The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 26th June 2016

Last week I predicted that the best trades for this week were likely to be short USD against Gold, JPY, CAD and CHF. This turned out to be a profitable forecast overall, as two of these pairs produced a positive result: USD/JPY 1.81%, GOLD 1.29%, USD/CAD -0.77%, USD/CHF -1.16%. The average result was a gain of 0.29%.

The focus of the market is strongly on the shock British referendum result at the end of last week. The British people voted to leave the European Union. Exactly how and even whether this can be executed has become an open question as Britain has descended into political and even constitutional chaos since the result became apparent, the details of which are too complex to be discussed here. Until some clarity is reached, we can expect this issue to become a running sore, with a great deal of volatility in the British Pound. However it is significant that the British Pound has not depreciated more strongly, as many pundits expected that a Leave vote would see the currency plunge by up to 20%.

This week therefore looks as if we can stick with “risk off” meaning short GBP, and long Gold, and JPY.

Fundamental Analysis & Market Sentiment

Fundamental analysis will probably be of very limited use this week. There is an extremely light news agenda scheduled, and the market’s attention will remain focused on political developments within the U.K. and European Union resulting from last week’s Brexit vote, as well as a Spanish General election that is being held today.

The Japanese Yen has again been the strongest currency this week. These days it has a status as a safe haven currency.

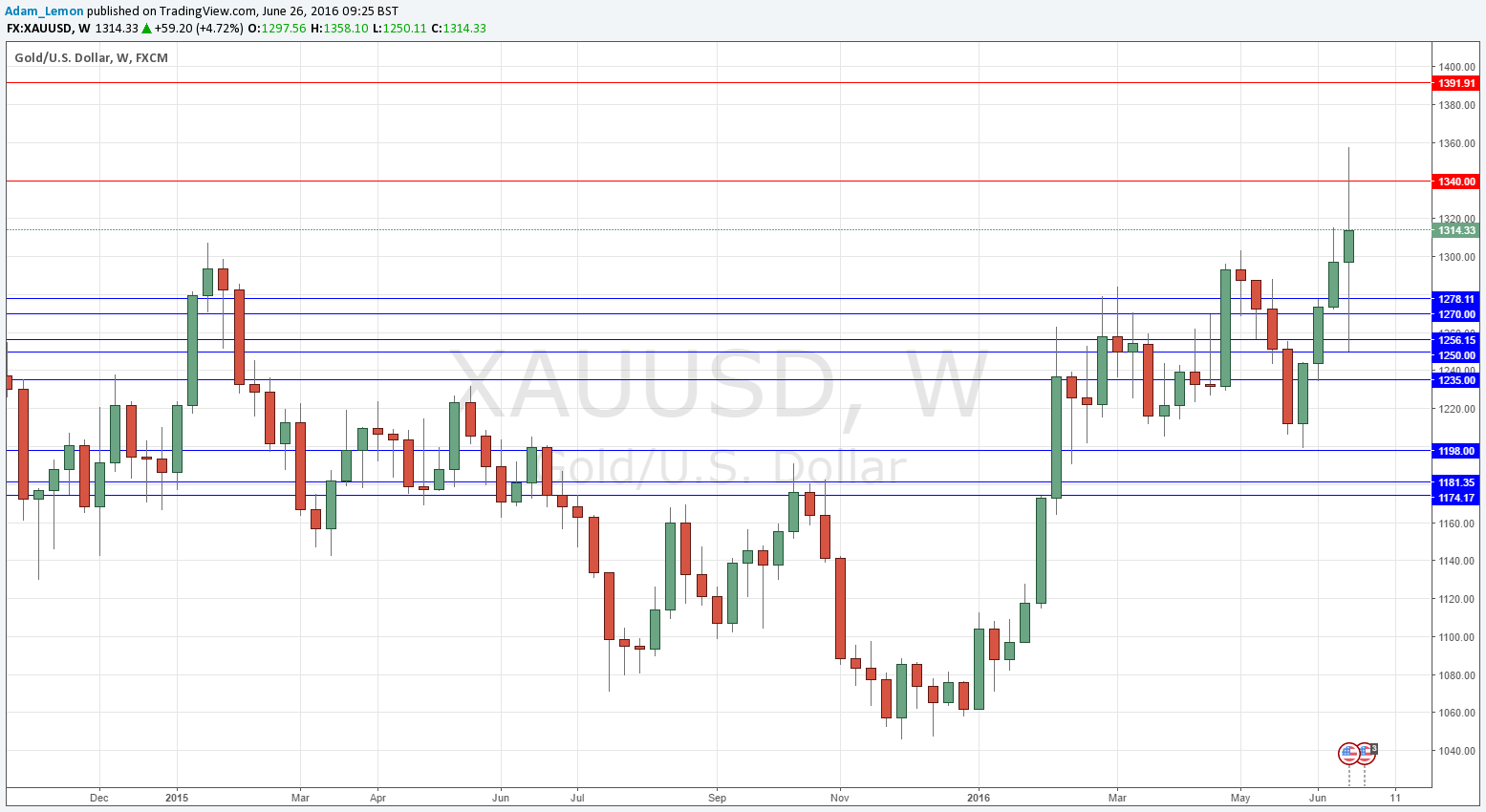

Gold undoubtedly remains strong although its advance was limited by the resistance at $1340 following the Brexit vote. Silver faces a similar problem, but looks weaker.

