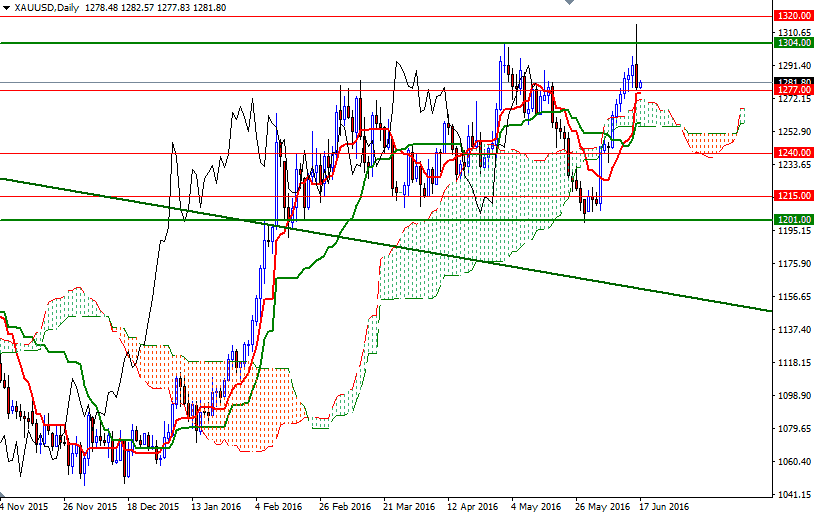

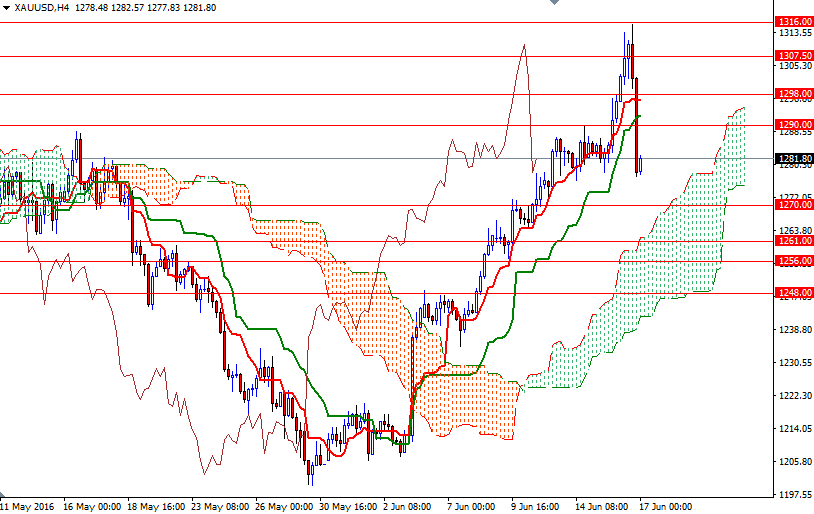

Gold prices ended Thursday's session down 1.04%, or $13.46, to settle at $1278.43 an ounce as investors took profits from a recent rally that pushed the market to the highest level in nearly two years. The XAU/USD passed through the $1307.50 level and reached the 1320/16 area. However, the market encountered heavy selling pressure and reversed its course. The market's inability to hold prices above $1307.50 encouraged sellers and as a result we returned to the $1277 level.

XAU/USD is hovering above the 1280/77 zone by the time of writing but yesterday's candle, with a long higher shadow, indicates that there is a certain amount of pressure. Closing near the lows of the trading range after being rejected at 1316 is of course a negative sing and it makes me think that we will be heading towards the 4-hourly Ichimoku cloud unless prices climb back above 1298/5 zone. Falling through 1280/77 would imply that the bears are getting ready to challenge the support at 1271.51-1270 where the top of the daily cloud sits. Once below that look for further downside with 1264 and 1261 as targets.

The initial resistance to the upside now stands in the 1290/87. If the bulls intend to charge towards 1298/5, they have to push prices back above 1290. Anchoring somewhere beyond 1298 would realign short-term charts with longer-term bullish inclinations and help test the resistance in the 1307.50-1304 zone. Only a daily close beyond 1307.50 could give the bulls another chance to approach the 1320/16 area.