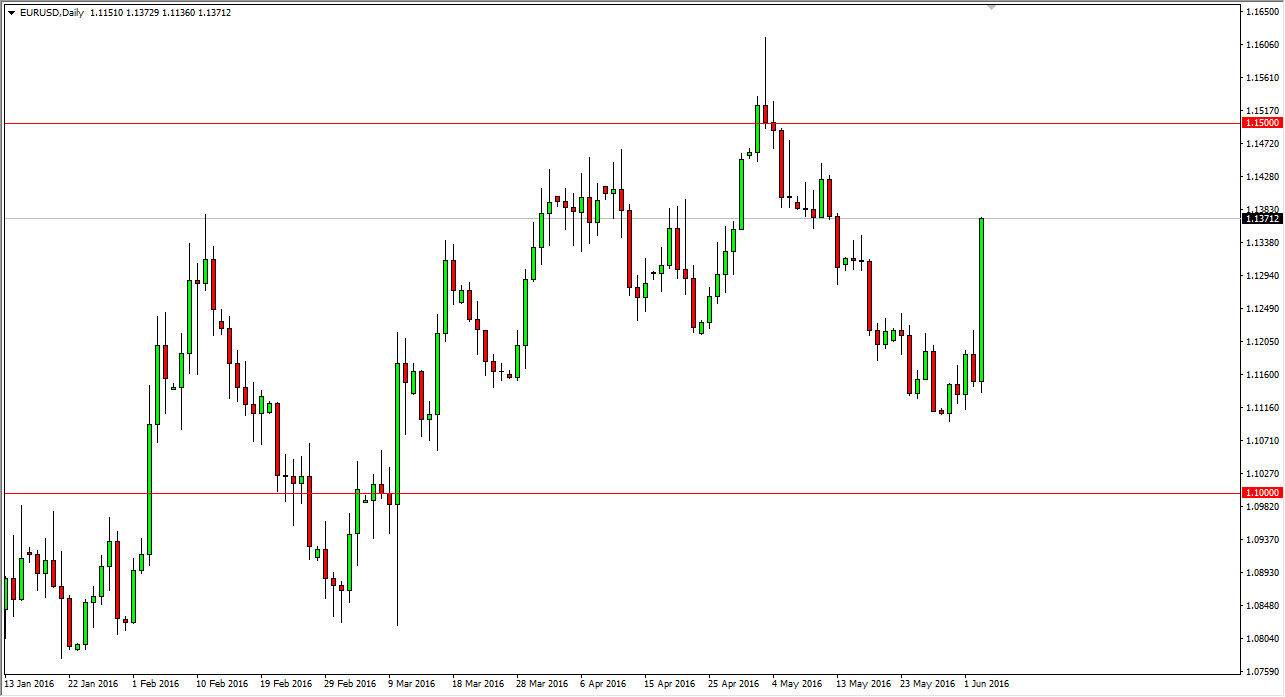

EUR/USD

The EUR/USD pair rose rapidly during the day on Friday after we got the nonfarm payroll announcement, as the Americans only added 38,000 jobs during the month of May. Because of this, it now throws into doubt that the Federal Reserve will be looking to raise interest rates as much as once thought. The candle is enormous, and can leave little doubt as to which direction we are going to head next. With this being the case, I’m looking for pullbacks to start buying the Euro, and have no interest whatsoever in selling this pair. Ultimately, I think we reach towards the 1.15 level, and then perhaps even higher than that. It will probably take a significant amount of momentum to break above that level, but it seems as if we are destined to do so now.

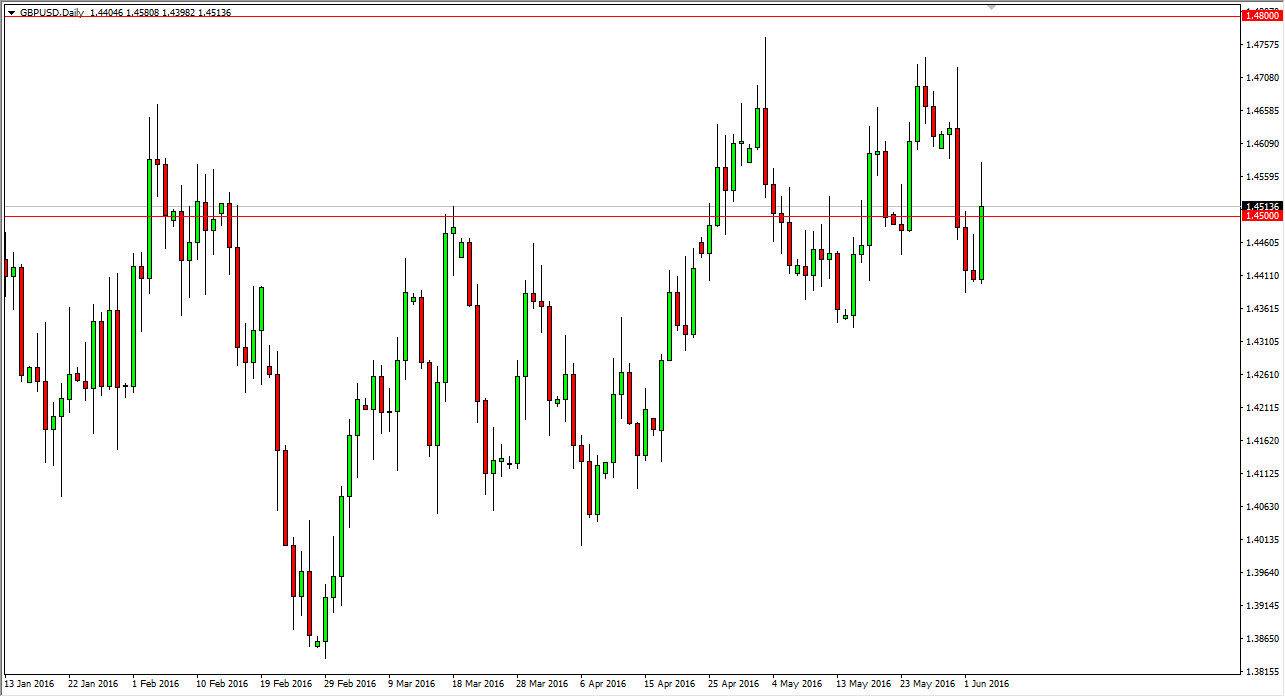

GBP/USD

The GBP/USD pair rose during the course of the session as well, and for the same reason essentially. After all, the jobs number out of America puts any significant increase in interest rates out of the Federal Reserve in extreme doubt now. However, this is a slightly different situation as the British pound will continue to be hampered by concerns out of the United Kingdom leaving the European Union. Because of this, even though this market should head higher due to the Federal Reserve inability to act, the reality is that there will still be quite a bit of headline risk when it comes to the British pound, so I think that although you can buy this pair, it’s going to be more profitable to buy the Euro against the US dollar instead. Pullbacks continue to be value in my estimation, and I think we are trying to build up to break out above the 1.48 handle. Once we do, becomes a move that should continue towards the 1.50 level.