The British Pound is down sharply, but not by nearly as much as had been expected would be the case following a Brexit vote. However, as the hours and days following the vote are not seeing a smooth execution of the people’s wishes, we may see the Pound open strongly lower and fall even further. On the other hand, there will be hope in some quarters that the vote can be disregarded and Britain somehow remain within the European Union, which may hold the Pound up.

Although the U.S. Dollar has been weak lately, it typically strengthens during times of fear in the markets, and Brexit is certainly having a fearful impact.

Technical Analysis

USDX

The U.S. Dollar rose last week, printing a bullish near-engulfing candle which is actually almost a doji so is not necessarily very conclusive. However the action is somewhat bullish with seeming support at 11700. It again closed at a price lower than the prices from both three months and six months ago, indicating the greenback remains in a downwards trend which never ended even during the recent price rise. The price action is suggestive of an upwards move this week.

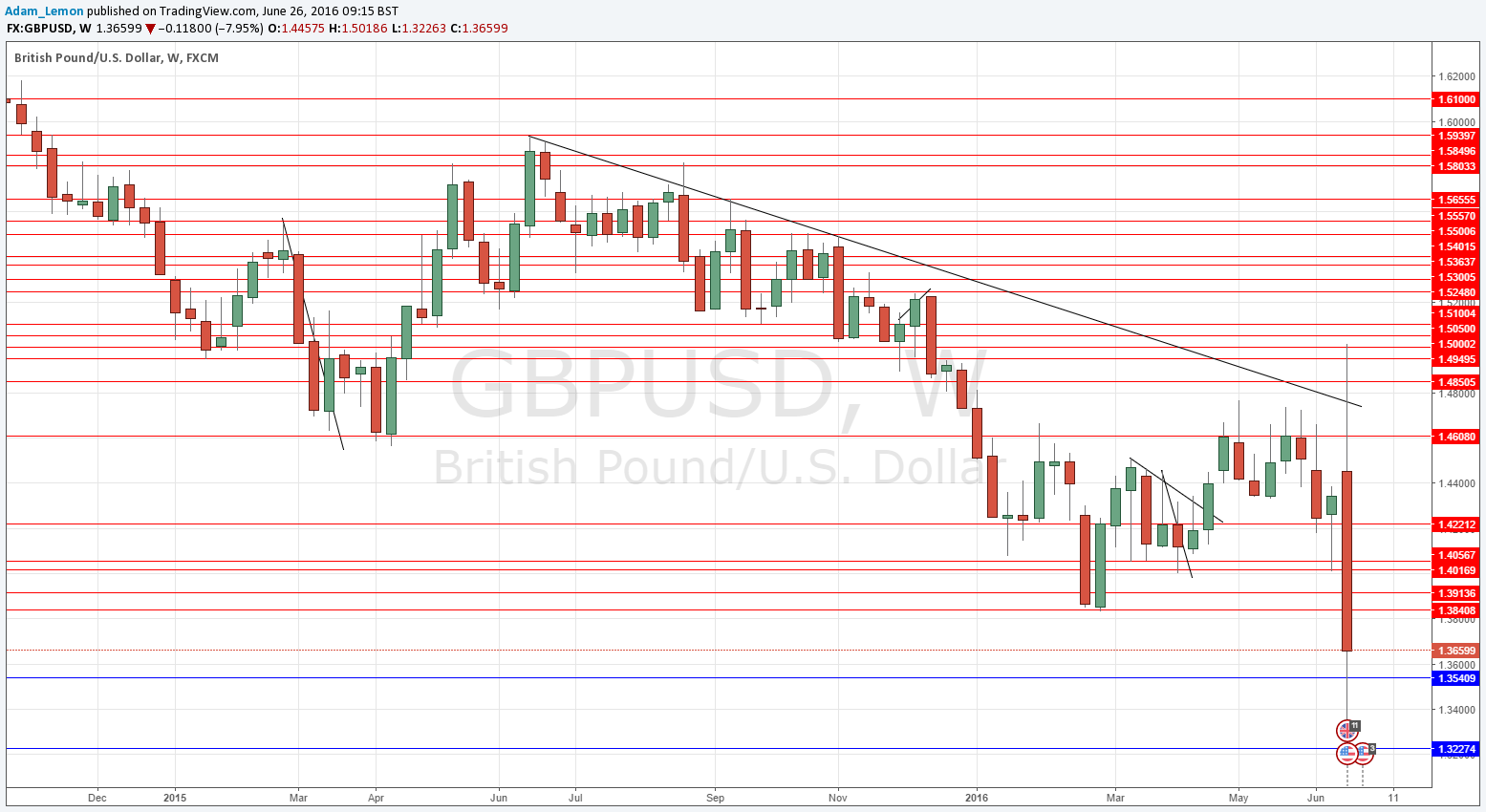

GBP/USD

The Brexit vote saw this pair reach a 31-year low price at 1.3227, although the price recovered to close at a level only a cent or so lower than the low of last February.

