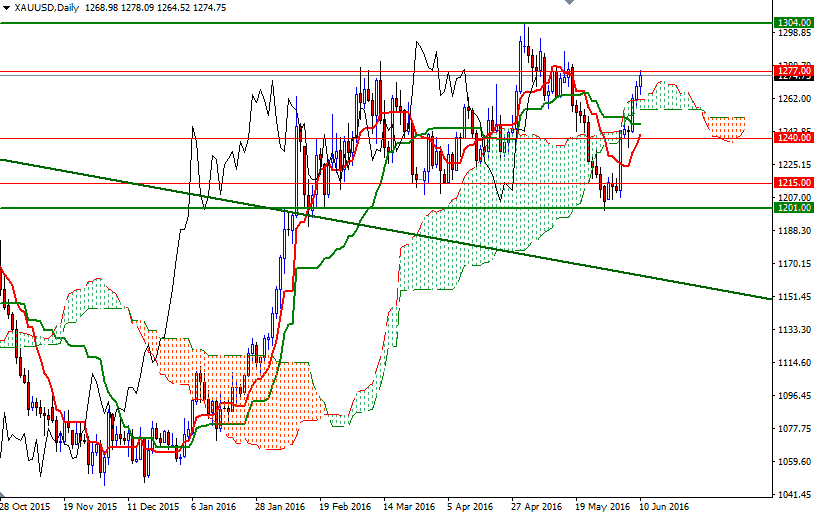

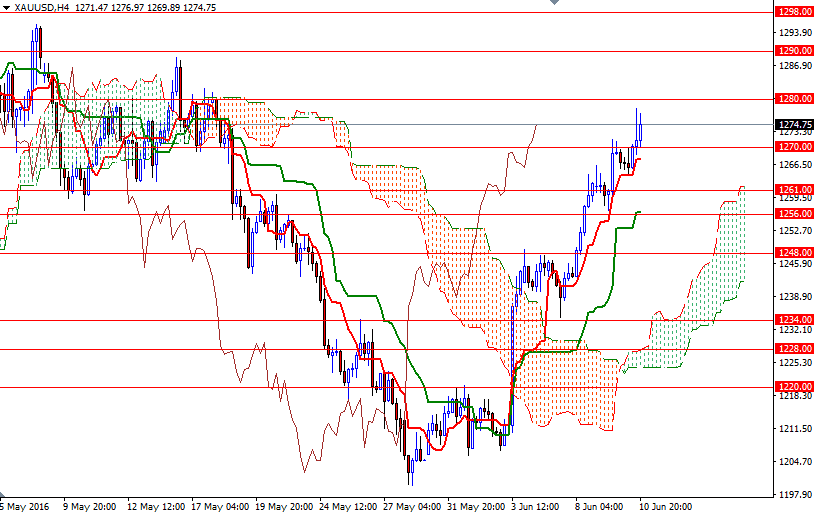

Technically, trading above the Ichimoku clouds on the weekly, daily and 4-hour charts gives the bulls an advantage. In other words, the general outlook suggests that there is the possibility of further price gains over the medium-term. However, we might see a range bound movement until the Fed’s statement on Wednesday. Although no policy action is expected, the market will be sensitive to any guidance on when the Federal Reserve will raise short term interest rates. Fed chair Janet Yellen, who spoke in Philadelphia, said “I continue to think that the federal funds rate will probably need to rise gradually over time to ensure price stability and maximum sustainable employment in the longer run.” Her comments suggest that they are going tighten at some point but they are in no rush.

The bulls will have to overcome the resistance at around the 1280 level in order to set sail for 1290/87. If XAU/USD pushes through this barrier, then it is technically possible to see a bullish continuation targeting 1298/5 and 1304/2. Only a daily close above 1304 could provide the bulls the momentum they need to march towards 1320/16. A failure to push prices above the 1280/77 zone could result in testing the 1270 level. Not too far from there, the 1261/56 area which is occupied by the daily Ichimoku cloud should be supportive so we need to get down below there in order to continue to the downside and approach the 4-hourly cloud. If the 1248/6 support is broken then the bears will be aiming for 1240.