Gold rose on Tuesday, helped by Brexit-fuelled declines in global stock markets, though gains were limited as markets waited for fresh guidance from the Federal Reserve. The XAU/USD pair initially tested the 1280/77 area but found enough support to reverse and test the 1290/87 resistance ahead. The U.S. May retail sales numbers came in stronger-than-expected, however, the data did little to increase the odds of a Fed rate hike in coming months.

Market participants are understandably in a more cautious mode ahead of a Federal Reserve policy statement later in the day. The central bank is widely expected to hold its key rate steady, following a dismal May jobs report. For the time being we continue to see shaky equity market and diminished likelihood of a June/July rate hike being supportive for gold but bear in mind that the Federal Reserve has at least one rate hike coming sometime later this year and that may prevent prices from going significantly higher.

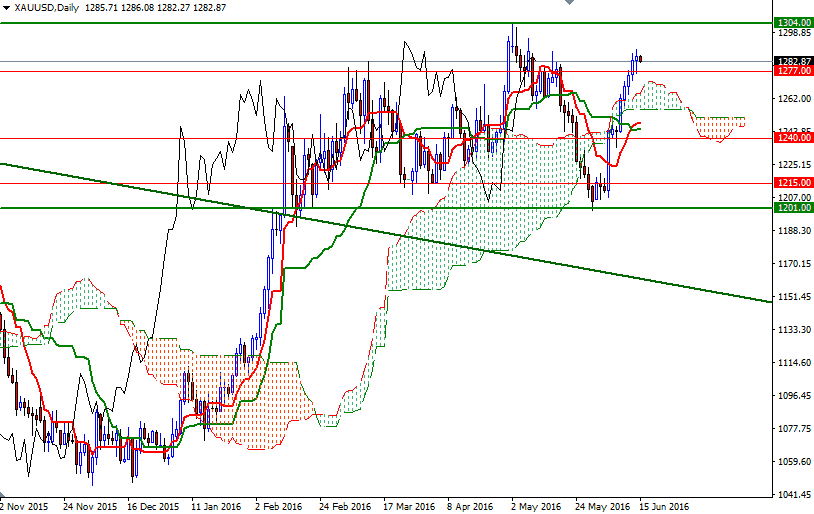

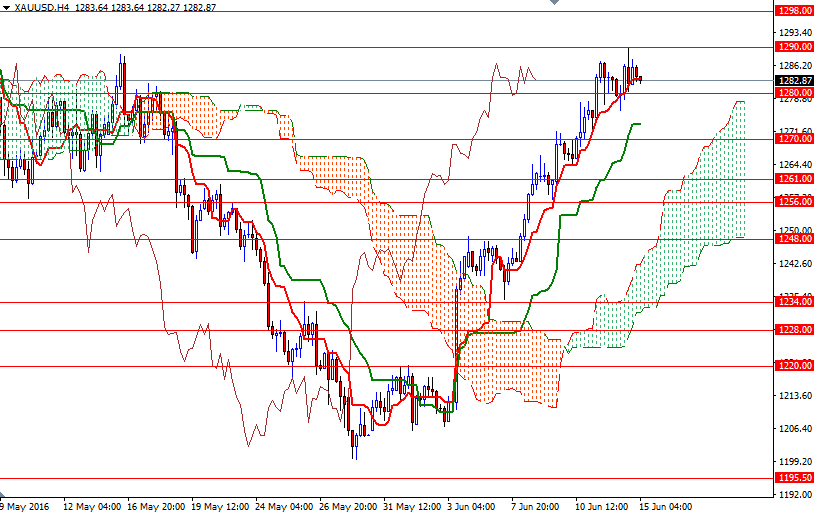

The key levels remains unchanged, as the market continues consolidating roughly between the 1290 and 1277 levels. A clean break out above the 1290 level would signal a further extension towards the 1298/5 area. Once beyond that, the market will be aiming for 1304/2. A daily close beyond 1304 could prolong the bullish momentum and open a path to 1320/16. On the other hand, if the bears increase the pressure and prices drop through 1277, it is likely the market will retreat back to 1270. Invalidating this support would suggest that the market is getting ready to challenge the 1264 and 1261 levels. Below that, the 1256 level -which happens to be the bottom of the daily cloud- stands out and the bears will have to demolish this strategic support so that they can test 1248.