This pair might continue to fall, or it may begin to revert back up to an area above 1.3840.

Everything will depend upon political developments in the U.K. but in any case, the pound looks very vulnerable to further sharp falls.

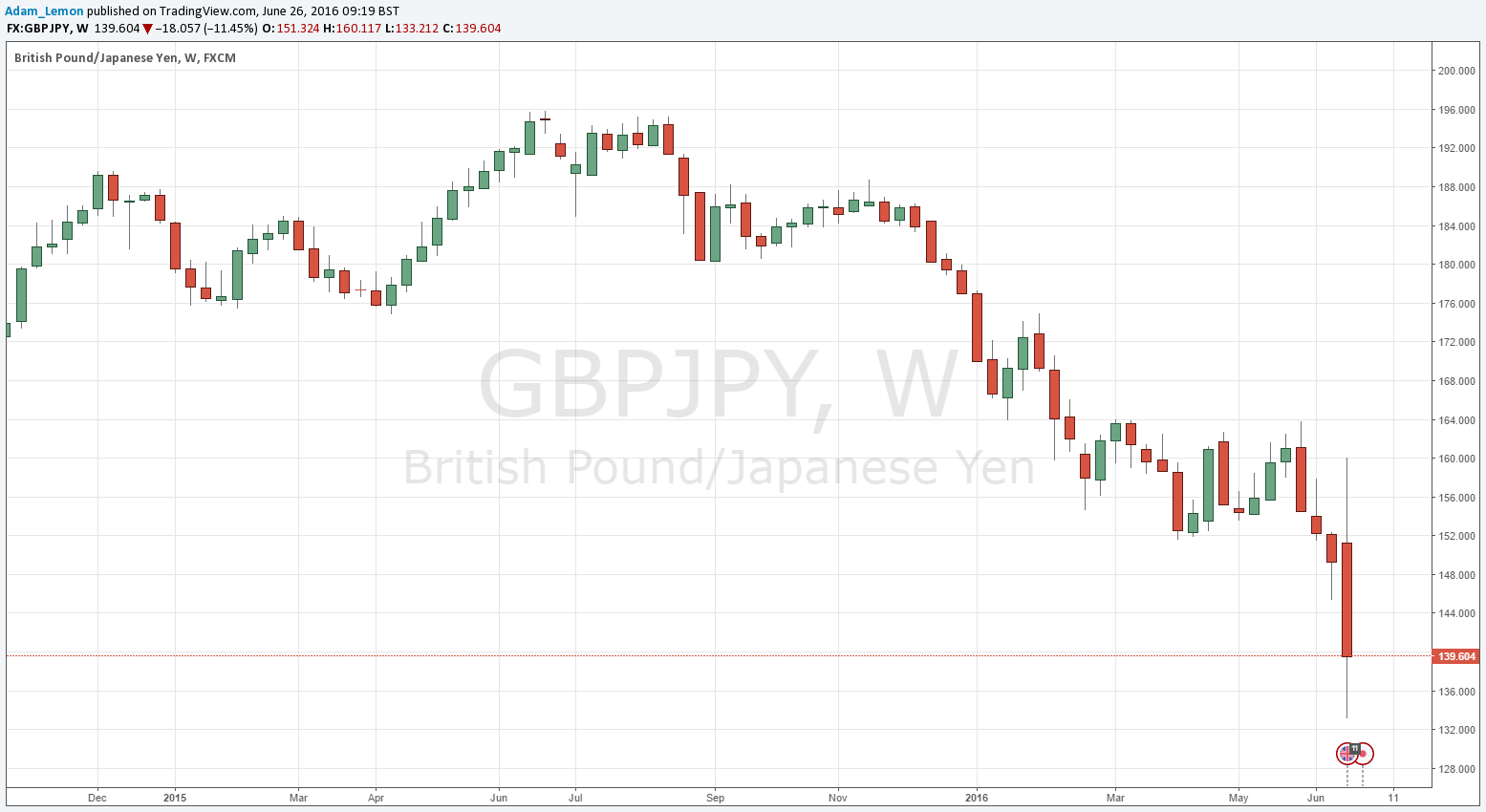

GBP/JPY

A similar situation to GBP/USD, expect these lows were seen before in 2013. The JPY has been stronger than the USD over recent months, so this may be a superior vehicle for shorting the GBP.

Gold

Gold looks somewhat stronger than USD even though it has been unable to really break up above the resistance at $1340. There is no doubt it has some good bullish momentum, with the price higher than it was 1, 3 and 6 months ago.

Conclusion

Bullish on the JPY and spot Gold, bearish on the GBP.